Cash-rich parastatals are set for leaner times after the State moved to raid their coffers in a move that will also see them surrender their surplus funds to the Treasury instead of investing in government papers.

President William Ruto’s administration is eyeing at least Sh708.43 billion held by the parastatals and regulatory bodies in the cash mop-up that will affect entities such as the Central Bank of Kenya (CBK), the Kenya Pipeline Company (KPC), and the Kenya Ports Authority (KPA).

Other public entities flush with cash earned from charging fees or levies are the National Health Insurance Fund (NHIF), and the National Social Security Fund (NSSF), the Public Service Superannuation Scheme (PSSS) and the Kenya Roads Board (KRB).

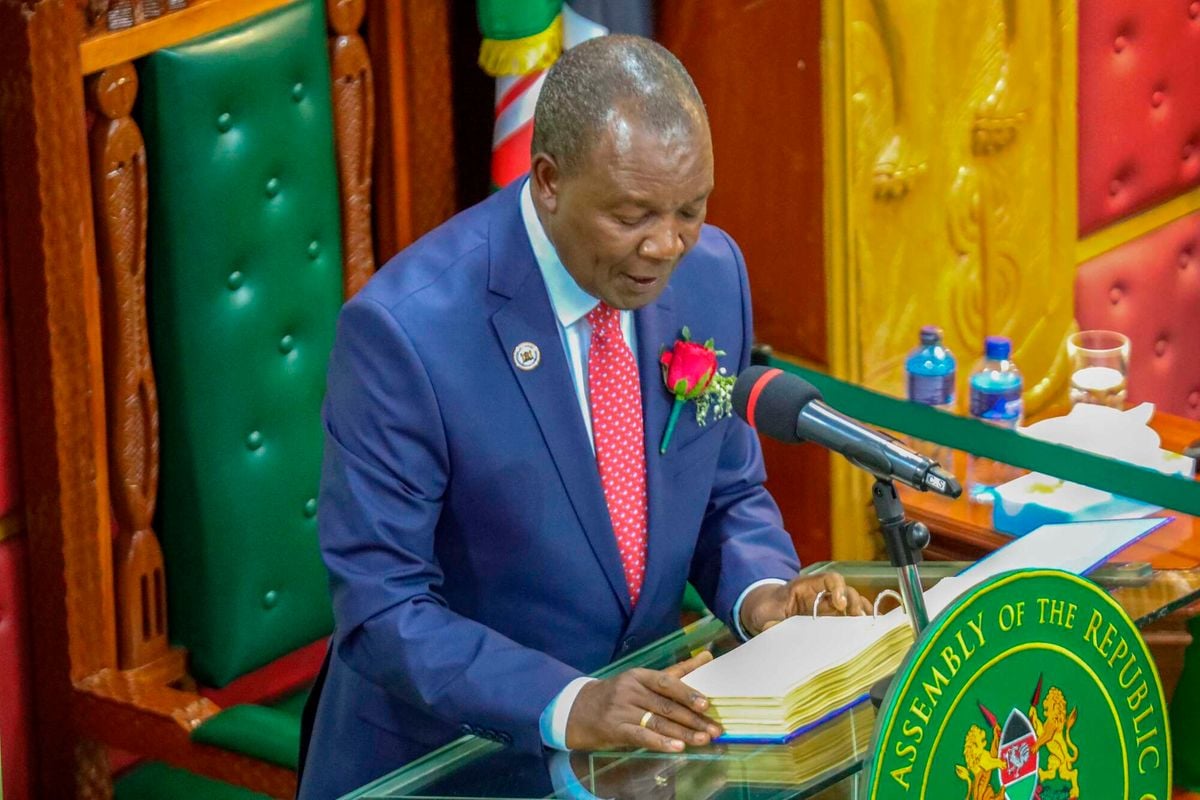

Treasury Cabinet Secretary Njuguna Ndung’u revealed in his budget speech last Thursday that a big chunk of the Sh708.43 billion, about Sh431.7 billion, is held in various financial institutions. The rest has been invested in government securities.

