Popular retail trading platform Robinhood has fired 9% of its workforce amid a firesale of its stock that has seen HOOD plunge to all-time lows.

In the past 30 days alone, HOOD has tanked roughly 38% to sit at $9.99 at the time of writing, marking the lowest price since the initial public offering (IPO) launch in mid-2021.

The decline is part of a longer-term bearish trend that has seen the price of HOOD continually decrease since its all-time high of roughly $70.39 on Aug. 4 2021 according to TradingView.

Robinhood publicly announced its staff readjustment via an April 26 blog post by CEO and co-founder Vlad Tenev. He noted that after going through a “period of hyper-growth” between 2020 and H1 2021, the firm’s headcount had increased nearly six times, from 700 to nearly 3800 employees.

However, Tenev suggested that too many job roles at the company have since become unnecessary, stating that:

“This rapid headcount growth has led to some duplicate roles and job functions, and more layers and complexity than are optimal. After carefully considering all these factors, we determined that making these reductions to Robinhood’s staff is the right decision to improve efficiency.”

“We will retain and continue to hire exceptional talent in key roles and provide additional learning and career growth opportunities for our employees,” he added.

Related: Robinhood CEO outlines how DOGE could become ‘currency of the internet’

Crypto to help drive the recovery?

Moving forward, Robinhood stated in the announcement that it is positioned well for the future with more than $6 billion worth of cash on its balance sheet, while also noting that it will continue to introduce “key new products across Brokerage, Crypto, and Spending/Saving” in 2022.

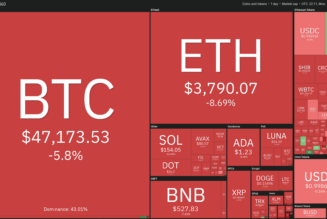

The firm’s total revenue last year totaled $1.82 billion, up 89% compared to 2020, and a significant part of Robinhood’s performance was due to revenue generated from crypto services.

Crypto transaction revenue totalled $419 million in 2021 marking a whopping 1451% increase compared to the year prior. In Q2 2021 in particular, crypto accounted for 41% of Robinhood’s total revenue, however it’s worth noting that the figure dropped down to around 13% by Q4.

Robinhood doesn’t appear to be losing interest in the sector this year however, and has made many moves geared towards expanding its crypto offerings of late.

On April 19, Cointelegraph reported that Robinhood acquired British crypto-asset firm Ziglu to help its expansion plans into U.K. and European markets, something which Tenev highlighted will “continue to accelerate” this year.

Earlier this month, Robinhood also rolled out its highly anticipated crypto wallet to 2 million waitlisted users, outlined plans to integrate the Lighting Network, and it listed Shiba Inu (SHIB) after months of campaigning from its supporters.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, Crypto revenue, HOOD, Robinhood, Vlad Tenev