- The macro guru told the community to focus on Bitcoin’s long-term

- He labelled the current liquidity and behaviour’ noise.

Co-founder and CEO of Real Vision Raoul Pal has defined an interesting position on Bitcoin’s market behavior.

The crypto investor earlier today posted on his Twitter account telling the community that Bitcoin, just as other assets, remains a risk-on product in the short term. However, unlike a good number of these ‘other’ risk assets, Bitcoin promises an exponential pattern of growth over the long term.

Bitcoin’s long-term trend is different from the majority of risk assets

The former Goldman Sachs executive asked holders to ignore the current volatility “noise” and instead focus on the overall potential of the digital asset.

“Bitcoin IS correlated with risk in the short term, of course, it does, it’s an asset and they all do! It is subject to short-term liquidity and behaviour, but its long-term trend is EXPONENTIAL, unlike most other risk assets. I don’t know why people struggle with this noise,” he noted.

The macro guru indicated that he remains rooted in the Ethereum hodling camp. Pal’s pro-ETH comments come hardly a week after saying he had flipped his initial preference for Bitcoin with Ethereum.

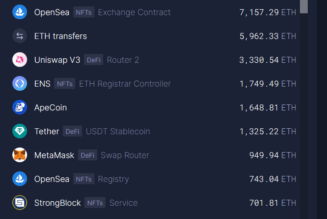

As per an interview published by Real Vision, Pal said there had been a consistent surge of institutional interest in Ethereum, which has contributed to his change of mind. He observed that, unlike in the past, institutional investors have started hodling ETH in their portfolios as they seek to diversify and get more involvement with blockchain.

“When my views on Bitcoin changed significantly, I don’t think less of it as an asset, but I thought about it in network terms and the community, and I thought the community is not attracting new people,” he said in the Cryptoverse interview.

Thursday’s crypto pullback

The short-term volatility that Raoul Pal wants the community to disregard as noise has continued to hit the markets today. Early Thursday, the markets plunged, causing a liquidation volume north of $230 million as per Coinglass.

Bitcoin is down back to $39k as the markets await the European Central Bank (ECB) to define action reactive to the imminent inflation crisis in Europe. The world’s leading digital asset almost erased the gains brought by President Biden’s executive order on crypto on Wednesday.

The ECB has since confirmed the interest rates will remain unchanged for longer as Europe contends the effects of the ongoing war in Ukraine.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Analysis, Bitcoin, crypto blog, Crypto news