Aave

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

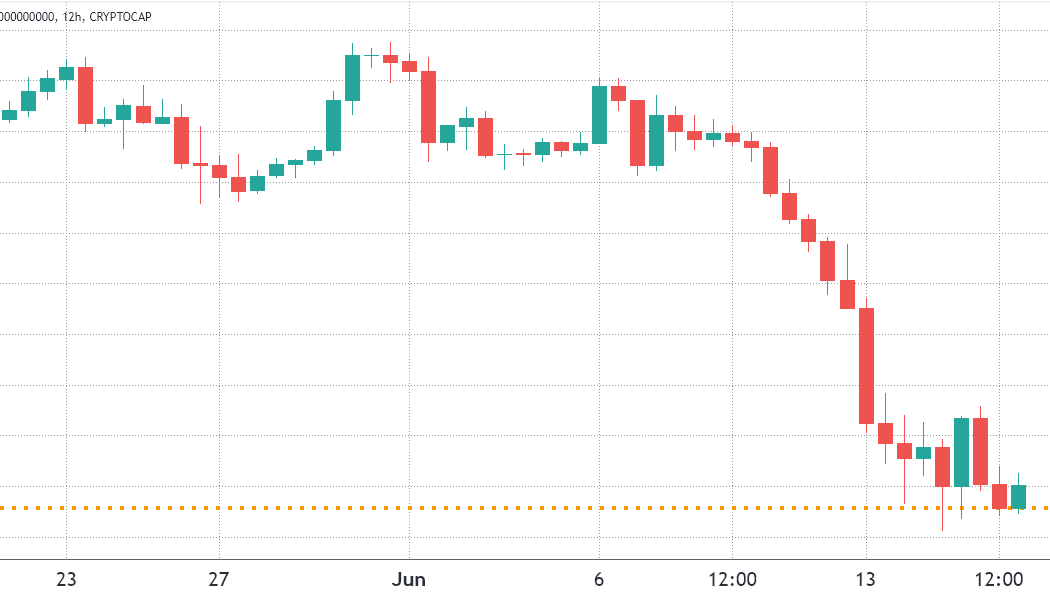

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

Finance Redefined: Three Arrow Capital and Celsius fall brings a tsunami of sell-off in DeFi

This past week, the decentralized finance (DeFi) ecosystem faced the brunt of the bears fueled by liquidation rumors of Three Arrow Capital (3AC) and Celsius liquidations. MakerDAO decided to cut off Aave (AAVE) from its direct deposit module as a safeguard in light of the possibility that Celsius folds and crashes the price of staked Ether (stETH). Trading firm 8 Blocks Capital called out to platforms holding funds owned by 3AC to freeze the assets as rumors of 3AC’s insolvency stay afloat. Micheal Saylor believes Bitcoin (BTC) and the Lightning Network can solve many of the DeFi ecosystem problems. The top 100 DeFi tokens were hit hard by bears, with the majority of tokens registering multi-month low along with double-digit losses over the past week. Crypto crash wreaking havoc on DeFi p...

