Aave

Bitcoin price consolidation could give way to gains in TON, APE, TWT and AAVE

The United States equities markets shrugged off the hotter-than-expected labor data on Dec. 2 and recovered sharply from their intraday low. This suggests that market observers believe the Federal Reserve may not change its stance of slowing the pace of rate hikes because of the latest jobs data. Although the FTX crisis broke the positive correlation between the U.S. equities markets and Bitcoin (BTC), the recent strength in equities shows a risk-on sentiment. This could be favorable for the cryptocurrency space and may attract dip buyers. Crypto market data daily view. Source: Coin360 The broader crypto recovery may pick up steam after more clarity emerges on the extent of damage caused by FTX’s collapse. Until then, bullish price action may be limited to select cryptocurrencies. Let’s lo...

DeFi sparks new investments despite turbulent market: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The prolonged crypto winter aided by the collapse of FTX has kept investors from backing a new protocol that merges DeFi and the foreign exchange market. A new Cosmos blockchain-based DeFi protocol has caught the eyes of investors who have put $10 million behind the project. Cardano-based leading stablecoin ecosystem Ardana abruptly stopped its development after several launch delays. However, the project remains open-source for others to add to it until they restart the development process. Aave community has now proposed a governance change after a failed $60 million short attack. The short attack was later trac...

Aave proposes governance changes after failed $60M short attack

On Nov. 23, one day after Mango Markets exploiter Avraham Eisenberg attempted to use a series of sophisticated short sales to exploit decentralized finance protocol Aave, project contributors have put forth a series of proposals to deal with the aftermath. As told by protocol engineering developer Llama and financial modeling platform Gauntlet both of whom are deployed on Aave: “Over this past week, the user 0x57e04786e231af3343562c062e0d058f25dace9e [wallet associated with Eisenberg] opened a short position on CRV [Curve] using USDC as collateral. At its peak, the user was shorting ~92M units of CRV (roughly $60M USD at today’s prices). The attempt to short CRV on Aave has been unsuccessful, and the user lost ~$10M USD from the liquidations.” Llama wrote that...

Mango Markets hacker allegedly feigns Curve short attack to exploit Aave

As described by analysts at Lookonchain on Nov. 22, tokens of decentralized exchange Curve Finance (CRV) appear to have suffered a major short-seller attack. According to Lookonchain, ponzishorter.eth, an address associated with Mango Markets exploiter Avraham Eisenberg, first swapped 40 million USD Coin (USDC) on Nov. 13 into decentralized finance protocol Aave to borrow CRV for selling. The act allegedly sent the price of CRV falling from $0.625 to $0.464 during the week. Fast forward to today, blockchain data shows that ponzishorter.eth borrowed a further 30 million CRV ($14.85 million) through two transactions and transferred them to OKEx for selling. The team at Lookonchain hypothesized that the trade was conducted to drive down the token price “so many people who used CRV...

