Kenya is seeking to spend another Sh130.7 billion ($1 billion) this year to pay off its multi-billion-shilling Eurobond maturing in 2027 as it staggers upcoming payments in efforts to ease currency and default risks.

The country has disclosed the buyback plan to the World Bank but did not reveal whether it would use taxes or tap fresh loans to pay off the Eurobonds whose next tranche of Sh117.6 billion ($900 million) matures in 2027.

Kenya was on the radar of global investors because of elevated fears that it could fail to repay the debut Eurobond due this month in the wake of strained public finances.

But in February, the country sold a new $1.5 billion (Sh196 billion) Eurobond, which came at a steep cost, to fund the buyback of a large portion of the $2 billion (Sh261.4 billion) bond.

The second buyback is expected to ease Kenya’s debt burden while alleviating a repeat of last year’s concerns that it can repay the looming debts, given its rising public loan repayments.

“To this end, the government of Kenya is considering another Eurobond buyback in 2024, bringing the total 2024 buyback to approximately Sh326.7 billion ($2.5 billion), smoothing the amortization profile as was done for the recent issuance which was smoothed over three years,” the World Bank stated in a report accompanying its Sh156.8 billion ($1.2 billion) loan to Kenya last week.

“In addition, the government is considering liability management by leveraging sustainability instruments like debt swaps and sustainability-linked bonds (SLBs).”

The confidence following the February payment of its first Eurobond lifted the Kenya shilling against the dollar to the current Sh130.50 from a peak of Sh160.75 on January 29.

By undertaking the buyback, the government cut through investor jitters that had seen some anticipating a potential default by Kenya in a situation that led to the sharp deterioration of the exchange rate in the run-up to the February action.

“The government addressed the immediate liquidity crunch by buying back $1.5 billion of the June 2024 Eurobond through the issuance of a new Eurobond on February 12, 2024, calming markets; yields for outstanding Eurobonds eased and the exchange rate appreciated again,” the World Bank added.

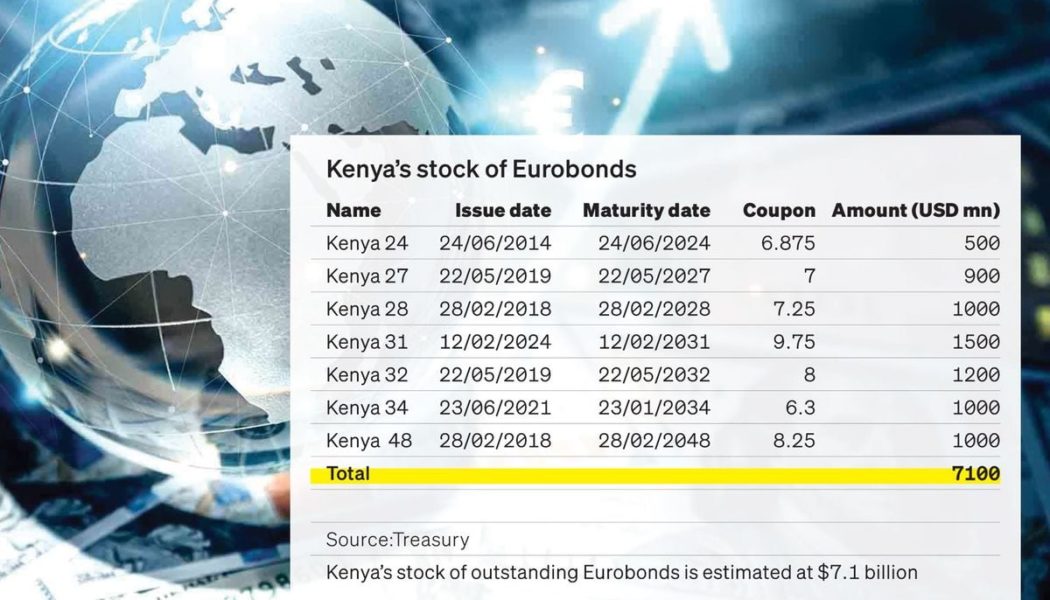

Kenya’s stock of outstanding Eurobonds is estimated at Sh927.9 billion ($7.1 billion) inclusive of the most recent issue with maturities expected between June this year and February of 2048.

The total outstanding Eurobonds amount to nearly 10 percent of Kenya’s public debt stock which stood at Sh10.3 trillion as of the end of March.

Eurobonds attract higher interest costs in contrast to loans from bilateral and multilateral partners such as the World Bank given their commercial nature.

Savings generated from the buybacks would, therefore, be crucial for a government that spent an estimated one-third of its ordinary revenue in the year to June 2023 on interest costs or Sh33 for every Sh100 in taxes collected.

The pressure on the government’s finances has forced it to squeeze every shilling it can from taxpayers, angering voters who had chosen this administration on the promise of lowering the cost of living.

But it benefits from international backing, including from the International Monetary Fund (IMF) and the World Bank which have offered multi-billion-shilling support.

According to the World Bank, the second buyback will largely target sovereign bonds maturing in 2028 and 2031.

Besides the Sh117.6 billion Eurobonds maturing in 2027, others are $1.5 billion (Sh196 billion) that should be repaid by 2031, Sh156.8 billion in 2032 and Sh130.7 billion in 2034.

The principal on the 2028 Eurobond must be paid at once, while the rest are staggered over three years.

The Treasury is likely to target a partial buyback on the Eurobond maturing in 2028.

The balance of Sh65.3 billion ($500 million) in outstanding payments for the June 2024 Eurobond is expected to be settled from a combination of financing from multi-lateral, bilateral lending and bank syndication.

“The remaining portion of the 2024 Eurobonds not purchased in the tender offer will be funded through a mix of the government funds and financing from multilateral and bilateral sources, including bank syndication,” Treasury Cabinet Secretary Njuguna Ndung’u said in February.

“This diversified financing approach aims to maintain a relatively low weighted average interest rate in the overall public debt portfolio, ensuring Kenya’s debt sustainability over the medium term.”

Kenya’s most recent Eurobond buyback has nevertheless been undertaken at a premium with the government accepting a higher interest rate of investor bids in contrast to the return settled during the paper’s first issuance.

Rising interest rates in the international capital markets have meant the government parting with a premium even as the buybacks help ease liquidity and default risk concerns.

The World Bank earlier warned Kenya of the persistence of a high risk of debt distress following the costly Eurobond buyback.

The multilateral lender highlighted that external borrowing had become more expensive than it was before the pandemic despite an ease of interest rate spreads.

The coupon on the new Eurobond issued in February was 9.75 percent compared to the 6.875 percent coupon on the 10-year sovereign bond which matures on June 24.

The recent reopening of the international capital markets for sovereign issues by countries in Africa, including Kenya, Benin and Ivory Coast has opened the window for the government to return to issues, helping resolve some of the pent-up liquidity and funding pressures seen in recent years.