Safaricom suffered a Sh21.7 billion loss from Ethiopia operations in the year ended March as it returned to profit growth at the group level, helped by double-digit expansion of mobile data and mobile money platform M-Pesa business.

The telecoms operator’s results published Thursday showed net profit from Safaricom Kenya grew 13.7 percent to Sh84.74 billion while Safaricom Ethiopia posted a Sh42.09 billion net loss.

Safaricom owns 51.67 percent of the Ethiopia unit, meaning its share of the loss booked in its financial report is Sh21.7 billion of the Sh42.09 billion.

On a consolidated basis, the company posted a net profit of Sh62.99 billion — a marginal rise from Sh62.26 billion posted a year earlier.

M-Pesa revenue in the period under review grew 19.5 percent to Sh140 billion while data revenue rose 25 percent to Sh67.4 billion, driving the 12.4 percent growth in total revenue to Sh349.45 billion.

The boost from M-Pesa and mobile data revenue helped Safaricom recover from the 10.6 percent profit drop in the year ended March 2023 to post a 1.2 percent growth in earnings during the period under review.

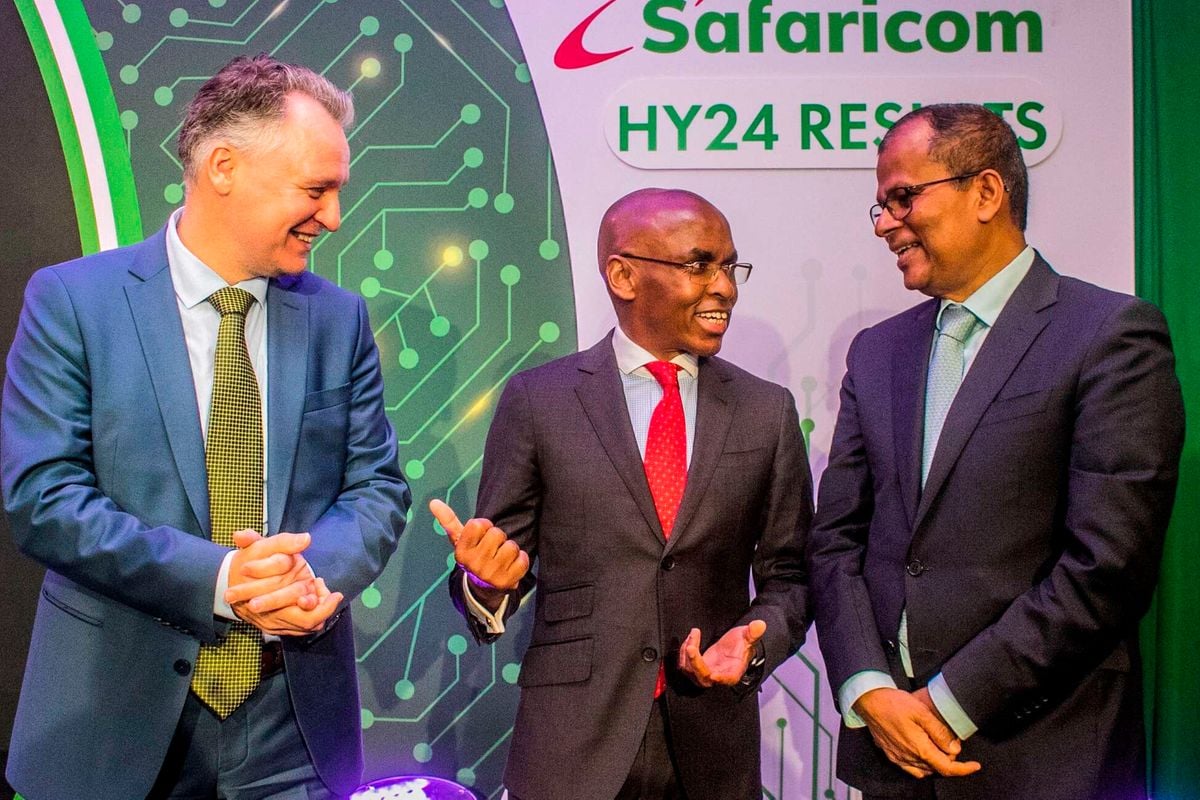

“We had an outstanding year in Kenya. We also outperformed group guidance, which was a revised guidance at group level. We are also encouraged by our commercial progress in Ethiopia. Our Kenyan operation is now a $1 billion business with operating profit hitting Sh140 billion,” said Peter Ndegwa, the chief executive at Safaricom.

“Net income, excluding minority interest, recorded a 1.2 percent growth. We expect from financial year 2025, Ethiopia will start being a significant growth contributor for top line and an accelerator for the bottom-line,” he said.

The telecoms operator launched commercial operations in Ethiopia in October 2022 and had by December last year put in $834 million (Sh110 billion).

M-Pesa’s share in Safaricom revenue moved to 40.1 percent while that of mobile data grew from 17.3 percent to 19.3 percent, cutting the share of voice and text messaging revenue further below 30 percent amid rising popularity of Internet calls and messaging applications such as WhatsApp.

The profitability in Kenya helped Safaricom maintain a Sh1.20 per share dividend amounting to Sh48.08 billion. The board has recommended a final dividend to Sh0.65 per share amounting to Sh26.04 billion to add to the Sh0.55 per share interim dividend totalling Sh22.04 billion that was paid in March.