Top 5 cryptocurrencies to watch this week: BTC, ETH, XTZ, KCS, AAVE

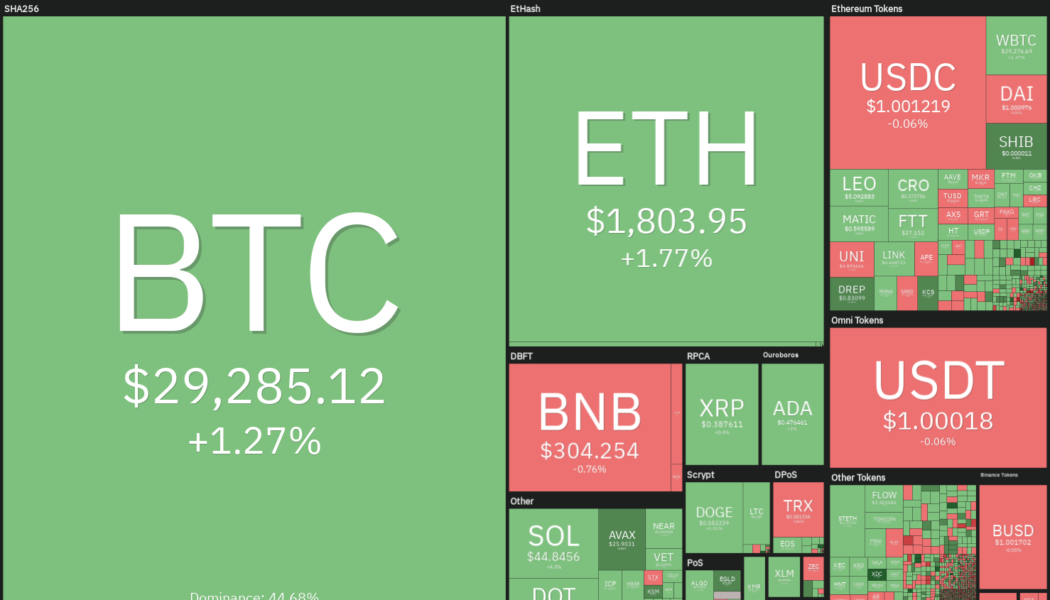

After declining for eight successive weeks, the Dow Jones Industrial Average rebounded sharply last week to finish higher by 6.2%. However, Bitcoin (BTC) has not been able to replicate the performance of the United States equities markets and is threatening to paint a red candle for the ninth week in a row. A positive sign is that Bitcoin whales have been buying the market correction. Glassnode data shows that the number of Bitcoin whale wallets with a balance of 10,000 Bitcoin or more has risen to its highest level since February 2021. The accumulation in the whale wallets suggests that their long-term view for Bitcoin remains bullish. Crypto market data daily view. Source: Coin360 Blockware Solutions highlighted that the Mayer Multiple metric which compares the 200-day simple moving aver...

Interview: Aave CEO on launch decentralised social network platform, Lens Protocol

Aave Companies has today announced the launch of an open-source tech stack for the building of social networking applications. Named the Lens Protocol, it will reside on the Polygon blockchain and allow developers to build social media apps, marketplaces, recommendation algorithms, and more. Contained within the decentralised ecosystem that we call Web3, it will leverage NFT technology to allow users to fully own their data, unlocking new ways for creators to monitise their digital content and relationships with followers. Amid all the controversy around freedom of speech and Elon Musk’s takeover of Twitter, it’s a poignant time to be launching this new kind of social media endevour, and turn the keys of censorship over to the public. To gain more of an insight, Coi...

Here are 3 ways hodlers can profit during bull and bear markets

For years, cryptocurrency advocates have touted the world-changing capability of digital currency and blockchain technology. Yet with the passing of each market cycle, new projects come and go, and the promised utility of these “real-world use case” projects fails to satisfy. While a majority of tokens promise to solve real-world problems, only a few achieve this, and the others are mere speculative investments. Here’s a look at the three things cryptocurrency investors can actually “do” with their coins. Lending Perhaps the simplest use case offered to cryptocurrency holders is also one of the oldest monetary applications in finance: lending. Ever since the decentralized finance (DeFi) sector took off in 2020, the opportunities available for crypto holders to lend out their tokens in exch...

DeFi token AAVE eyes 40% rally in May but ‘bull trap’ risks remain

A sharp rebound move witnessed in the Aave (AAVE) market in the last three days has raised its potential to rise further in May, a technical indicator suggests. AAVE price rebounds from key support Dubbed a “rising wedge,” the pattern appears when the price rises inside a range defined by two ascending, contracting trendlines. It typically resolves after the price breaks below the lower trendline with convincingly rising volumes. AAVE has been painting a similar ascending channel since early February 2022. The AAVE/USD pair has bounced in the past few days after testing the wedge’s lower trendline as support. This means the bulls are now eyeing the pattern’s upper trendline near $280, up over 40% from April 20’s price. AAVE/USD daily price chart. Sou...