By Friday last week, parastatals held 5.15 percent of the government’s domestic debt, amounting to Sh276.73 billion, data from the CBK shows.

Prof Ndung’u noted that the funds held by public entities in various financial institutions by the end of July last year would have come in handy when the government was in dire financial straits, with public servants experiencing delays in salary payments as the State prioritised debt service.

“The National Treasury undertook an inventory of bank accounts and balances held by public entities in various financial institutions and established that as at 30th June 2023, these entities held Sh431.7 billion with various financial institutions,” he said.

“These large cash balances were not immediately accessible at a time when the government was cash-strained.”

Beginning next month all monies collected by the public entities are to be consolidated into a Treasury single account (TSA) held at the CBK and another one at the commercial banks, said Prof Ndung’u.

“The National Treasury in this respect, will establish a Treasury Function to manage the TSA and TSA-Sub Accounts’ structure so that everyday government financial position is known and ascertained. The migration to the TSA system commences on 1st July 2024,” said Njuguna.

Cash-rich parastatals have been used as centres of political patronage, with the executive positions being filled with well-connected individuals while Cabinet Secretaries use the firms to exert their influence.

But with the consolidation of the cash into a single account and the surplus surrendered to the Treasury, the incentive for political patronage is likely to be weakened.

The law requires parastatals to surrender the surplus cash to the Treasury at the end of the financial year. However, most of them opt to invest the money.

Questions have been raised about the logic of parastatals getting money from the Exchequer, or raising money on behalf of the State, only to lend it back by buying Treasury bills and Treasury bonds.

As part of a financing deal that Kenya has with the International Monetary Fund (IMF), President Ruto’s government has been consolidating funds by increasing revenues flowing to the Exchequer, both from taxes collected by the Kenya Revenue Authority (KRA) and fees, fines and commissions, charged by various public entities.

High debt service costs, which have left the Treasury with little money for other public services, have seen the government aggressively go after the cash held by public entities even as it hits taxpayers with new tax measures.

State corporations are not only expected to wean themselves off the Exchequer by improving their revenues, they are now also expected to remit most of that money to a single account held at the CBK.

In his budget speech last week, Prof Ndung’u also announced the suspension of a policy which allows semi-autonomous government agencies (SAGAs) to invest their surplus funds, a directive that mirrors an earlier one issued by his predecessor, Ukur Yatani.

Mr Yatani had also directed all the parastatals to liquidate their investments in Treasury bonds and remit the cash to the Treasury. However, the directive does not seem to have been successful as the fraction of domestic debt held by parastatals has barely reduced. Invoking the requirements of the Public Finance Management Act, 2012 and the Public Finance Management Regulations, 2015, Prof Njuguna directed SAGAs to surrender such surplus funds to the Exchequer.

By the end of June last year, surplus funds for 510 public entities, including SAGAs, State corporations and public funds, was Sh196.4 billion, an increase of 27 percent from Sh143.66 billion in the previous period.

The CBK, the PSSS and the NSSF had the highest surplus funds at Sh145.49 billion, Sh44.6 billion and Sh25.5 billion respectively.

Other corporations with high surplus funds are the National Government Constituencies Development Fund (Sh20.17 billion), the KPA (Sh11.99 billion), the Kenya Civil Aviation Authority (Sh5.08 billion), KenGen (Sh5.19 billion), and Kenya Pipeline Company (Sh4.1 billion).

Also as part of consolidating funds, all public entities have been ordered to receive payment for their services through a single digital payment platform paybill number 222222.

All the other payment platforms are to be shut down, with all the State corporations required to migrate their services to eCitizen by the end of this year.

State bodies are expected to raise close to Sh400 billion through these fees and fines, known as ministerial Appropriation-in-Aid, in the fiscal year starting July. Most State corporations have since increased the fees and fines for various services, as the State moves to supplement tax collection.

State agencies that have increased non-tax revenues include the Immigration Department, which wants higher passport application and visa fees.

Other government services that have been raised are land transaction fees as well as service charges by the National Transport and Safety Authority.