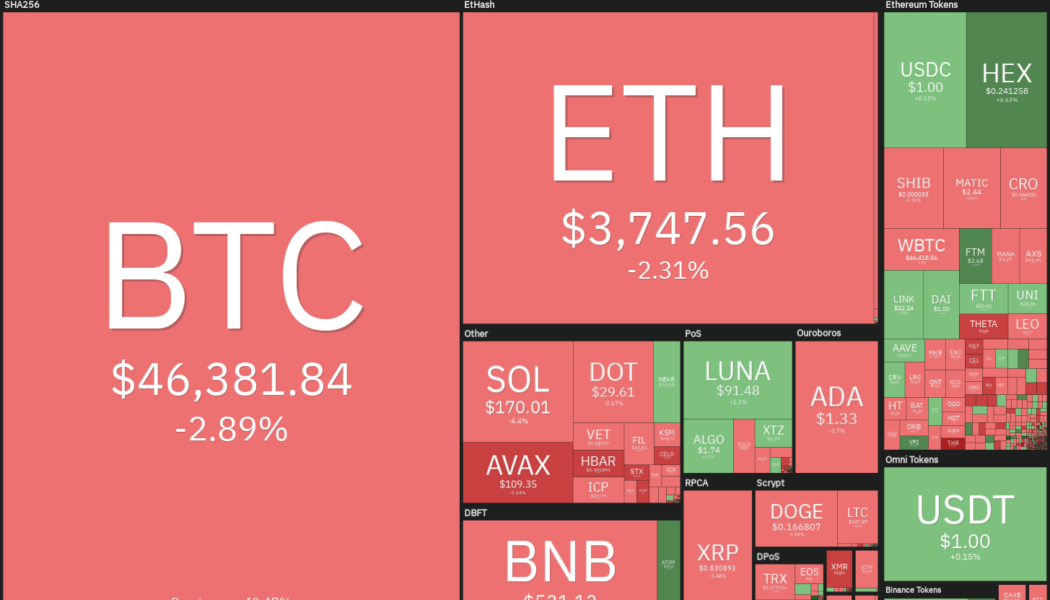

Bitcoin’s (BTC) price action has been uneventful in the first few days of the new year and it continues to languish below the psychological level at $50,000. The Crypto Fear and Greed Index is in the fear zone registering a value of 29/100.

On-chain analytics resource Ecoinometrics said stages of extreme fear rarely remain for long, which means “there is a limited downside at 30 days.”

Bitcoin continues to garner support from various quarters. Wharton School finance professor Jeremy Siegel said in an interview with CNBC that Bitcoin has replaced gold as an inflation hedge in the minds of Millennials.

Savvy investors have been turning to Bitcoin to protect their portfolios against the possible debasement of fiat currencies. Hungarian-born billionaire Thomas Peterffy advocated putting 2% to 3% of one’s portfolio in crypto to hedge in case fiat “goes to hell.”

Could Bitcoin shed its range-bound action and start a trending move? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin’s failure to rise above the 20-day exponential moving average (EMA) ($48,449) suggests that bears are selling on every minor rally. Both moving averages are sloping down and the relative strength index (RSI) is in the negative zone, indicating advantage to bears.

The bears will now try to sink the price below the strong support at $45,456. If they succeed, it will suggest the resumption of the down-move. The BTC/USDT pair could first drop to the Dec. 4 intraday low at $42,000 and if this level cracks, the next stop could be $40,000. The longer the price sustains below the 20-day EMA, the greater the possibility of a move down.

Conversely, if the price turns up and breaks above the 20-day EMA, it will suggest that bulls are attempting a comeback. The pair could then rise to the 50-day simple moving average (SMA) ($51,938), which may act as a strong barrier. If bulls thrust the price above this level, it will suggest a possible change in trend. The pair could then start an up-move to $60,000.

ETH/USDT

Ether’s (ETH) rebound off the $3,643.73 to $3,503.68 support zone has reached the 20-day EMA ($3,899) where the bears are mounting a stiff challenge.

The gradually downsloping moving averages and the RSI in the negative zone indicate that bears have the upper hand.

If the price continues lower, the bears will again try to pull the ETH/USDT pair below the support zone. If they manage to do that, the pair could start its downward journey to $3,270 and then to $2,800.

On the contrary, if bulls push the price above the moving averages, it will suggest that the corrective phase could be over. The pair could then rally to $4,488

BNB/USDT

Binance Coin (BNB) bounced off the strong support at $500 and reached the 20-day EMA ($536) where the recovery is facing resistance. Both moving averages are turning down and the RSI is in the negative zone, suggesting a minor advantage to the bears.

If bulls push the price above the 20-day EMA, the BNB/USDT pair could rise to the overhead resistance at $575. This level may again act as a stiff resistance. If the price turns down from this level the pair could extend its stay inside the range between $500 and $575 for a few more days.

