Economy

Select firms to remit taxes daily in new plan

Thursday May 04 2023

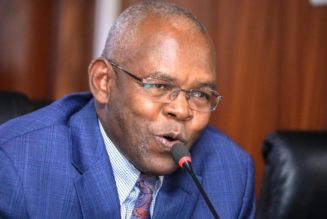

The Finance Bill 2023 is seeking to impose daily remittance of excise duty on firms with a history of falsifying actual sales through self-declaration. FILE PHOTO | POOL

The Kenya Revenue Authority (KRA) will have a free hand in requiring firms in sectors with a high risk of under-declaring taxes to pay dues daily if proposed changes to the law are approved by legislators.

The Finance Bill 2023 is seeking the green light from the lawmakers to allow the taxman to impose daily remittance of excise duty on firms with a history of falsifying actual sales through self-declaration.

The proposed policy shift follows a successful pilot that was done on about 17 betting firms last year that KRA said resulted in collections jumping as much as 50 percent compared with previous receipts.

Read: New digital tax mechanism promises Kenya windfall

Treasury Secretary Njuguna Ndung’u has now proposed changes to the Excise Duty Act to require all betting and gaming firms to remit taxes daily in a fresh war on tax cheats.

The proposed amendments to the law through the Finance Bill 2023 further empowers Commissioner for Domestic Taxes to rope in other sectors through a Gazette notice.

Presently tax on excisable goods and services is paid on the 20th of the following month, except for goods from abroad whose taxes are remitted at the time of importation.

“The commissioner may, by notice in the Gazette, require taxpayers in any sector to remit excise duty collected on certain excisable services within 24 hours from the closure of transactions of the day,” the Treasury wrote in the Finance Bill before the National Assembly.

“For the purposes of this section, ‘closure of transactions of the day’ means midnight of that day.”

The KRA had earlier said the daily remittance of excise duty will be facilitated through the integration of the tax system with targeted firms, giving it real-time access to the transactions.

The full-scope access of transactions will eliminate the current scenario where firms largely pay excise duty based on self-declared sales.

The taxman had earlier singled out mobile network operators as the next target after betting firms, suspecting them of under-declaring sales of airtime, internet and mobile money transactions.

Tax experts said daily payments were only possible if supported by facilitative technologies on the KRA side and the targeted firms, including telcos.

Read: Experts ask KRA to set tax targets to curb budget woes

“The only way you can pay taxes on a daily basis is if the technology supports it. I presume if there is any sort of interface between the KRA’s i-Tax system and telcos’ system, for example, whereby you are on a daily basis, as a transition occurs, ensuring the tax on it goes to some portal… and at the end of the day, it must be transferred,” Nikhil Hira, a partner at tax advisory firm Kody Africa LLP, said in an earlier interview.

“The question is do the firms have the technology which can support this.”