On March 11, the United States Department of Labor warned employers that sponsor 401(k) retirement plans to “exercise extreme care” when dealing with cryptocurrencies and other digital assets, even threatening to pay extra legal attention to retirement plans with significant crypto investments.

Its rationale is familiar to any crypto investor: The risk of fraud aside, digital assets are prone to volatility and, thus, may pose risks to the retirement savings of America’s workers. On the other hand, we are seeing established players in the retirement market taking steps toward crypto. For one, retirement investment platform ForUsAll decided last year to implement crypto as an investment option for 401(k) fixed retirement accounts in partnership with Coinbase. Is this the beginning of a larger trend?

Why even bother?

Apart from the simplistic explanation that digital assets have the magical ability to make people extremely rich in a short period, there are two serious points to consider regarding crypto and retirement investments.

The first is investment diversification. At least for now, cryptocurrencies, nonfungible tokens (NFTs) and other digital assets possess relative autonomy from the larger traditional financial market. In some cases, this could make them relatively stable when equity and other traditional markets are in turmoil.

A second, perhaps more pragmatic, point is that one doesn’t have to pay the same amount of taxes when buying and trading crypto via a retirement plan. This is a matter of both profit and time — each time an American investor makes money from selling cryptocurrency, they are required to record it to report to the Internal Revenue Service. Retirement accounts are, as a rule, exempt from that burden. As Dale Werts, partner at law firm Lathrop GPM, explained to Cointelegraph:

“Trading crypto inside a qualified plan would be treated like any other asset transaction in a plan, so the same tax benefits would apply. Normally, asset transfers within a plan are not taxed — that is the whole point of a qualified plan. Gains you accrue can be retained tax-free until you take a distribution.”

What the law says: 401(k)s, the ERISA and IRAs

Because 401(k) investments are subject to the Employee Retirement Income Security Act (ERISA) of 1974, it’s hardly surprising that digital currencies fall into a legal gray zone when they are part of a retirement investment portfolio. The ERISA doesn’t specify which asset classes can or cannot be included in a 401(k). In a somewhat outdated manner, it obliges fiduciaries to “show the care, skill, prudence, and diligence that a prudent person would exercise” when dealing with retirees’ hard-earned money.

Nevertheless, the vast majority of employers prefer not to go against the spirit of the law; hence, there are few opportunities to directly invest in crypto via 401(k) plans at the moment. As Christy Bieber, a contributing analyst at investment advice firm The Motley Fool, noted to Cointelegraph:

“Those who use a 401(k) to invest for retirement will not generally have the ability to buy cryptocurrencies when investing for their later years. That’s because 401(k) accounts usually limit you to a small selection of mutual funds or exchange-traded funds.”

A common solution for those who are nevertheless eager to make crypto a part of their retirement funds is self-directed individual retirement accounts (IRAs), where the choice of which assets to allocate is usually open.

The Retirement Industry Trust Association has estimated that between 3% to 5% of all IRAs are invested in alternative assets such as cryptocurrencies. According to various surveys, between 49% and 54% of millennials are invested in cryptocurrencies or NFTs and/or consider them to be a part of their retirement strategy.

Werts, who includes crypto in his own personal retirement investment strategy, said that while the Labor Department highlighted crypto’s general risks and challenges, ERISA in no way prohibits digital assets as an investment option in a 401(k) plan. He sees three primary options for those who are interested in crypto as a retirement asset:

- “You can (if available from your employer) use a self-directed 401(k) to invest in alternative investments like cryptocurrencies. A simple Google search turns up at least one alternative to ForUsAll: BitWage. Many firms are working on ETFs, too (like Vanguard and SkyBridge Capital), although the Securities and Exchange Commission is not yet approving any. There are Bitcoin futures investment options approved by the Commodity Futures Trading Commission.”

- “You can invest in a long list of publicly traded companies that own crypto, like MicroStrategy, Tesla, Coinbase, Block, PayPal, Marathon Digital Holdings and Nvidia. I have done this. Of course, these companies have other business objectives, so you have to be ‘on board’ with whatever those objectives are.”

- “You can invest through your 401(k) plan in trusts, like Grayscale Investments’ Bitcoin trust and Ether trust (both of which I have invested in). This is easy, and they are like unit trusts or money market funds — you buy a ‘unit’ of a trust, which is completely liquid, rather than a fractional interest in a particular cryptocurrency.”

From 2% to 5%

Putting the regulatory obstacles aside, the main argument against crypto in retirement plans is still purely economic. Experts generally recommend that crypto comprise no more than 5% of one’s retirement investment portfolio due to its volatility and unclear regulation prospects in the United States.

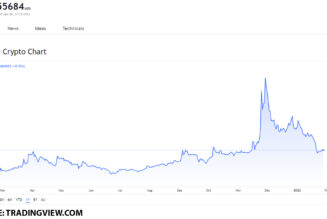

Bitcoin (BTC) serves as the perfect example of this volatility, as the No. 1 currency has lost some 30% of its market value since November 2021 and was at one point down nearly 50%. That is nothing close to the S&P 500’s conservative dynamic: The index showed a steady average annual return of 13.6% between 2010 and 2020.

“Five percent may be the right amount for some investors, but it depends on your individual risk tolerance as well as your timeline for retiring,” said Bieber, pointing out that the risk of losing everything in crypto assets is still much higher when compared with investing in an S&P 500 fund. And the 5% mark is a better fit for younger investors, while older adults who will need to draw from their accounts soon may want to keep their crypto allocation to 2% or less. Bieber added:

“Ultimately, because of the big risk that cryptocurrencies present, you shouldn’t invest more of your retirement money in them than you can afford to lose. If putting 5% of your retirement money into digital currencies would mean you’d end up with a nest egg that doesn’t provide adequate income, you should allocate far less of your money — or none at all — to this higher-risk investment.”

What’s next?

Can crypto gain more widespread adoption among retirement investors, at least on a limited scale? Bieber believes the scenario is possible if cryptocurrencies continue to gain mainstream acceptance among institutional investors, which would both drive their spread to the most conservative corners of the financial market and, in a somewhat virtuous circle, make them less volatile. She commented:

“It’s possible that if the SEC starts regularly allowing ETFs or mutual funds to purchase cryptocurrencies directly, more funds could be created that are devoted to this asset class. And some could eventually be offered in 401(k)s. […] If cryptocurrencies continue to gain mainstream acceptance and many ETFs or mutual funds are offered that provide exposure to them, target-date funds and robo-advisors could also begin to include these funds as part of the portfolios they build.”

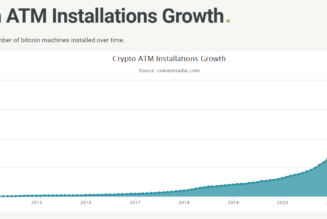

There’s no lack of interest in crypto, but seeing future steady demand relies on an easy, accessible infrastructure that would benefit retirement investors. This means the U.S. regulatory community will need to update the nearly 50-year-old retirement legislation. In this context, the Labor Department’s recent warning looks somewhat like a Band-Aid and tells us more about the uncertain present than about the future — and retirement plans, as we know, are all about certainty.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, cryptocurrencies, Cryptocurrency Investment, fintech, investments, Law, USA