The Sh48.08 billion dividend, which is the same as that of the previous financial year, will be paid on or about August 31, 2024 to the shareholders on the register of members as at close of business on July 31, 2024.

The telecoms operator expects to break even in Ethiopia at operating income level in the financial year to March 2025, even as it projects that the Horn of Africa business will require capital spending of between Sh21 billion and Sh25 billion.

“We believe the worst is behind us from the group financial point of view. When you look at the group numbers, you have to look at Kenya and Ethiopia separately because Ethiopia is in the investment phase and with such large greenfield investments in the last two years, it is expected to have losses at the start,” said Dilip Pal, the chief finance officer at Safaricom.

Safaricom is also betting on mobile money and data business in Ethiopia where it has on boarded 4.51 million M-Pesa users and doubled the number of active mobile data users to 1.99 million.

M-Pesa has seen increased usage, with transaction value rising Sh9.6 billion to Sh40.24 trillion. Safaricom also saw mobile data usage rise as the uptake of smartphones on its network increased by 13 percent to 22.93 million.

Expanded use of the M-Pesa platform from just sending and receiving money to other uses such as paying for goods and tapping loans has contributed to the rise in revenue.

Revenue from Fuliza overdraft service dropped to Sh3.9 billion from Sh5.4 billion despite the value of disbursed loans rising 18.9 percent to Sh833.8 billion. The telco booked Sh700 million revenue from KCB M-Pesa and Sh2.3 billion from M-Shwari as active borrowers on these platforms increased, driving the uptake.

Voice and messaging, which were for years the mainstay of Safaricom and commanded 47.2 percent of revenue six years ago, saw their share decline to 26.5 percent in the period under review from 29.7 percent a year earlier as the cut in mobile termination rates (MTR) piled pressure on voice revenue.

MTR, which are the charges levied by a mobile service provider on other operators for terminating their voice calls on its grid, was cut to Sh0.58 starting August 2022 from Sh0.99. In March this year the MTR fell to Sh0.41, in what looks set to pile more pressure on voice revenue.

Safaricom’s direct costs in the year to March 2024, including commissions to agents and licence fees, hit Sh97.05 billion from Sh92.2 billion while other operating expenses such as those towards network maintenance closed at Sh83.3 billion from Sh74.1 billion.

Editor’s note: The headline to this article has been amended to reflect the group after-tax profit.