Economy

Protests over new taxes unnerve global investors

Wednesday July 19 2023

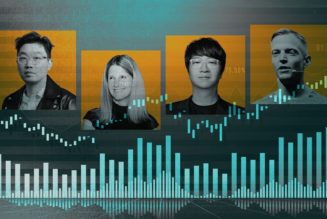

Demonstrators light fires and block roads as they protest tax increases in Nairobi, Kenya on July 12, 2023. PHOTO | GERALD ANDERSON | AFP

Investors are increasingly getting worried about continued anti-government protests in Kenya amid legal hurdles in enforcing new tax measures meant to help the country avoid a sovereign debt default.

Kenya’s opposition plans a new wave of demonstrations from Wednesday through Friday to, among other grievances, protest the worsening cost of living crisis, exacerbated by the tax measures to fund President William Ruto’s first budget.

Read: Businesses count losses as anti-government protests bite

The anticipated unrest, economists say, will likely reduce the circulation of cash, hurt investments and put jobs at stake in a country struggling to create decent employment opportunities for its growing population of skilled youth.

Global analysts, however, see the full implementation of the painful taxes, projected to raise Sh211 billion in new revenue as necessary in “placing Kenya’s public finances on a sustainable footing.”

“Protests and the suspension of a raft of tax hikes have made the Kenyan government’s task of averting a sovereign default all the more difficult,” Jason Tuvey, deputy chief emerging markets economist at UK-based Capital Economics, wrote in a note on Kenya.

“It remains to be seen if these are bumps on the road for the government’s austerity plans or permanent roadblocks. Either way, investors have been spooked by recent developments with dollar bond spreads widening by 50 basis points over the past week or so as the path to avoiding default continues to narrow.”

Chief Justice Martha Koome appointed three judges on Tuesday to hear and determine several petitions challenging the Finance Act, 2023 whose implementation was halted by the High Court on June 30.

The bench will have Justice David Majanja of the commercial court as the presiding judge and Justices Christine Meoli and Lawrence Mugambi.

Treasury Cabinet Secretary Njuguna Ndung’u’s attempts to have the suspension lifted were rejected by Justice Mugure Thande, who ruled that Kenyans might be subjected to an unconstitutional law should the petitions succeed.

At the same time, Attorney-General Justin Muturi has moved to the Court of Appeal seeking to lift the freeze arguing that the suspension is affecting government operations.

Among the matters the court will deal with first is an application filed by Busia Senator Okiya Omtatah seeking punishment for Energy and Petroleum Regulatory Authority (EPRA) managing director Daniel Kiptoo, after the agency adjusted fuel prices despite being served with the court order.

Epra announced record fuel prices after the Finance Act, of 2023 doubled the value-added tax (VAT) on the commodity to 16 percent from 8.0 percent.

The bench will also decide on applications by various parties to consolidate the petitions.

The Ruto administration is banking on the full enforcement of the tax measures to narrow the fiscal deficit from an estimated 5.8 percent of the gross domestic product in the last financial year to a projected 4.4 percent in the current year.

Reduced fiscal deficit, amid increased mobilisation of tax revenues, is projected to ease pressure on the Treasury to borrow beyond the budgeted Sh663.50 billion in the current year ending June 2024, lower than the estimated Sh824.0 billion in the year ended June.

The Central Bank of Kenya (CBK) has said the government has little room for spending cuts, meaning the success of the country’s fiscal consolidation largely hinges on the new taxes, which include a 1.5 percent housing levy on monthly pay for workers.

“[On new taxes], we are only concerned about the impact of the high debt levels that we have. I know, sometimes, we think that there is a lot to cut on expenditure but you will be surprised to know… there is very little room for sharp expenditure cuts and we don’t want to cut development expenditure,” CBK Governor Kamau Thugge said on Monday.

“So it’s very important that we mobilise revenue so that we reduce borrowing to stabilise our debt going forward.”

The CBK, the government’s fiscal agent, is staring at 59.83 percent growth in external debt servicing costs to Sh622.47 billion, payments which global analysts are worried Kenya will struggle to honour amid elevated interest rates in international markets.

These include a Sh258.24 billion bullet repayment of the debut Eurobond.

Read: How markets are shrugging off opposition-led protests

“We argued a couple of weeks back that the 2023/24 budget – which aims to narrow the budget deficit through a range of tax hikes – would if implemented in full, go a long way towards placing Kenya’s public finances on a sustainable footing,” Mr Tuvey wrote.

“But we also highlighted the risk that the [taxation] measures could stoke unrest. This has materialised over the past week, with protests taking place across key cities.”

Several businesses in most parts of the country, including Nairobi’s central business district (CBD), remained closed for the better part of Wednesday last week during violent protests, which left more than a dozen civilians dead.

The United Nations Human Rights Office said last Friday that it was concerned over “widespread violence, and allegations of unnecessary or disproportionate use of force, including the use of firearms, by police during protests in Kenya.”

“The policing of protests must seek to facilitate peaceful assemblies, and any use of force must be guided by the principles of legality, necessity, proportionality and non-discrimination. Firearms should never be used to disperse protests,” the UN body said in a statement.