Telco Safaricom has revealed that its active M-PESA users have surpassed the 30-million mark for its Kenya customers, according to Techweez.

Techweez says that this new development follows after the product’s 15th birthday after its launch in May 2007. M-PESA has the most active market accounting for more than 30 million of the service’s 51 million customers across Kenya, Tanzania, the Democratic Republic of Congo, Mozambique, Lesotho, Ghana, and Egypt.

“The growth in M-PESA customer usage has been driven by the launch of various innovations over the years including financial services such as M-Shwari, KCB M-PESA, and Fuliza,” Peter Ndegwa, CEO of Safaricom, said.

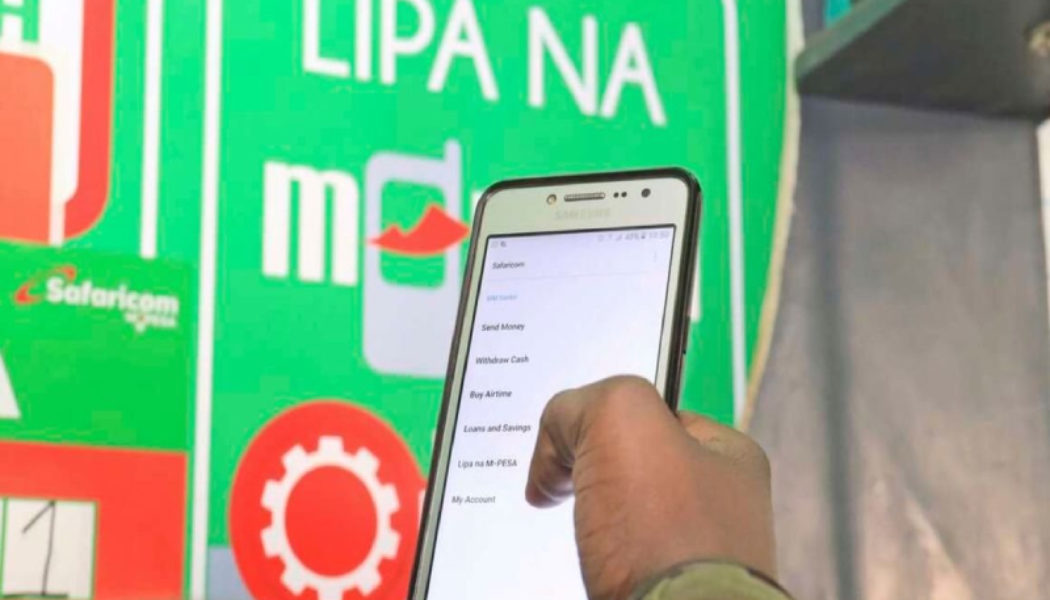

Last year, Safaricom launched the M-Pesa Super app that enables users to request payments, send money, pay bills and transact seamlessly across the borders, according to Business Daily.

The Central Bank of Kenya (CBK) reportedly plans to launch a national payment system that will force Safaricom to accept cash from rival firms such as Airtel on its Lipa and M-Pesa, enabling a seamless transfer of money through merchants.

The new system which will be introduced in 2024 will remove the barrier where Airtel subscribers cannot pay for goods and services through Safaricom’s till and pay-bill numbers.

Safaricom said that M-PESA recorded explosive growth in business usage with the number of businesses accepting payments on its Lipa Na M-PESA service in the last two years, more than doubling from 173,000 in April 2020 to more than 387,000 today.

“Safaricom has equally established both local and global partnerships that enable customers to send and receive money, and to make payments across the world including with PayPal, AliExpress and Western Union,” Ndegwa said.

M-Pesa has more than a million downloads on Google Play Store currently and Safaricom says that it is looking to grow its continental and global partnerships to introduce new international money transfer solutions.

By Zintle Nkohla

Follow Zintle Nkohla

Follow IT News Africa

Tagged: Airtel, AliExpress, Central Bank Kenya, digital payment, East Africa, IT News, IT News Africa, M-Pesa Africa, M-PESA Kenya, Mobile and Telecoms, mobile banking, PayPal, Peter Ndegwa CEO of Safaricom, Safaricom, tech news, technology, Telco Safaricom Kenya, Top Stories