Conversely, if the price turns down from the 20-day EMA, the bears will again attempt to sink the pair below $500. If they manage to do that, the selling could intensify and the pair could start a new downtrend to $450.

SOL/USDT

Solana (SOL) has been trading between $167.88 and the 20-day EMA ($180) for the past few days but this tight range trading is unlikely to continue for long.

Both moving averages are turning down and the RSI is in the negative zone, indicating that bears are in control. If sellers pull the price below $167.88, the SOL/USDT pair could drop to $148.04 and then to $120.

Conversely, if bulls thrust the price above the 20-day EMA, the pair could rise to $204.75. This level may again act as a resistance but if bulls overcome this hurdle, the pair could rise to the resistance line of the falling wedge pattern.

ADA/USDT

Cardano (ADA) has been trading close to the 20-day EMA ($1.37) for the past few days, which suggests a stalemate between the bulls and the bears.

If bulls propel the price above the 20-day EMA, the ADA/USDT pair could rise to the overhead resistance at $1.59. A break and close above this level could push the pair to the resistance line of the descending channel.

The bulls will have to push and sustain the price above the channel to indicate that the downtrend could be over. Conversely, if the price turns down from the current level, the bears will again try to pull the pair below $1.18 and retest the critical support at $1.

XRP/USDT

Ripple (XRP) bounced off $0.80 but the bulls are struggling to push the price above the 20-day EMA ($0.87). This suggests that the sentiment remains negative and traders are selling on rallies.

If the price continues to slide lower, the bears will try to pull the XRP/USDT pair to the strong support at $0.75. If this level cracks, the pair could start the next leg of the downtrend to $0.60.

On the contrary, if the price rises above the moving averages, the pair could rally to $1. This level may act as a strong resistance and if the price turns down from it, the pair could remain range-bound for a few more days.

A break and close above $1 could indicate that the downtrend could be over. The pair could then start its march toward $1.41.

LUNA/USDT

Terra’s LUNA token is in an uptrend. Both moving averages are sloping up and the RSI is in the positive territory, indicating that bulls have the upper hand.

The bulls are attempting to push the price above the minor resistance at $93.81. If the price sustains above this level, the LUNA/USDT pair could retest the all-time high at $103.60. A break and close above this level could signal the resumption of the uptrend.

The pair could first rally to $135.26 and then reach $150. Contrary to this assumption, if the price turns down from the current level and breaks below the 20-day EMA ($83), it could signal the start of a deeper correction to the 50-day SMA ($66).

Related: Bitcoin dips below $47K as US dollar surge dampens BTC price performance

AVAX/USDT

Avalanche (AVAX) bounced off the $98 support and rose above the moving averages on Dec. 31 but the bulls have not been able to clear the downtrend line. This suggests that bears are defending this level with vigor.

If bears pull the price below the moving averages, the AVAX/USDT pair could drop to $98. A break below this level could open the doors for a possible drop to $75.50.

On the contrary, if the price rebounds off the moving averages, it will suggest that the sentiment has turned positive and traders are buying on dips. That will improve the prospects of a break above the downtrend line.

The pair could then rise to $128. A break and close above this level could complete an inverse head and shoulders pattern, which has a target objective at $177.50.

DOT/USDT

Polkadot (DOT) rose above the 20-day EMA ($28) on Jan. 2 and the bulls will now attempt to clear the overhead resistance zone at $31.49 to $32.78.

The 20-day EMA is flat and the RSI has jumped into the positive territory, indicating that buyers are attempting a comeback. If bulls drive the price above $32.78, the DOT/USDT pair could rise to $40.

If the price turns down from the overhead zone, it will suggest that the pair could consolidate between $22.66 and $31.49 for a few more days. The bears will have to pull and sustain the price below $22.66 to start the next leg of the downtrend.

DOGE/USDT

Dogecoin’s (DOGE) bounce to the 20-day EMA ($0.17) is facing strong resistance from the bears. The moving averages continue to slope down and the RSI is in the negative zone, suggesting that bears are in control.

The sellers will now try to pull the price to $0.15. If the price rebounds off this level, the bulls will again try to push the DOGE/USDT pair above the 20-day EMA. If they do that, the pair could rise to the overhead resistance at $0.19.

A break and close above $0.19 will be the first sign that bulls are back in the game. The pair could first rally to $0.22 and then to $0.24.

Alternatively, if the price plummets below $0.15, the downtrend could resume. The pair could drop to $0.13 and then slide to the psychological level at $0.10.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Avalanche, Binance Coin, Bitcoin, Cardano, crypto blog, Crypto news, Dogecoin, Ethereum, Markets, Polkadot, Price analysis, Ripple, Solana, Terra