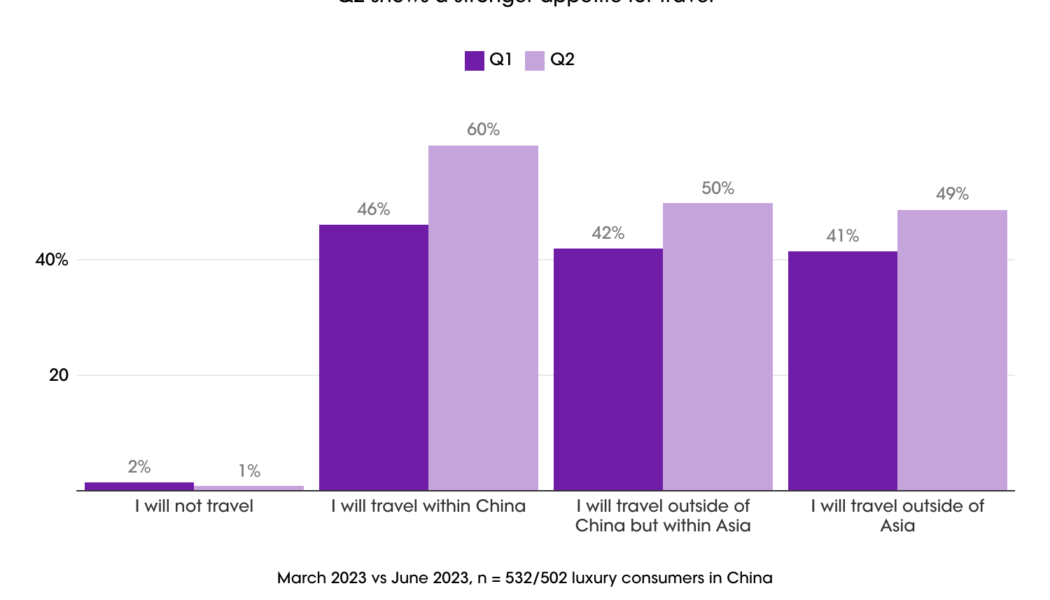

As international travel slowly returns in the region, luxury brands may want to sit tight for the definitive opportunities beyond China. Eight per cent of Chinese consumers purchase designer fashion overseas, while 18 per cent purchase in Chinese territories such as Hong Kong, Macau, and Hainan Island. Age seems to be a defining factor when it comes to understanding where consumers are shopping. More than 40 per cent of consumers aged 35-54 prefer shopping in physical stores in their own cities, whereas Gen Z punches above average for shopping online (47 per cent compared to the average of 29 per cent).

Beyond Asia, the EU and the UK might be placed more favourably for inbound high-spending Chinese tourists, compared to the US, given price favorability in these markets, as well the growing concerns regarding the US-China relationship. One-third of luxury shoppers surveyed are concerned about how the situation will span out between the two nations.

Irrespective of travel intentions or economic concerns, however, bellwethers with the highest purchase intent are already pumping up their international strategies. Gucci, for example, has set up ultra-exclusive salons in LA and other existing boutiques across New York, Paris, London, Milan, Dubai, Hong Kong, Shanghai, Taipei and Tokyo to lure the crème-de-la-crème of luxury’s high-end clientele from all over the world, including China. With assortments ranging from $40,000 on the lower end to as high as $3 million, these private salons aim to target only the wealthiest shoppers, set to be the least impacted by economic conditions.

China’s high-spending youth

Going forward, youth unemployment emerges as a main source of concern. One in five young luxury consumers (aged 18 to 24) are worried about losing their job, while two in five are concerned about the country’s economy. With long-term industry growth forecast to be driven by China’s high-spending Gen Z, brands need to start thinking about how they can protect and grow luxury consumption among younger cohorts — whether it’s minimal designs, preferred modes of discovery, or accessible subsidiary lines.