Time to switch from LinkedIn to MetaMask? Not yet, but soon

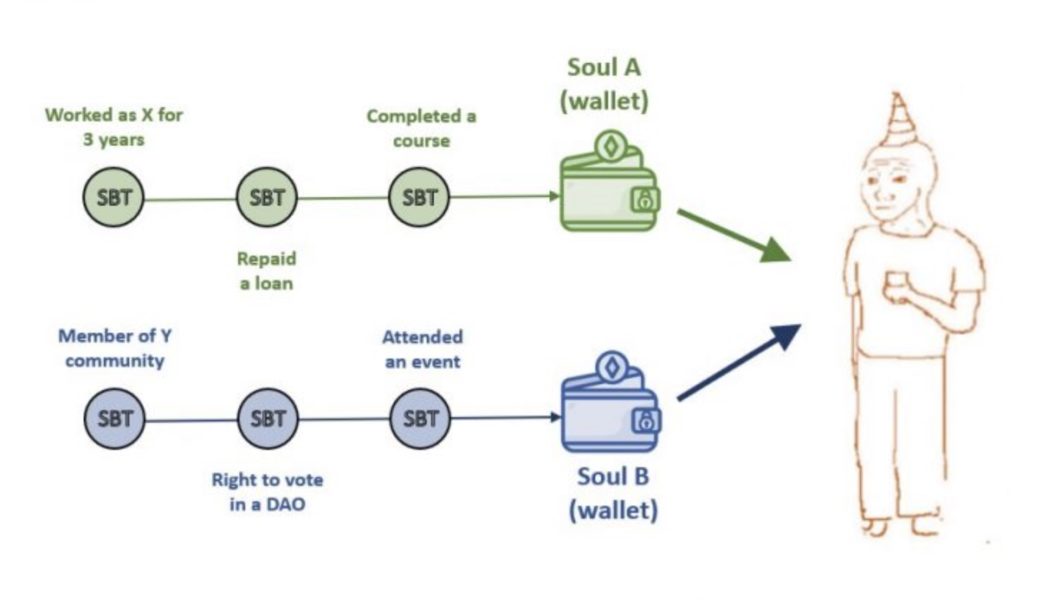

The function of crypto wallets has changed significantly over the last few years. They initially secured token holdings or served as art galleries with nonfungible tokens (NFTs). Today, they’ve become like bank accounts for many, and soon, they will offer even more functionality by enabling digital curriculum vitae (CVs). In a May 2022 paper, Ethereum co-founder Vitalik Buterin and others introduced the concept of “Soulbound tokens” (SBTs). Buterin and his co-authors argued that credentials on a blockchain offer many advantages to establishing provenance and reputation. Nonfungible tokens will serve as essential building blocks Related: Facebook and Twitter will soon be obsolete thanks to blockchain technology SBTs are like PoAPs, but they are non-transferable and, therefore, bound to a wa...

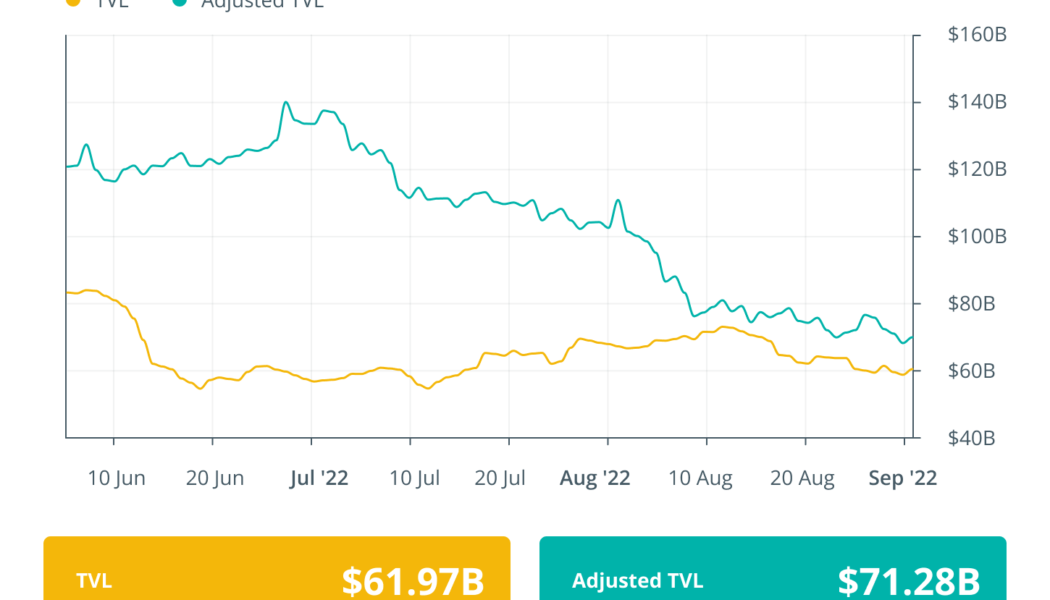

Experts weigh in on the Ethereum vulnerabilities after Merge: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The past week in the DeFi ecosystem saw major developments centered around the Ethereum Merge. Aave (AAVE) community proposed temporarily suspending Ether (ETH) lending before the Merge, citing the potential issue of high ETH utilization that may result in liquidations being hard or impossible and annual percentage yields (APYs) reaching negative figures. An industry expert shared his opinion on possible censorship vulnerabilities that the Ethereum network could eventually face in the wake of its transition to a proof-of-stake (PoS) blockchain. Moving ahead of the Ethereum Merge developments, some other major even...

