The commission previously punted two other Bitcoin ETF products for an additional 45 days

The US Securities and Exchange Commission on Tuesday revealed that it had pushed the deadline for reviewing the spot ETF proposal from technology and financial services firm NYDIG for another 60 days. The regulator explained that it saw it appropriate to delay the decision to either approve or reject the application until March 15th. The extended period, according to the commission, would provide enough time to review and make a determination on the ETF.

“The Commission finds that it is appropriate to designate a longer period within which to

issue an order approving or disapproving the proposed rule change so that it has sufficient time

to consider the proposed rule change and the issues raised in the comments that have been

submitted in connection therewith. Accordingly, the commission, pursuant to Section 19(b)(2) of the Act, designates March 16th, 2022, as the date by which the commission shall either approve or disapprove the proposed rule change,” the notice read.

NYDIG’s Bitcoin ETF application adds to the list of those either delayed or postponed

It is almost one year since the New York-based subsidiary of asset management firm Stone Ridge submitted its ETF application. The SEC initially pushed the deadline for deciding on the fund to January 15th, but with the date fast approaching, the regulator delayed it for the second time.

One notable positive for the crypto ETF community is that SEC Commissioner Hester Peirce appears to have joined the crowd rooting for the decisions to be made soon. In an interview, Peirce said she was baffled at the habitual delays and equally concerned about when the regulator will finally make decisions on the products.

“I can’t believe we’re still talking about this as if, you know, we’re waiting for one to happen […] We have issued a series of denials even recently, and those continue to use reasoning that I think was outdated at the time,” she said.

The SEC is reportedly sitting on more than 20 crypto-related ETF applications but has so far not given the green light to a first. It rejected spot bitcoin ETF applications from WisdomTree (WisdomTree Bitcoin Trust) and Kryptoin (Kryptoin Bitcoin ETF) last month. The delayed ETF proposals, on the other hand, include those from asset management firms Bitwise (the Bitwise Bitcoin ETP Trust until February 1st) and Grayscale (Grayscale Bitcoin Trust until February 6th).

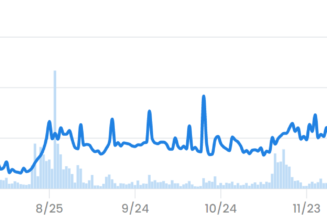

The SEC has shown leniency in approving futures ETFs, with three already approved. At present, interested investors can get indirect Bitcoin exposure through the ProShares BTC futures contracts fund that launched in October or Valkyrie Balance Sheet Opportunities ETF launched on NASDAQ mid last month. Elsewhere, the Canadian financial regulator has continued giving approval to crypto ETFs.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, crypto blog, Crypto news, Policy and Regulation, SEC