Luxury brands LVMH, Hermès and Christian Dior clocked sharply higher India sales in 2023, as connoisseurs of apparel, bags and accessories flocked to local stores after the covid pandemic ruined foreign travel. Alongside, a clutch of luxury malls came up in top cities, designed to serve the wealthy and the well-travelled.

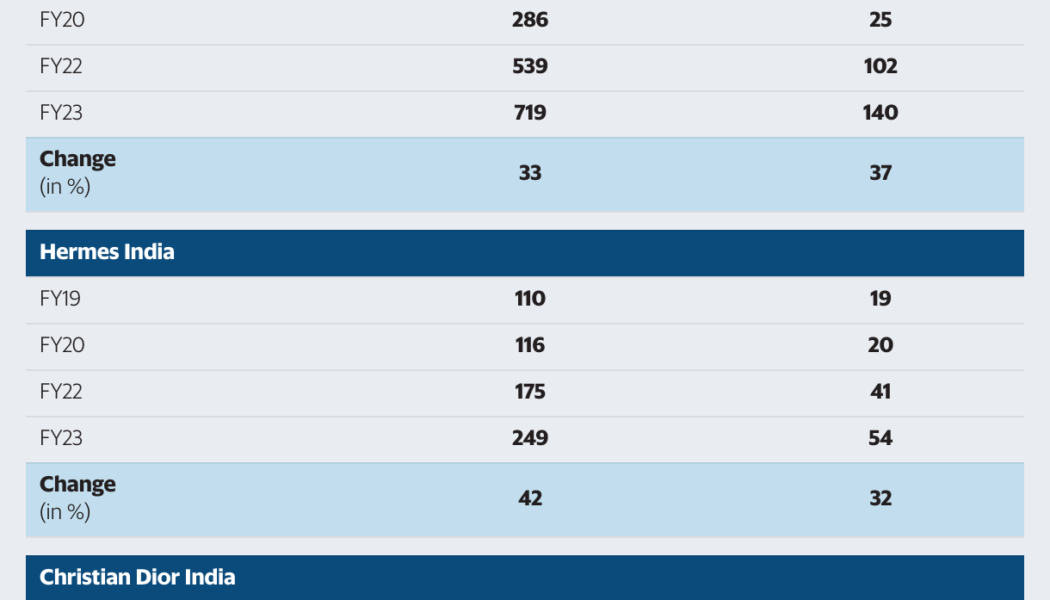

Louis Vuitton India Retail Pvt. Ltd, the Indian unit of LVMH instantly recognizable with its LV monogram and Damier check patterns, clocked over ₹719 crore sales in FY23, up 33% from the previous year’s ₹539.28 crore . Net profit rose 37% to ₹140 crore, up from ₹102.4 crore in FY22. In FY20 and FY19, its net profit had stood at ₹25.3 crore and 16.1 crore, respectively, filings with the Registrar of Companies, accessed through business information platform Tofler showed.

Rival Hermès, which runs its India business through a local partner under Hermes India Retail and Distributors, reported 42% higher sales at ₹249.4 crore in FY23, against ₹175.4 crore the previous year. It clocked a profit of ₹54.3 crore, up 31% from the previous year’s ₹41.4 crore. In FY19, it had recorded revenue from operations of ₹109.6 crore and a net profit of ₹18.7 crore. Hermès keeps a very limited production line, controls distribution, and sells exclusive bags like the Birkin and Kelly, all at steep price tags.

Similarly, Christian Dior, which retails under Christian Dior Trading India Pvt. Ltd, reported revenue of ₹183.22 crore in FY23, up 20% from the previous year’s ₹152.6 crore. However, profit fell to ₹32.13 crore from ₹35.59 crore in the previous year, as expenses rose. In contrast, the company had clocked a net loss of ₹26.7 crore in FY19. In 2023, a majority of its business came from leather goods, with the company selling ₹102.1 crore worth of bags and shoes. It sold ready-to-wear products of ₹21.7 crore and accessories worth ₹12.7 crore.

“Indian luxury is still running on the covid halo led by millennial and Gen Z buyers, a lot of whom are now buying in India and not just abroad,” said Raahuul Kapoor, founding partner, Luxury Ampersand Frolics, a luxury retail company and consultancy. “Buyers are using these luxury brands to define themselves, though a lot of the money for these purchases is still coming from Gen X (the demographic cohort following the Baby Boomers and preceding millennials or the parents of these generations),” Kapoor said, adding that LV’s India success could have been helped by its online shopping vertical.

According to Euromonitor International, India’s luxury goods market is among the world’s fastest-growing, projected to reach $8.5 billion in 2023, up $2.5 billion from 2021. India has witnessed a remarkable rise in the number of ultra-high-net-worth Individuals—individuals with net assets exceeding $30 million. This affluent class possesses significant disposable income and a growing appetite for luxury goods and experiences.

“A lot of the sales are now happening from towns that were earlier not even considered by these brands. There has been rapid growth in the number of buyers, too. The evolved or the ‘old money’ rich, on the other hand, are moving to ‘quiet luxury’ where they want to showcase their brands less and less with fewer logos and monograms, for instance, brands like Stefano Ricci and Brunello Cucinelli, which are also experiencing 200 times the growth they were during covid,” Kapoor of Luxury Ampersand Frolics added.

On 7 December, Mint reported that a dozen luxury brands were close to opening their first India stores, or looking to scale up their presence in the country, including Dolce & Gabbana, Golden Goose, Balenciaga and Jacquemus. The growth has also been aided by the rise of luxury malls in top cities.