Top 5 cryptocurrencies to watch this week: BTC, VET, THETA, RUNE, AAVE

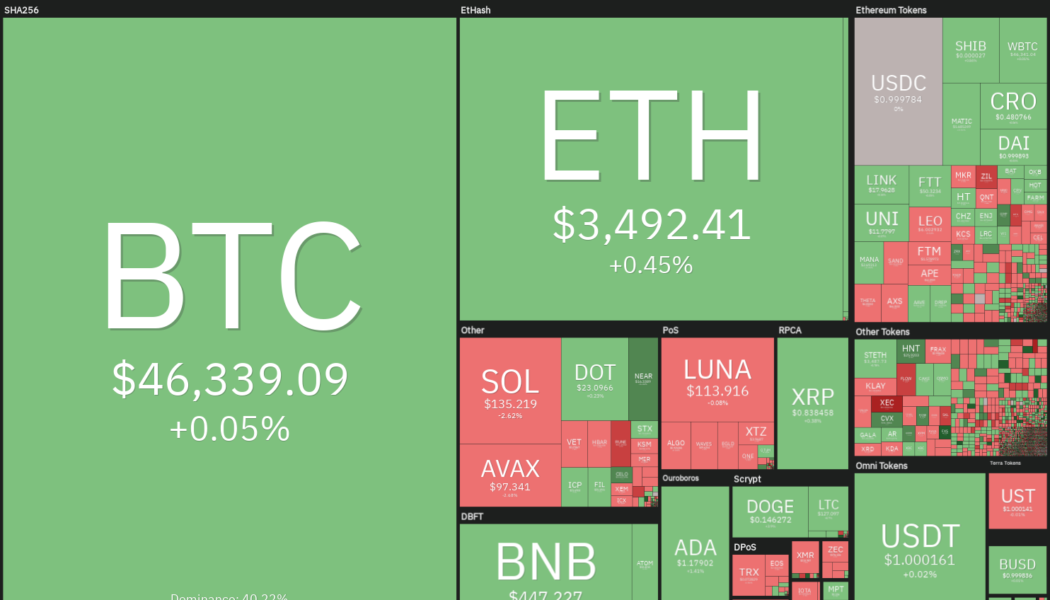

Bitcoin (BTC) is attempting to hold above its closest support level, and traders are watching to see if the price can remain strong and close above the 2022 yearly open price at $46,200 for the second week in a row. April has historically been the best performing month of the year for the S&P 500, according to Sam Stovall, chief investment strategist at CFRA. If history repeats itself and the close correlation between the United States equity markets and Bitcoin continues, it could bode well for the crypto markets in the near term. Crypto market data daily view. Source: Coin360 Another sentiment booster could be that the 19th million Bitcoin entered circulation on April 1. For the remaining 2 million BTC, the crypto markets will have to wait for a long time because the last Bitcoin is ...

Aussie fintech to offer mainstream direct access to DeFi with a fixed rate

Australian fintech company Block Earner has officially gone live, offering everyday investors a 7% fixed rate investment product by utilizing decentralized finance (DeFi) technology. Block Earner has already attracted attention from big names in the crypto industry, finalizing a $6.4 million seed funding round in December last year. It was led by Framework Ventures and joined by Coinbase Ventures, DeFi Alliance, LongHash Ventures and crypto veteran Kain Warwick, the founder of Synthetix, an Australia-based crypto derivatives exchange. Jordan Momtazi, the co-founder of Block Earner, said in an interview to Cointelegraph that Australia’s current economic climate makes products that offer yields on savings attractive, especially when it is practically impossible to achieve similar returns usi...

Altcoin Roundup: 3 portfolio trackers NFT and DeFi investors can use to stay organized

The cryptocurrency ecosystem has seen a tremendous amount of growth over the past couple of years, as the introduction of decentralized finance (DeFi) and the popularity of nonfungible tokens (NFT) have led to an explosion of projects on more than a dozen blockchain networks. The rapidly growing ecosystem means investors have to keep track of multiple wallet addresses, making portfolio trackers a popular option for traders needing to manage a diverse multichain portfolio. Here are three portfolio-tracking decentralized applications, or DApps, crypto traders can use to help monitor their investments. Zapper Zapper supports the basic management of cryptocurrencies held on 11 different networks including Ethereum, Polygon, BNB Chain, Fantom, Avalanche and Optimism. The basic layout of t...

Market changes suggest SOL, UNI, AAVE, and MANA are ripe to buy, Santiment analyst says

A Santiment analyst has said these tokens are in a good zone for investors who want to buy into trader pain. Optimism on Solana grows as development activity continues to rise. In a recent YouTube video, the director of marketing at crypto analytics firm Santiment Brian Quinlivan highlighted a few altcoin ecosystems whose metrics show that they are set for a surge. The metric in question is market value to realized value (MVRV). MVRV shows the average loss or profit of a crypto token’s coins in circulation at the current price. It helps indicate to willing buyers when the time is right to do so. Uniswap (UNI) Despite the number of daily active addresses on the ecosystem falling sharply (from 3,259 on October 29, up to a recent 836 active ones), Quinlivan reviewed the asset’s 30-day long MV...

First cross-chain governance proposal passes on Aave

On Monday, the first cross-chain governance proposal passed on decentralized finance, or DeFi, borrowing and lending platform Aave (AAVE). According to DeFi Llama, the amount of total value locked on Aave is approximately $12 billion. As told by its developers, a proposal executed on Aave, which is built on the Ethereum (ETH) network, was sent to the Polygon (MATIC) FxPortal. The mechanism then read the Ethereum data and passed it for validation on the Polygon network. Afterward, the Aave cross-chain governance bridge contract received this data, decoded it and queued the action, pending a timelock for finalization. The development team wrote: The Aave cross-chain governance bridge is built in a generic way to be easily adapted to operate with any chain that supports the EVM [Et...