In the spring of 2020, Alaina Bradley was working in the collections department at a storage facility in eastern Tennessee. She was already pretty miserable before, but it got worse when the pandemic hit and she was overseeing mass auctions of people’s treasured belongings on the daily. With not much to lose, she decided to take a chance on something wild — and maybe too good to be true — that she’d been following on Facebook.

One of her mutuals from when she lived in Atlanta a few years back had been sharing screenshots of his gains on Robinhood nonstop, plus links to his stock trading course and pay-to-join investing community. “At first I thought, ‘Oh, he’s scamming people,’” Bradley says. But by the time that first stimulus check came in, Bradley, 30, was willing to give it a shot. She paid $99.99 for the class and access to the community from Steven Barge, an entrepreneur and owner of Barge Consulting Group.

On her first trade a few weeks later, she turned $27 into $230. She was floored. Flush with beginner’s luck, she then dumped her entire stimulus check into her Robinhood account.

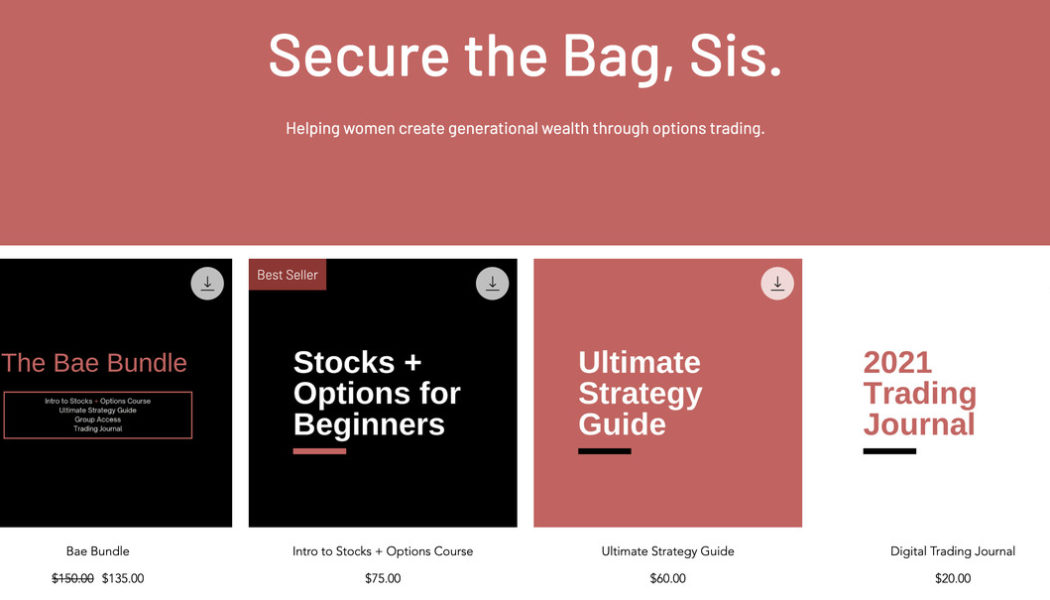

A year later, Bradley says she makes her living as a day trader, and she’s started selling her own investing courses, community, and coaching services under the moniker Options Bae. She’s one of many of-the-moment financial influencers taking their own experiences in the amateur investor boom of late — driven by the ease of commission-free trading and the rise of meme stocks — and making money showing others how to get in on the action. It’s an exciting prospect for would-be investors, but it’s also a gamble, opening up many more people to the types of riskier financial moves usually reserved for the professionals.

“It’s high risk,” says Danielle “London” Elliott, a founding member of another trading group called Put Gang. Her group specializes in options, which are contracts that allow buyers to either purchase a certain stock at a predetermined price in the future (“call” options) or sell at a predetermined future price (“put” options). “But you can make a lot of money because you’re reserving multiple shares. It’s where the volatility is.”

Groups like Options Bae and Put Gang offer a way in for newbies interested in learning the stock market. You can find them on Instagram or Facebook posting their daily results, and sharing free tips and tricks in weekly meetings on Clubhouse open to all. While there are plenty of ways to learn the tools of the trade online via Google and YouTube, those who want more help are encouraged to pay for online courses and join the community.

For $50 a month, Put Gang members get access to a digital course on options trading as well as access to a read-only version of their private Discord channel. For $150 a month, customers get everything included in the lower tier and the ability to participate in the conversation on Discord and ask questions.

