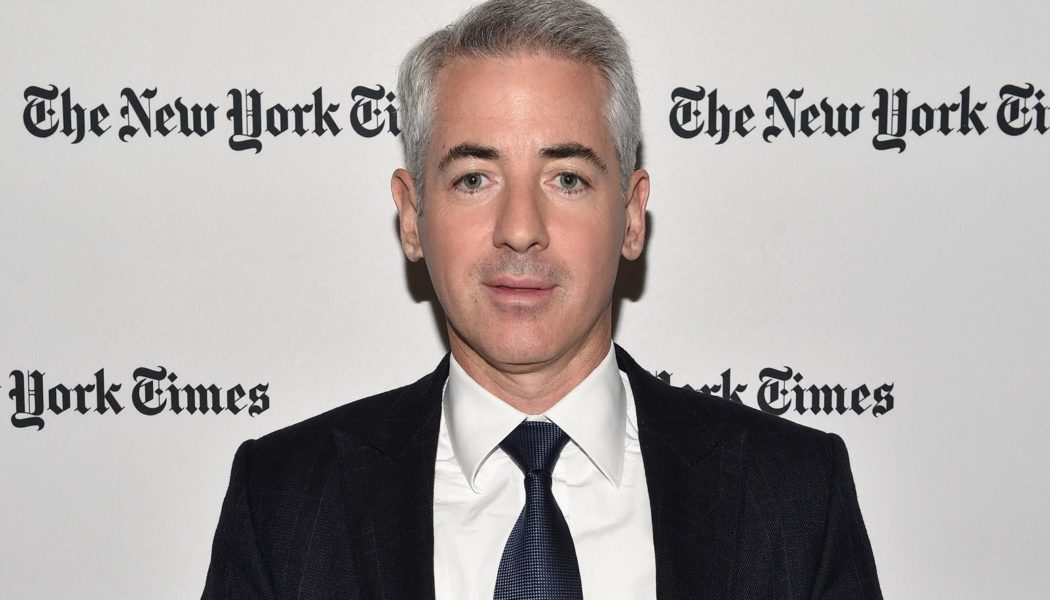

Pershing Square Holdings fulfilled its plans on Tuesday (Aug. 10) to acquire a stake in Universal Music Group ahead of Vivendi’s spin off on Sept. 21. The high-profile hedge fund led by Bill Ackman paid about $21.78 per share and $2.8 billion in total for 7.1% of UMG’s equity. The deal values UMG at 33 billion euros ($38.7 billion). PSH and its affiliates have the right to acquire another 2.9% of UMG’s ordinary shares by Sept. 9.

Tuesday’s announcement came three weeks after Pershing Square’s special purpose acquisition company (SPAC), Pershing Square Tontine Holdings, dropped its plans to buy a 10% stake in UMG in a complicated deal at a 35 billion euros ($41 billion) valuation. After PSTH investors lost interest, driving down the share price, and the Securities and Exchange Commission objected, according to Ackman, PSTH changed course. As an alternative, Ackman said the PSH hedge fund would step in and buy between 5% and 10% of UMG’s ordinary shares.