1inch

Total value locked in DeFi dropped by 66%, but multiple metrics reflect steady growth

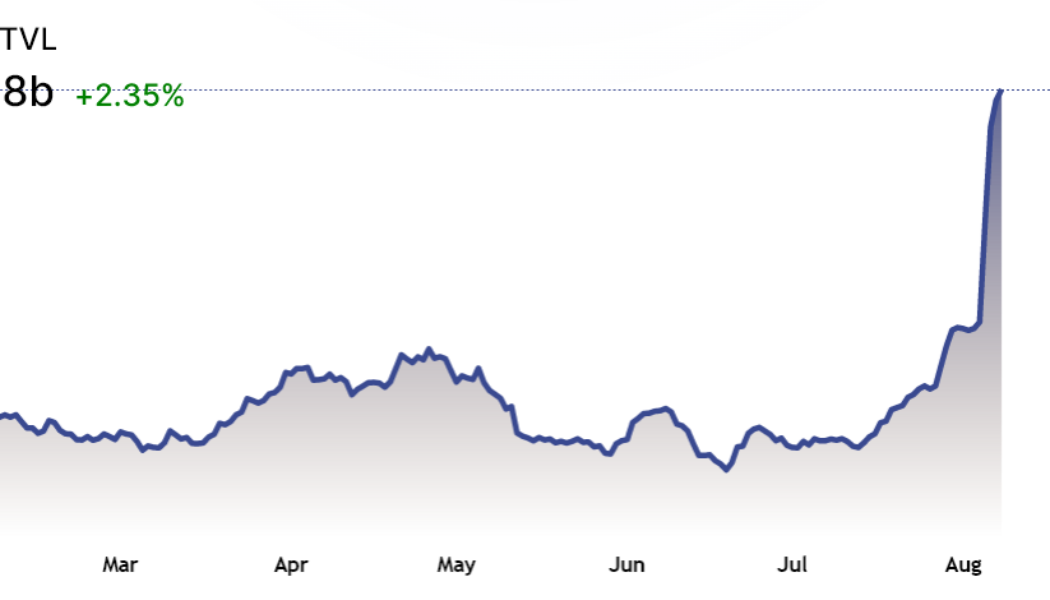

The aggregate total value locked (TVL) in the crypto market measures the amount of funds deposited in smart contracts and this figure declined from $160 billion in mid-April to the current $70 billion, which is the lowest level since March 2021. While this 66% contraction is worrying, a great deal of data suggests that the decentralized finance (DeFi) sector is resilient. The issue with using TVL as a broad metric is the lack of detail that is not shown. For example, the number of DeFi transactions, growth of layer-2 scaling solutions and venture capital inflows in the ecosystem are not reflected in the metric. In DappRadar’s July 29 Crypto adoption report, data shows that the DeFi 2Q transaction count closed down by 15% versus the previous quarter. This figure is far less concerning...

1inch plugs into Klaytn as Asia continues to climb aboard

South Korea’s most popular metaverse blockchain Klaytn is set to benefit from deeper liquidity and improved token swaps through a new partnership with decentralized finance (DeFi) protocol 1inch Network. Klaytn has enjoyed success in South Korea as the country continues to see prolific nonfungible token (NFT) and GameFi use. Klaytn is a product of tech behemoth Kakao, which commands a user base of some 52 million people that use its flagship KakaoTalk application and suite of software products. Klaytn derived its proprietary blockchain technology from the Ethereum Virtual Machine and powers various play-to-earn and AAA games, NFT marketplaces and Metaverses. As its user base continues to grow, the platform is looking to improve its scalability, efficiency and affordability. Klaytn al...

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...