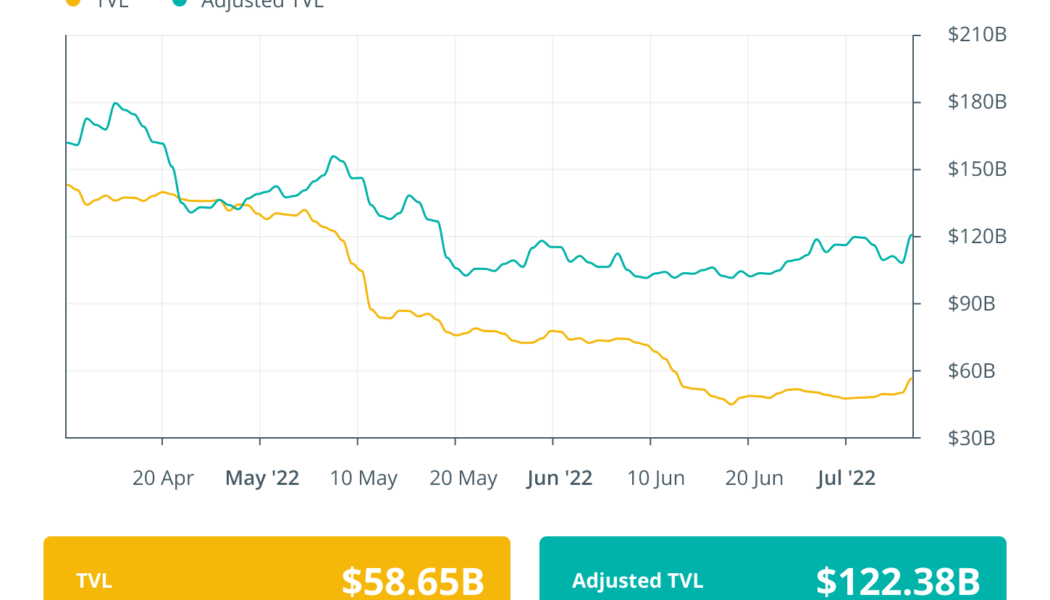

Finance Redefined: DeFi’s downturn deepens, but protocols with revenue could thrive

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments related to the DeFi lending crisis as Celsius filed for bankruptcy. At a time when bears are more dominant in the current market, DeFi protocols with a revenue system can thrive. Lido Finance has announced plans to offer its Ether (ETH) staking services across the entire L2 system. Aave plans to leverage Pocket’s distributed network of 44,000 nodes to access on-chain data from various blockchains, and gamers are plugging in DeFi through the Razer reward partnership. The majority of the top 100 DeFi tokens traded in green, with many registering double-...

DeFi token AAVE faces major correction after soaring 100% in a month

The price of Aave (AAVE) has more than doubled in a month, but its bullish momentum could be reaching a point of exhaustion. AAVE price tests key inflection level Notably, AAVE has surged by over 103% after bottoming out locally at $45.60 on June 18, hitting almost $95.50 this July 15. Nevertheless, the token’s sharp upside retracement move has brought its price closer to the level that triggered equally sharp pullbacks since early June. In other words, AAVE has been testing an ascending trendline resistance that constitutes a “bear flag,” a bearish continuation pattern. For example, the trendline’s previous test on July 9 ended up in a 20% downside move. Similarly, a similar attempt on June 24 pushed AAVE price lower by nearly 30%. AAVE/USD daily price chart. ...

