Founded in 2017, OKEx is a centralized cryptocurrency exchange based in Seychelles. According to CoinGecko, OKEx is the world’s third-largest cryptocurrency brokerage, with nearly $12 billion in trading volume within the past 24 hours. The exchange lists 312 coins and 518 cryptocurrency trading pairs.

It’s often difficult for new cryptocurrency enthusiasts to navigate the complex world of trading and finance. OKEx seeks to bring such sophisticated trading methods to everyday users’ disposal by providing a simple interface. During an exclusive ask me anything (AMA) session with Cointelegraph Markets Pro Users, OKEx staff discussed trading tools, financial regulation, the OKExChain (OEC) blockchain, meme coins, and DeFi offerings on the OKEx platform.

Cointelegraph Markets Pro User: How can someone benefit from bots / API [Application Programming Interface] trading with no coding experience? Does OKEx have any partnerships fully integrated?

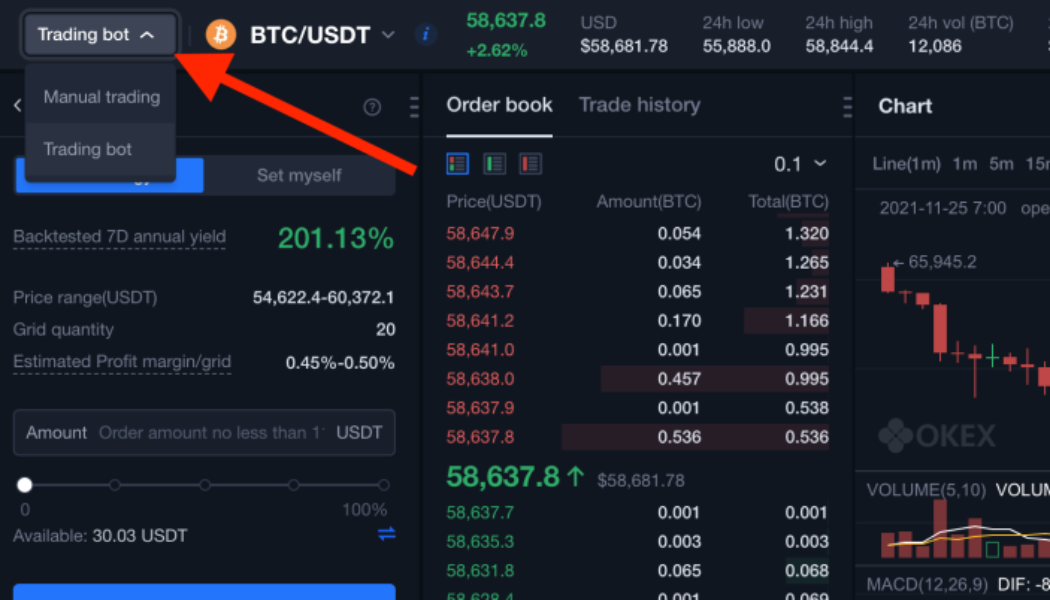

OKEx Staff: TLDR [Too Long, Didn’t Read], you do NOT need to have any coding experience to automate trades with the trading bot on OKEx. We make it really easy for you to set the trading bot up — it’s integrated into the OKEx trading dashboard. You can basically go fully automated by choosing the AI option and just setting the order amount in Tether (USDT) or you can manually set your parameters, including the upper and lower price limits, for the asset you want to trade.

So the bot is essentially an auto-trading tool with pre-set parameters. Trading bots can maximize profit potential, especially in times of a range-traded market. So with a trading bot, like the one we have on OKEx, it will be more profitable if the market you choose goes up (selling), then down (buying), then up, down, etc., rather than just up, up, up. The trading bot on OKEx is available for all spot trading pairs, which means you can buy and sell Ether (ETH), in and out of Bitcoin (BTC), for example. A trading bot video tutorial is coming soon! Next week, likely, but here’s the written tutorial. And here’s what it looks like in the user interface (UI). You don’t need to [have] API/coding experience in order to execute such a powerful and automated strategy.

OKEx trading interface | Source: OKEx

Trading bot profit and loss | Source: OKEx

CT Markets Pro User: How do you think the India crypto ban will impact the crypto space?

OKEx staff: I think, for India, the regulator would like to have a more comprehensive framework in regulating crypto instead of banning it. History told us when crypto is allowed and regulated — it can even be stronger. The India ban is unlikely to have any major impact on the market. Crypto has become quite resilient to such news developments over the past couple of years.

CT Markets Pro User: Cryptocurrencies have a pretty high beta [volatility]. Do you guys use the same financial model (i.e., Black Scholes) as stocks to price crypto derivatives?

OKEx staff: Our option market uses the Black Scholes model to compute mark price (fair value of the specific contract). And for risk management, we are using a SPAN-like scenario stress-tester (like the Chicago Mercantile Exchange) to calculate the maximum loss of the client’s portfolio.

CT Markets Pro User: I recently heard [of] some developments with the OKExChain. What’s going on with that?

OKEx staff: Yes, the rumors are true! [The trading chain] It’s called OEC. The mainnet was launched this summer. A little bit about OEC: it’s an EVM [Ethereum Virtual Machine] compatible public blockchain that uses Cosmos / Tendermint architecture. OKEx has been quietly developing OEC for several years to make it as robust as possible and to address the blockchain trilemma. As opposed to being an Ethereum clone, it’s being built from the ground up. For more in-depth info on OEC, you can read this, but it’s not light reading.

CT Markets Pro User: What is the OKEx DeFi Hub? What products and services are currently offered and the best staking opportunities?

