Safaricom has opened a window for partnership with satellite Internet providers that rival Elon Musk’s Starlink in a push to tap customers in areas not served by its networks.

The telecoms operator yesterday said it would prefer future partnerships with satellite providers to expand its reach in remote areas without deploying huge capital for infrastructure deployment.

Safaricom chief executive Peter Ndegwa said the entry of Starlink will not push it into making “duplicate investments” by splurging on satellite technology in areas such as urban centres where its wireless Internet and fibre connectivity is already serving customers.

The number of Kenyans using satellite Internet has surged since Starlink, a subsidiary of Mr Musk’s aerospace company SpaceX, entered the Kenyan market in July last year.

The American firm, riding on the back of one of the world’s richest persons with a networth of $237 billion (Sh30.6 trillion), is betting on lowering Internet costs, triggering a response from the dominant Safaricom.

Mr Ndegwa clarified that it is not in talks to tie-up with Starlink, but kept the door open for a future deal if the satellite firm is open for a partnership.

“We see satellite as a technology that will help us cover areas that cannot be commercially viable through fibre and mobile because of the level of investment needed. We are open for collaboration with satellite providers,” Mr Ndegwa said in an interview with the Business Daily.

“It could be Starlink, AST or any other provider. But our view is that it should complement rather than duplicate the investment that we have already made.”

Starlink has struck partnership agreements to distribute and provide Internet services in remote areas in many parts of the world, shying away from equity or ownership deals.

It has a licence to operate in Kenya and tapped little-known firm Karibu Connect as a reseller of its products in Kenya.

Vodafone, which has 5.0 percent direct stake in Safaricom and a 35 percent indirect ownership via Vodacom, has also shied from dealing with Starlink.

Instead, it has partnered with Starlink’s rival, Amazon.com’s Kuiper for Internet networks in Europe and Africa where satellites would be used to connect mobile base stations in remote locations to Vodafone core networks, eliminating the need for fibre-based or fixed wireless links.

In Kenya, Mr Ndegwa said the focus will be to partner with satellite Internet operators in unserved and underserved areas where investing as a single player may not generate a decent return.

He revealed that three years ago the telco piloted the satellite technology with AST SpaceMobile—a US-based satellite designer and manufacturer— on how to complement its investment in Internet connectivity with satellite.

“To the extent that we have places we have not covered, we should partner in the future with appropriate satellite providers, including Starlink,” the Safaricom CEO said.

“But to just use satellites to compete in urban areas, frankly that will be a duplication for us. We are still not at a stage where we can say we are partnering with Starlink but in the future, we don’t rule this out.”

Safaricom asked the Communications Authority of Kenya (CA) in July to re-evaluate its decision to grant independent licences to satellite service providers, warning that such arrangements could allow illegal connections and harmful interference with mobile networks.

It also cited security risks and lapses in regulatory oversight due to the cross-border nature of satellite services.

Safaricom wants the satellite service providers to operate as infrastructure providers while giving the operating licence to the existing mobile network operators (MNOs).

The government has a 35 percent stake in Safaricom and earned Sh17 billion in dividends from the firm –a position a few analysts thought would convince the State to offer the Nairobi bourse-listed firm protection.

But President William Ruto has publicly supported Starlink’s entry into Kenya.

Safaricom has avoided a direct price war with Starlink and instead raised its home fibre Internet speeds by up to five times in efforts to protect revenues and guard its customer base.

For the same prices, Safaricom home fibre customers will now access 15 megabytes per second (mbps), up from 10mbps at Sh2,999; 30mbps up from 20; 80mbps, doubling from 40; and 500mbps, up from 100mbps.

The telecoms operator also introduced a higher speed package of 1,000 mbps from the previous maximum of 100mbps in response to Starlink’s entry.

“There has been a lot of excitement by customers with the entry of Starlink into the market. You expect that with a new entrant with a new technology, which is satellite,” said Mr Ndegwa, arguing that the telco will avoid price wars but balance between investing for customer experience and getting returns.

“We did not increase speeds just because of Starlink, we were already seeing this as a huge opportunity to deliver a great experience for our customers. We also realised that with the base offer we had, a lot of customers were maxing out.”

Starlink recently introduced the cheaper and portable version of its Internet installation called Starlink Mini, going for about Sh27,000, being substantially lower than the Sh45,000 asking price for the standard package it started with.

Mr Ndegwa says about 15 percent of homes and businesses are currently connected, leaving a lot of opportunities for Internet service providers (ISPs) to exploit.

Safaricom’s fibre optic footprint hit 17,000 kilometres at the end of March this year, marking a 21.4 percent growth from 14,000 kilometres in a similar period last year. Residential homes connected to fibre optic networks grew by 34.9 percent to 371,989.

Kenya is among the few countries in Africa that have allowed Starlink. Others are Nigeria, Rwanda, Mozambique, Malawi, Zambia, Benin and Eswatini.

But Starlink’s entry in Africa has been met with numerous regulatory obstacles in some countries. Several African markets have classified Starlink as ‘illegal’ within their territories. They include Cameroon, Cote d’Ivoire, South Africa, Senegal and DRC.

Earlier this year, Cameroon ordered the seizure of Starlink equipment at ports as the satellite service provider was not licensed.

Part of the concern by governments in Africa is the need to control the content being shared on Starlink.

In the case of South Africa, Mr Musk’s country of birth, Starlink was denied licence after it failed to comply with the requirement to cede a 30 percent stake to the locals.

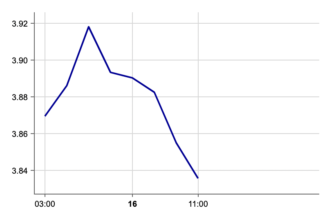

Latest data from the CA reveals that following Starlink’s entry into the Kenyan market, satellite Internet usage more than tripled to 4,808 subscriptions in March, up from just 1,354 in September last year.

Safaricom currently controls the giant share of the fixed Internet market, with about 37.4 percent of all subscribers, followed by Jamii Telecoms (Faiba) and Wananchi Group (Zuku), which enjoy about 23 percent and 19 percent of the market share respectively.