Capital Markets

Stockbrokers fight for survival after latest profits plunge

Monday April 17 2023

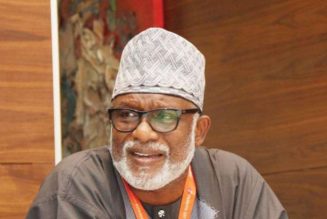

The Nairobi Securities Exchange. FILE PHOTO | DIANA NGILA | NMG

Stockbrokers paid the price for a depressed stock market and the tough economy last year after their earnings fell by a quarter on the back of lower trading commissions and advisory revenue.

A Business Daily analysis of the industry financials shows that the stockbrokers collectively booked net profits of Sh500.6 million, down 24 percent from the Sh658 million they earned a year earlier.

Eight out of 22 intermediaries reported losses for the year, with NCBA Capital emerging as the most profitable investment bank with net earnings of Sh268.3 million, largely drawn from fund management fees.

The industry has suffered a tough stretch in recent years that has coincided with reduced equities trading activity at the stock market, which provides their main line of revenue in terms of commissions from stock sales and purchases.

Last year, equities turnover at the Nairobi Securities Exchange (NSE) fell to a 10-year low of Sh97.3 billion from Sh137.4 billion in 2021, while market capitalisation shrank by Sh606.8 billion to Sh1.986 trillion.

At the same time, bonds turnover fell by Sh215.1 billion to Sh741.85 billion—retreating from the record Sh957 billion seen in 2021.

It is this drop in traded turnover that has caused the biggest headache for players in the market whose revenue is derived from commissions charged on trades.

Read: Foreign investors pull out Sh24 billion from NSE in 2022

“During the year, the equity market was negatively impacted by rising international and domestic interest rates, which resulted in capital outflows and a reallocation of capital towards fixed-income assets,” the NSE said in a market performance summary for 2022.

For the intermediaries, these lower turnovers translated into a fall of 13.5 percent in brokerage commissions to Sh1.69 billion last year.

At the NSE, stockbrokers are allowed to charge a commission on every trade capped at 2.1 percent, though, in reality, they offer discounts on this rate due to competition.

The NSE and the Capital Markets Authority (CMA) are due a cut of 0.12 percent each out of this commission, while the Central Depository and Settlement Corporation (CDSC) is paid 0.08 per cent.

On the bonds market, stockbrokers charge a fee of 0.03 percent per transaction.

On the expense side, stockbrokers struggled to cut overheads, largely due to rising employee costs that gobbled up Sh1.34 billion, representing a 15 percent jump year-on-year from Sh1.16 billion.

Total expenses, therefore, fell by just 1.5 percent to Sh2.76 billion, from Sh2.81 billion a year earlier.

The earnings today for the industry are a far cry from those they were recording a decade ago when the NSE was at its peak on the tail end of a prolonged bull run that had been partly driven by regular listings that introduced hundreds of thousands of new investors to the market.

In 2014, when the equities market was at its most vibrant with an all-time high traded turnover of Sh215.7 billion, the stockbrokers made Sh3.7 billion in trade commissions, driving their net profits to Sh1.26 billion.

The intervening years have not just seen a steady erosion in earnings, but also in the industry’s asset base, which has fallen by Sh2.3 billion to Sh12.8 billion since 2014.

For the NSE and the CDSC, their thin share of the falling brokerage commissions has put even more pressure on their bottom line, forcing them to diversify and seek new income lines.

In the year ending December 2022, the exchange reported a near ten-fold fall in net profit to Sh13.7 million from Sh132.5 million in 2021, attributed to reduced turnover in the equity trading line.

The CDSC has recently mooted introducing an account maintenance fee for investors and entitlement schedule fees for issuers in a bid to bridge a funding gap that isn’t helped by rising system maintenance costs and demands or a return by its principal shareholders.

Read: NSE drops Sh226bn as sell-off hits Safaricom, KCB

For the NSE, the search for new revenue has seen the exchange introduce new products such as derivatives and day trading to try and reinvigorate the market and unlock new activity that will generate fees.

The exchange has also sought to monetise its market data, the bulk of which was being offered to investors for free a decade ago.