OKEx staff: DeFi is a new mode on OKEx. You can toggle between the “Exchange” and “DeFi” modes on okex.com or in the app. It’s basically like a bridge between the worlds of CeFi and DeFi — OKEx brings DeFi to you in one cohesive interface. First of all, you don’t have to have an OKEx account to use the DeFi mode. You connect your Web 3.0 wallet, you can track wallets and see all your DeFi assets in one place. At the moment, the DeFi mode (which launched this fall) currently consists of our very own NFT marketplace, GameFi center, and dashboard, where you can view all of your decentralized assets, including your NFTs. But there’s more coming soon! OKEx provides a bespoke Web 3.0 wallet that you can conveniently use via the browser extension (Chrome or Firefox) or directly in the OKEx app. Currently, staking, savings and yield-farming offers are only available on OKEx Earn via our centralized platform. That’s all I can say for now.

CT Markets Pro User: I’d appreciate your views on multi-billion dollar meme coins and whether they serve as a viable source of inflow to crypto, or are they ticking time bombs ready to destabilize the market if and when they pop; meaning, is there truly room in a rational crypto market for these coins?

OKEx staff: Good question! Yes, meme coins are definitely acting as gateways for non-native crypto investors/traders due to their accessibility. There is a definite possibility of these coins sliding sharply in the future, but I wouldn’t go so far as to say they can destabilize the market at this point. Their speculative nature is out there for all to know, and these coins don’t take themselves too seriously, which means investors are somewhat aware of the risks. Moreover, the top meme coins, such as DOGE and SHIB, have actually cemented themselves reasonably well by now. We actually did an episode on meme coins on our podcast. Here is a link to that for the full discussion.

CT Markets Pro User: How does OKEx integrate with the play-to-earn games?

OKEx staff: At the moment, the GameFi center on okex.com is a play-to-earn game aggregator. So you can find all the latest and most popular blockchain games there. You can easily filter by blockchain network and we feature games on over 20 different networks, including games exclusively built on OEC (the public blockchain developed by OKEx, which I explained above). Each game listed on OKEx GameFi has its own page that tells you all about the game, the price history of the in-game assets and other key info. We also include the link directly to the game’s site so you can go play it — most play-to-earn games are played in-browser. Here’s a fun spacey game built on OEC.

CT Markets Pro User: How would you compare\contrast Okex with, say, Coinbase? What makes OKEX stand out in a world with so many exchange choices?

OKEx staff: OKEx is an advanced trading platform that offers derivatives (options, futures, perp swaps), trading bots, margin trading and a vast number of tokens. Plus, we recently launched a DeFi mode with decentralized offerings, such as NFTs and crypto games, and a handy dashboard to manage all your DeFi assets. Our line of services, ranging from highly liquid trading markets to staking/farming options, are aimed at catering to traders and investors of all levels.

Other than the DeFi mode, the trading bot mentioned earlier and our new portfolio margin mode are a couple of examples of how we continue to push forward with services and tools that facilitate [the success of] crypto market participants. OKEx is the first platform to offer true portfolio margin with multi-currency collateral risk offset — this is a huge plus for professional traders trading large portfolios, specifically options/other crypto derivatives because it lets them heavily reduce margin requirements.

CT Markets Pro User: Where do you see the total crypto market cap going in one year, five years? What market segment is undervalued right now? Identity? Meta? Layer one?

It’s hard to say any exact numbers, but it seems like the charts go up and to the right! However, market participants will do well to keep tabs on monetary policy changes in the next year. Personally, I think that Web 3.0/digital identity/metaverse projects are undervalued compared to where they (or at least some) will be in a few years. We talked a lot about this with some great guests on last week’s episode of our podcast.

Disclaimer: The following market predictions were made before of the onset of news of a novel coronavirus variant negatively impacted capital markets worldwide on Nov. 26. They may not be applicable in the current environment and should not be regarded as investment advice.

CT Markets Pro User: Do you guys think that [Bitcoin price] $69 thousand was the top? Is there still a chance for another alt season in the next couple of months?

OKEx staff: $69 thousand is the top or not is a matter of time frames, in my opinion. On-chain metrics, such as exchange flows and balances, indicate that the last all-time high ($69 thousand) is very unlikely to be the top for this cycle. That being said, BTC is also not likely to move straight up, even if most metrics are bullish. This is because of the way the market has matured and the increasing diversity of market participants as well. Matured in the sense that there is a difference in market composition from 2013 to 2017 and 2021. A lot more “serious” investors and institutional involvement and futures from CME, for instance, and the exchange-traded funds (ETFs).

The bigger a market gets, the slower it moves and the less volatile it becomes. However, the next few months, especially Q1 2022, should be interesting to observe as we may see this bullish cycle extend into the next year instead of ending in December. If that happens, we will definitely see another alt season.

I think we are already starting to see something of a meme season/metaverse season at the moment. Obviously the news from Facebook going all-in with the metaverse spurred on that side of things, but the decentralized metaverse is definitely seeing new capital inflow. In my view, the market cycles through sectors; for instance, we are currently seeing metaverse trending but could see other lagging categories start catching up as long as BTC remains bullish/doesn’t slide too sharply. Generally, if the market looks strong, everything is going to rise sooner or later. We can see there is a consistent inflow from institutional money. Equity balance on institutional flow is steadily increasing. Hard to tell with regards to buying Ethereum, though, since they trade everything and all have different types of strategies.

The BTC exchange net position change metric, for instance, is still not showing signs of the current price, or the last ATH [All Time High], being a top like the one we saw in May.

Bitcoin net trading position change | Source: OKEx