Or would-be traders can check out a community like Stock Street University, which offers broader education on long-term investing and day trading. For $99.99, you get access to live virtual classes on investing strategies and 30-day access to the community. After that, you can pay $29.99 a month to continue to participate in the community chat and get daily email updates, among other things.

Today, Stock Street University, which was launched officially in February, has 200 paying members in its Discord. While founders Q Sylvester, Marley Star, and JWise Pierre would love to grow Stock Street University’s membership and drive more revenue, the founders say their ultimate goal is more altruistic. They’re trying to increase financial literacy, especially for Black people and working people who have been shut out of wealth-building. “The typical white millennial family has $88,000 in wealth. The typical Black millennial family has about $5,000 in wealth,” Pierre says. “If you look at the data, only 1 percent of venture capital goes to Black founders.”

“The goal is to show people there’s another path,” Star says, putting it simply: Why grind so hard when you can make your money work for you?

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22773439/optionsbaewebsite.png)

In the era of meme stocks and Dogecoin millionaires, the proliferation of stock trading communities is right on trend. 2021 has been a banner year for small, independent investors. While WallStreetBets’ GameStop frenzy is the most visible example, Credit Suisse estimates that trading activity of independent investors has doubled since the start of 2020, from 15-18 percent to over 30 percent by early 2021.

These DIY trading influencers are not unlike so many creator-entrepreneurs who came before them. They’re simply building an audience from an authentic connection and marketing their wares accordingly. But selling the promise of generational wealth is arguably way more dicey than selling, say, handcrafted pottery or photography presets.

This is one reason the Stock Street University and Options Bae websites are very careful to carry risk disclaimers. The founders of Stock Street don’t see themselves as financial advisers. “We don’t give financial advice,” Sylvester says. “All we can say is, this is something you can look into. This is what the market has done for us.”

“It’s a lot of responsibility, but I’m honest,” Put Gang’s creator, Michael, who goes by “The App God” online, says. “I tell people, look, in this game there are wins and there are losses. Our goal is to make our wins bigger than our losses.” His co-founder Elliott tells people, “Start with an amount of money you’re willing to lose.”

In Put Gang’s Discord, a CNBC stream is broadcasting every day for those who don’t have cable. There’s a constantly updating live chat, resources like an investing slang glossary and videos on the Fibonacci tools, a semi-controversial mathematical technique for making trading decisions. “What I like about our group is we’re not just a bot telling you what to buy,” Elliott says. “There are so many stock Discords now, but with a lot of them you’re not learning the principles and the strategies.”

The way these groups work together sounds a lot like what a day for pro Wall Street traders is like, says Eric Liu, co-founder of investment analysis firm Vanda Research. “The social groups are entirely new for the retail investor,” Liu says. Nowadays, the behavior of amateur traders is often a driving factor in how the market moves — and that’s in no small part thanks to the networked community aspect of being an independent trader today.

Liu points to the dot-com boom, the last time there was a similar influx of everyday traders trying to get in on the action. Back then, the information sources were Forbes magazine, the nightly news, and the Yahoo message boards. Today, powerful social media platforms allow for a constant, real-time flow of information, as well as access to a hive mind of people who are working together to make money.

This has pros and cons. On the one hand, it’s exciting and brings more momentum to the market so that trends can happen faster, Liu says. For the individual trader, this means there are more opportunities to get involved, whether that’s because it’s easier to find your own way to it from the app store, or because you keep seeing a mutual posting screenshots of his gains on Facebook.

The con is that there’s no such thing as a guarantee on the stock market — and mistakes can be costly. “I’ve lost a lot of money in a matter of minutes,” Elliott says. She declines to say exactly how much, saying only that it was enough that “if you told me I’d lose that much money in 9 minutes a year ago, I would have had a heart attack.”

There’s also the fact that the current boom is not guaranteed to last. Historically speaking, booms are pretty much always followed by busts. Could a huge correction in the market be on its way? Absolutely.

It’s a tricky line to walk, but even Liu says that many are underestimating the staying power — and the prowess — of individual investors. “The naysayers will compare the retail phenomenon to gambling. But it’s not. There is a risk. But it’s not a coin flip,” Liu says. He believes “the more access, the more education, the better.”

For many of the people who’ve discovered the market over the past year, they see no turning back in their future. “This literally changed my life,” Elliott says. “It changed how I view success, how I view my time.”

“I can never sleep in now,” Michael adds. “I will never miss a market open for the rest of my life.”