Does that song on your phone or on the radio or in the movie theater sound familiar? Private equity — the industry responsible for bankrupting companies, slashing jobs and raising the mortality rates at the nursing homes it acquires — is making money by gobbling up the rights for old hits and pumping them back into our present. The result is a markedly blander music scene, as financiers cannibalize the past at the expense of the future and make it even harder for us to build those new artists whose contributions will enrich our entire culture.

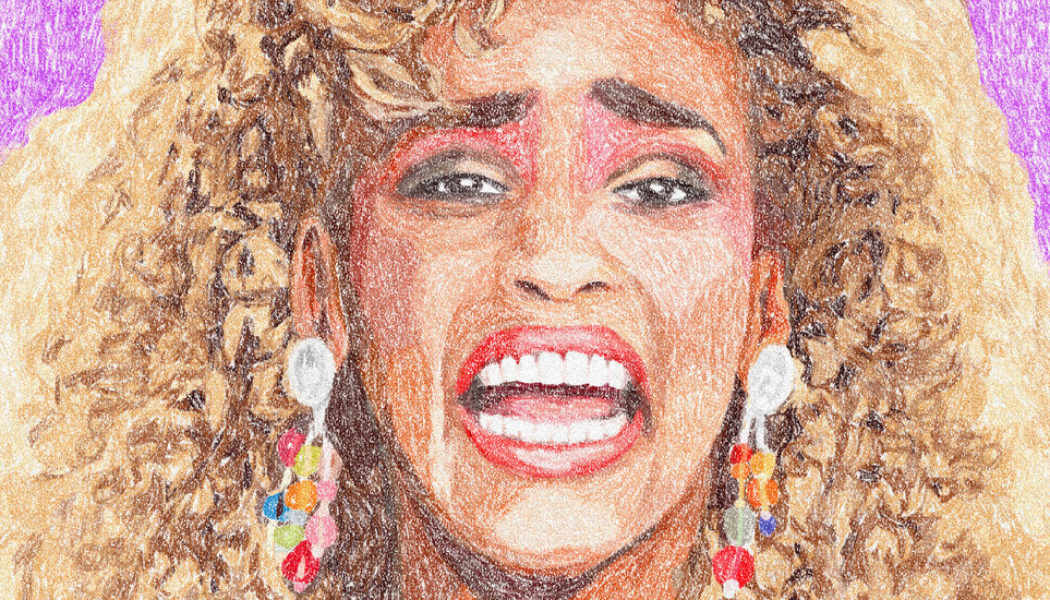

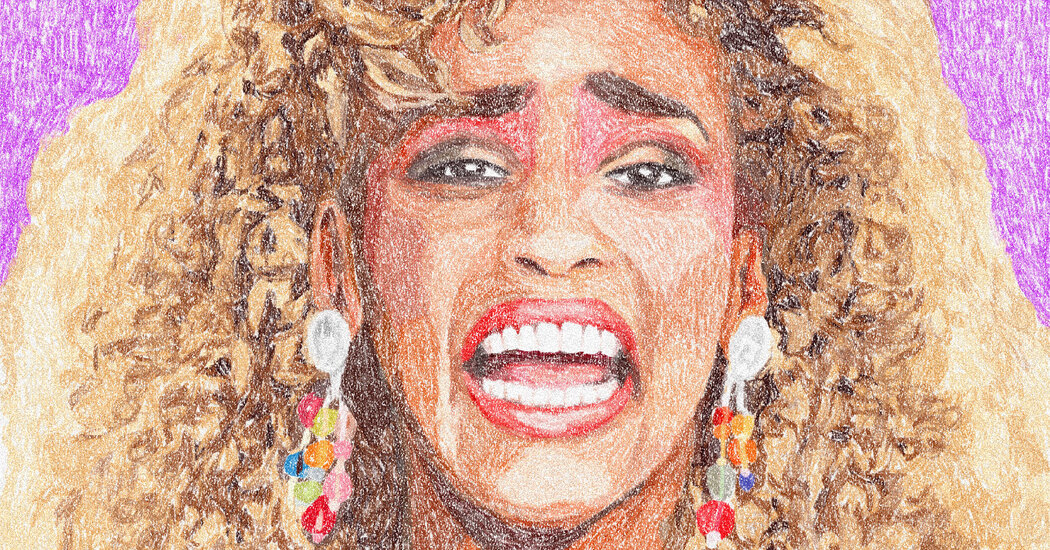

Take Whitney Houston’s 1987 smash “I Wanna Dance With Somebody (Who Loves Me),” which was bought in late 2022 as part of a $50 million to $100 million deal with Primary Wave, a music publishing company backed by two private equity firms. The song was recently rebooted into our collective hippocampus via a movie about the singer, titled, naturally, “I Wanna Dance With Somebody,” which helped boost streams of the song and her hits collection. Primary Wave — which has entered into a variety of deals with artists or their estates that could include publishing rights, image rights and recorded-music revenue streams — has also helped introduce a Whitney Houston Signature Fragrance and a nonfungible token based on an unreleased Houston recording.

Buying up rights to a proven hit, dusting it off and dressing it up as a movie may impress at a shareholder conference, but it does little to add to a sustainable and vibrant music ecosystem. Like farmers struggling to make it through the winter — to think of another industry upended by private equity — we are eating our artistic seed corn.

Private equity firms have poured billions of dollars into music, believing it to be a source of growing and reliable income. Investors spent $12 billion on music rights in just 2021 — more than in the entire decade before the pandemic. Though it is like pocket change for an industry with $2.59 trillion in uninvested assets, the investments were welcomed by music veterans as a sign of confidence for an industry still in a streaming-led rebound from a bleak decade and a half. The frothy mood, combined with a Covid-related loss of touring revenue and concerns about tax increases, made it attractive for many artists, including Stevie Nicks and Shakira, to sell their catalogs, some for hundreds of millions of dollars.

How widespread is Wall Street’s takeover? The next time you listen to Katy Perry’s “Firework,” Justin Timberlake’s “Can’t Stop the Feeling” and Bruce Springsteen’s “Born to Run” on Spotify or Apple Music, you are lining the pockets of the private investment firms Carlyle, Blackstone and Eldridge. A piece of the royalties from Luis Fonsi’s “Despacito” goes to Apollo. As for Rod Stewart’s “Do Ya Think I’m Sexy” — hey, whoever turns you on, but it’s money in the till for HPS Investment Partners.

Like the major Hollywood studios that keep pumping out movies tied to already popular products, music’s new overlords are milking their acquisitions by building extended multimedia universes around songs, many of which were hits in the Cold War — think concerts starring holographic versions of long-dead musicians, TV tie-ins and splashy celebrity biopics. As the big money muscles these aging ditties back to our cultural consciousness, it leaves artists on the lower rungs left to fight over algorithmic scraps, with the music streaming giant Spotify recently eliminating payouts for songs with fewer than 1,000 annual streams.