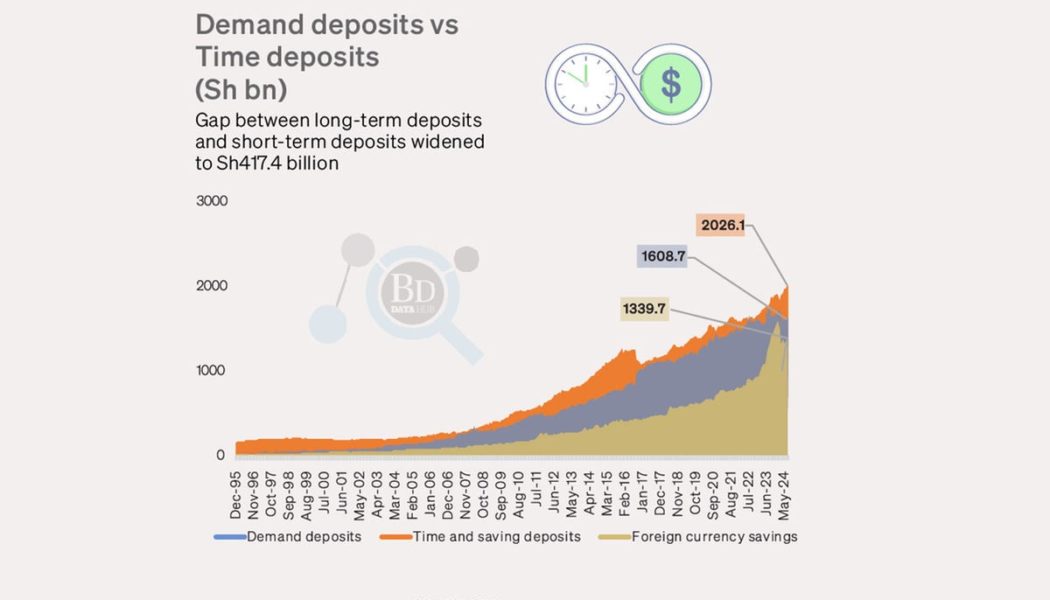

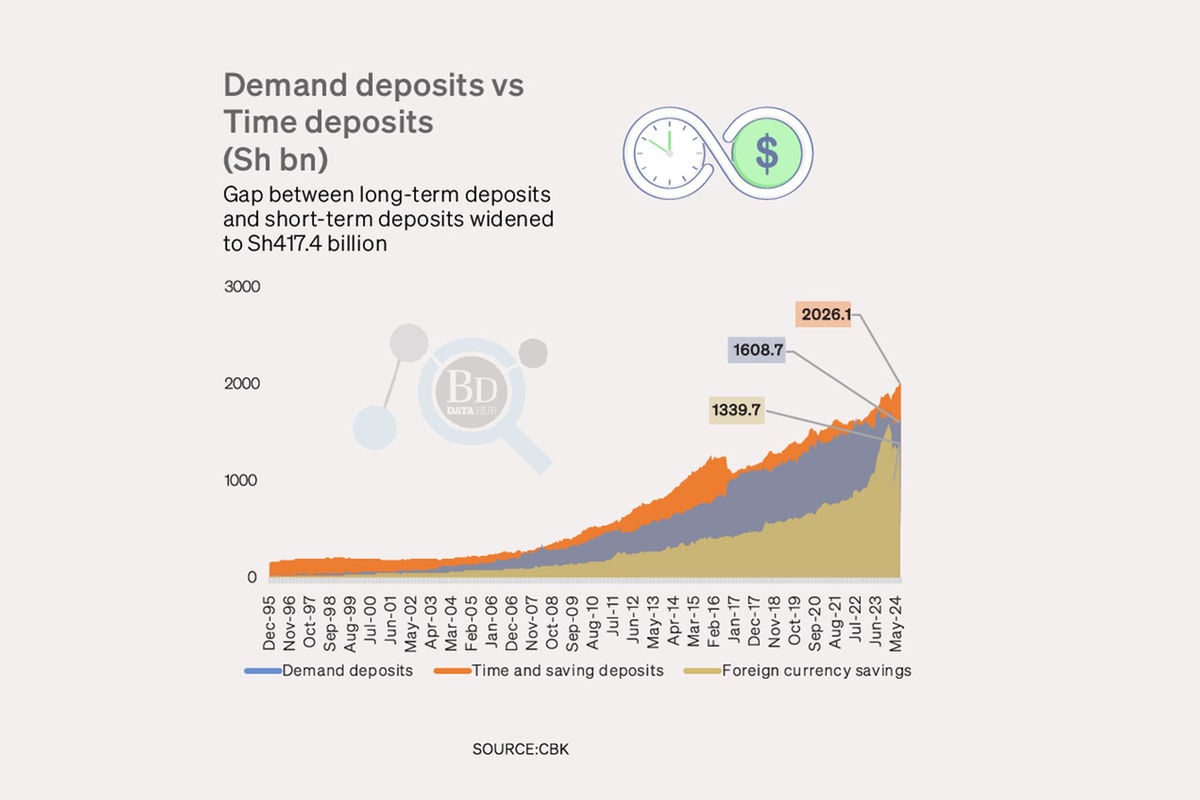

Savings in fixed deposit accounts grew by Sh124.8 billion in the first seven months of the year, crossing Sh2 trillion amidst relative high returns offered by banks.

Data from the Central Bank of Kenya (CBK) shows that cash in fixed deposit accounts stood at Sh2.03 trillion in July, accounting for Sh48.1 billion growth compared to June.

Time and savings deposits — cash in fixed deposits — have grown faster than demand deposits, signalling the growing appetite for gains from the high returns offered to Kenyans.

The time deposits attract a higher interest compared to savings. Official data indicates that commercial banks paid an average 11.28 percent on fixed deposits compared to 4.56 percent return offered on demand deposits.

Only demand deposits recorded declining growth while fixed deposits rose to Sh2.03 trillion on the back of high interest offered by banks competing with other investment classes.

Lenders offered an average return of 11.28 percent for long-term deposits in July, with June being the highest ever when returns averaged 11.48 percent.

Notably, the interest offered by commercial banks beat inflation that stood at 4.3 percent for 13 consecutive months, demonstrating lender’s intentions to lure cash-endowed individuals.

Deposit rate

The difference between deposit rate and inflation is the real interest rate which stood at 6.83 percent in the month, posting a positive return in the past 13 months.

Consequently, the return on both savings and deposit accounts reaped significant benefits from the upward revision of domestic interest rates, which began with the CBK raising the benchmark lending rate to manage persistent high inflation and exchange rate volatility.

With the CBK cutting the rate from 13 percent in February this year to a lower benchmark at 12.75 in August before settling for 12 percent in October, however, the stage has been set for lower domestic interest rates which will impact return paid to savers in commercial banks.