The super app is set to be a one-stop solution for investors with both crypto and non-crypto use cases

One of the largest payment processing platforms in the world, PayPal, announced the launch of its new personalised finance app that is aimed at acting as a single destination for users to securely manage and do more with their money.

The app, marketed as an introduction to the next era of digital payments, specifically caters to consumers looking to invest and transact in crypto with its high-yield savings services.

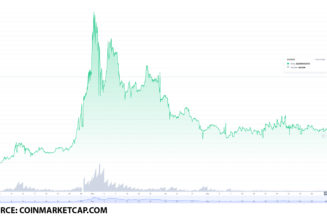

The inclusion of crypto-based financial services in an app that also caters to traditional financial users can be understood as a motivating sign for the future of mainstream crypto adoption.

In a press release yesterday, PayPal revealed that the app would be equipped with new features and services that will enable in-app shopping, bill payments and early access to direct deposits. Its wide use case will facilitate both crypto and non-crypto transactions in one application with added benefits and rewards.

PayPal has collaborated with the online bank Synchrony Bank to provide a high-yield savings account as part of the super app. The high-yield savings and crypto capabilities of the app can be accessed by users directly via the finance tab in their personal dashboard, the press release stated. Further, the announcement revealed that customers could potentially receive as high as 0.4% yearly yield on savings with the app.

Moving forward, the company hopes to improve investment capabilities and add more offline transaction features by enabling offline payments through QR codes in the app.

The release of the app comes just two months after PayPal CEO Dan Schulman announced that the company’s super app was all set for a US-wide rollout. PayPal was also one of the first financial giants to enable crypto payments in select countries, with Schulman publicly stating that the time for mainstream adoption of crypto has arrived.