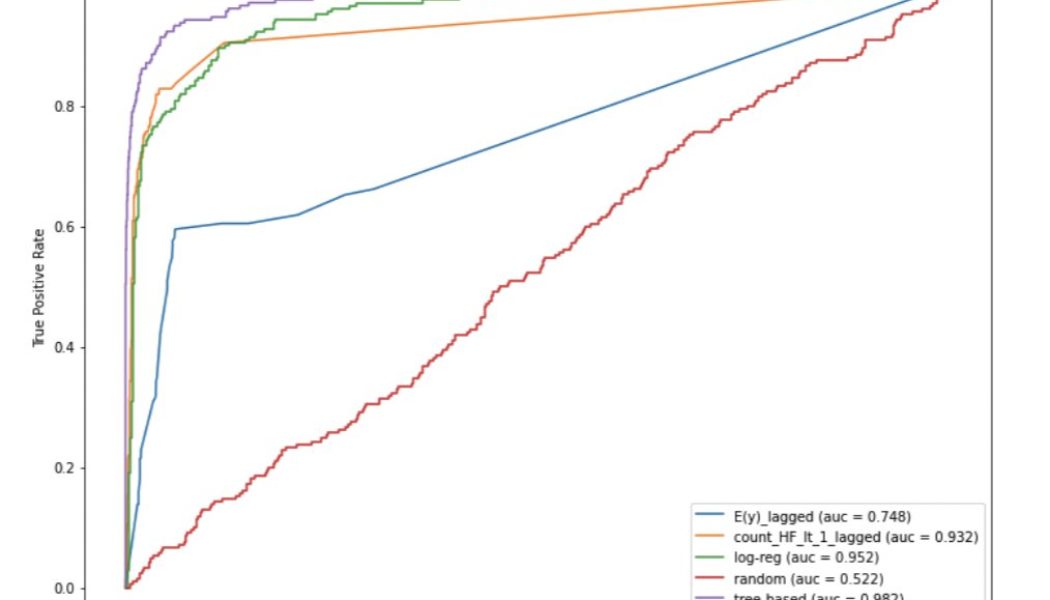

Cred Protocol unveils its first decentralized credit scores

Cred Protocol, a decentralized credit scoring startup has unveiled the results of its first automated credit scoring system for users of decentralized finance (DeFi). Cred Protocol CEO Julian Gay outlined the results in a Twitter thread, which showed how Cred successfully utilized past transaction behavior on the Aave protocol to assess the creditworthiness of future borrowers based on on-chain behavior in the DeFi space. 1/ Over the last few months, we’ve been working to build one of the first credit scores for DeFi. Today, we’re excited to share the results of our first credit score with the world! Read more below — Julian Gay (@juliangay) July 14, 2022 By using machine learning to assess time-based account attributes and analyze the user’s past transaction behavior, Cred Pro...

UNI, MATIC and AAVE surge after Bitcoin price bounces back above $20K

Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981. Daily cryptocurrency market performance. Source: Coin360 The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development. Nevertheless, the green in the market is a welcome sight after the rough start to 2022. Top 5 coins with the highest 24-hour price...

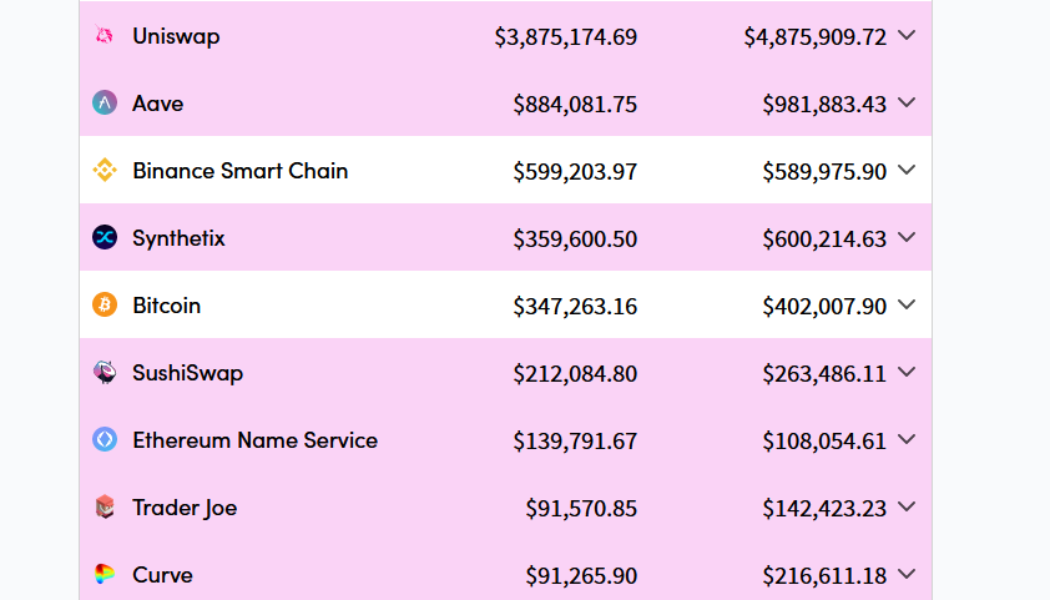

DeFi summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms

Decentralized exchange (DEX) Uniswap has overtaken its host blockchain Ethereum in terms of fees paid over a seven-day rolling average. The surge appears part of a recent spate of high demand for DeFi amid the current bear market. Decentralized finance (DeFi) platforms such as AAVE and Synthetix have seen surges in fees paid over the past seven days, while their native tokens, and others such as Compound (COMP) have also boomed in price too. According to data from Crypto Fees, traders on Uniswap accounted for an average daily total of $4.87 million worth of fees between June 15 and June 21, overtaking the average fees from Ethereum users which accounted for $4.58 million. Uniswap’s most advanced V3 protocol (based on the Ethereum mainnet) accounted for the lion’s share of the total f...