A16z

Ethereum’s popularity ‘a double-edged sword’ — a16z’s State of Crypto report

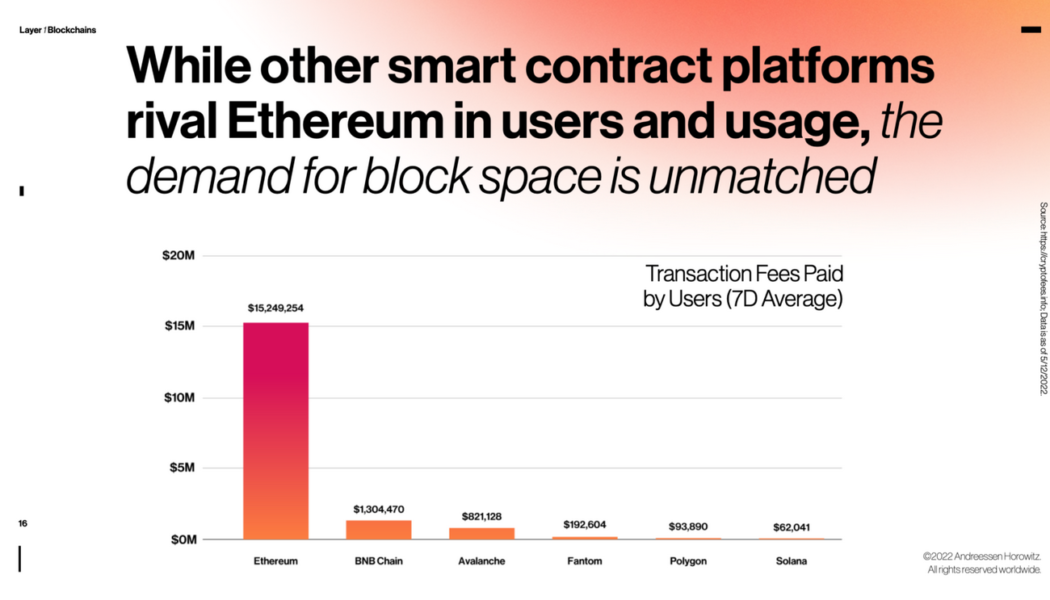

Crypto venture fund giant Andreessen Horowitz (a16z) has highlighted that development and demand on Ethereum is “unmatched” despite the network’s high transaction fees. The firm does warn, however, that its “popularity is also a double-edged sword” given Ethereum prioritizes decentralization over scaling, resulting in competing blockchains stealing market share with “promises of better performance and lower fees.” The comments came via a blog post introducing a16z’s 2022 “State of Crypto” report, with the firm’s data scientist Daren Matsuoka, head of protocol design and engineering Eddy Lazzarin, General Partner Chris Dixon, and head of content Robert Hackett all working together to provide five key takeaways from the study. Outside of Ethereum, the report focuses on topics such as Web3 de...

Columbia Uni professor heads up a16z’s new crypto research unit

Theoretical computer scientist and Columbia University professor Tim Roughgarden has been appointed the head of Andreessen Horowitz’s (a16z) new crypto research unit. Roughgarden’s resume includes more than three years as a professor of computer science at Columbia University in New York, along with a 14-year stint at Stanford. He has also served as a research partner at a16z since February last year. a16z is one of the most active venture capital firms in crypto, with its funds reportedly worth around $9 billion. Partly guided by the firm’s new unit which was announced earlier today, Roughgarden has stated that its funding into crypto research will grow by “many multiples of the next couple of years.” “We’re currently in a particular moment in time, witnessing a new multidisciplinar...

Columbia Uni professor heads up a16z’s new crypto research unit

Theoretical computer scientist and Columbia University professor Tim Roughgarden has been appointed the head of Andreessen Horowitz’s (a16z) new crypto research unit. Roughgarden’s resume includes more than three years as a professor of computer science at Columbia University in New York, along with a 14-year stint at Stanford. He has also served as a research partner at a16z since February last year. a16z is one of the most active venture capital firms in crypto, with its funds reportedly worth around $9 billion. Partly guided by the firm’s new unit which was announced earlier today, Roughgarden has stated that its funding into crypto research will grow by “many multiples of the next couple of years.” “We’re currently in a particular moment in time, witnessing a new multidisciplinar...

Crypto venture capital firms see surging assets under management

Venture capital (VC) firms focused on Web3 projects and crypto businesses are accumulating billions of dollars worth of assets under management as more capital is injected into the sector. The assets under management figure for Web3 and crypto investment firm Paradigm has recently been revealed. Filings show that the firm has $13.2 billion in assets, a growth of 343% compared to the $2.98 billion reported in a filing in December 2020. The filings were reviewed by business journalist Eric Newcomer. Writing for his newsletter, he looked at recent applications with the U.S. Securities and Exchange Commission (SEC) for some of the biggest venture capital firms in the Web3 and crypto sectors. To be registered as an “investment advisor,” these firms must disclose their regulatory assets under ma...

Crypto investor Katie Haun raises $1.5 billion for Web3 venture fund

Katie Haun, crypto investor and board member for Coinbase and OpenSea announced that she had raised $1.5 billion for her new fund, Haun Ventures. On Tuesday, March 22, Haun posted an article on Twitter, briefly introducing the firm and sharing that the funds would be used to invest in Web3 projects. Introducing @HaunVentures, a firm built for the next generation of the internet. We’ve raised $1.5 billion across two funds to invest in web3. An exciting first step, but the real work begins now. https://t.co/tBeE4OEJkD — Kathryn Haun (@katie_haun) March 22, 2022 The firm will invest through two funds, a $500 million early-stage fund, and a $1 billion acceleration fund. The two funds represent the largest debut on record for investment vehicles led by a female General Partner, according to dat...

Reports Bored Ape creator in talks with A16z: Potential valuation $5B

Silicon Valley tech VC Andreessen Horowitz (A16z) is reportedly eying an investment in Bored Ape Yacht Club creator Yuga Labs, with a reported valuation as high as $5 billion. Sources for the Financial Times revealed that Yuga Labs is seeking funding for a multi-million dollar piece of the company. If a deal is secured, it would mark the first institutional investment Yuga Labs has accepted as its popular nonfungible token (NFT) collection has become one of the biggest in the industry. The terms of the deal have not yet been set and negotiations may be canceled outright. Neither A16z nor Yuga Labs have confirmed the talks p Bored Ape Yacht Club (BAYC) is currently the second-most traded collection on the largest NFT marketplace OpenSea, with 380,821 ETH ($1 billion) in total traded volume....