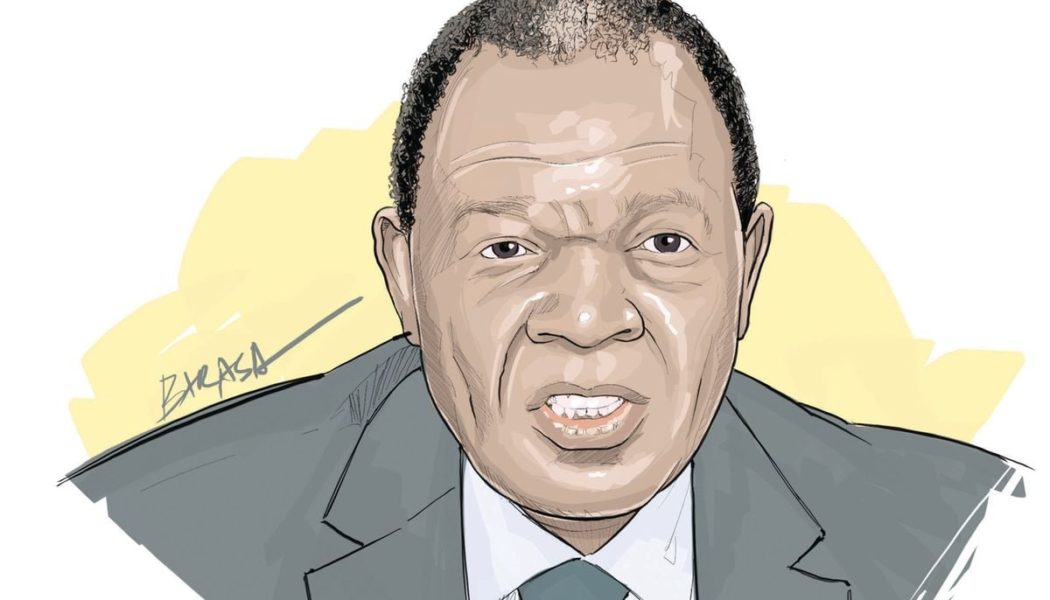

For Njuguna Ndung’u, his sacking alongside 21 other Cabinet Secretaries two weeks ago, marked the end of one of the toughest tenures at the helm of the National Treasury.

Prof Ndung’u, a soft-spoken economist, took over at the Treasury when the country was facing one of its worst dollar shortages and, as fate would have it, he left just as the country was experiencing unprecedented youth-led anti-government protests.

Interestingly, Prof Ndung’u was in charge of the National Treasury, which had for the first time sought to tax bread in a raft of tax measures that triggered countrywide protests as Kenyans took on the government over what was seen as a punitive Finance Bill, 2024.

Parliament would later reject the professor’s push to tax bread, weeks before President William Ruto was forced to reject the Finance Bill, 2024 in a bid to quell the protests.

The rejection of the Finance Bill left a Sh346 billion gap in the budget for the fiscal year 2024/25, prompting a raft of cuts in the national and county governments.

But it is his admission of a broke Exchequer and mounting debt payment obligations that best describes Prof Ndung’u’s pains at one of the country’s most lucrative Cabinet positions.

“We are even having trouble with paying salaries, we are clearing salaries with arrears. Just imagine that. But we cannot default on external debt because our credibility is going to be ruined. Debt takes the first charge,” he told the Parliamentary Committee on Finance and National Planning in December last year.

Six months later, billions of dollars from a World Bank loan helped Kenya to pay off the $560 million balance of the Eurobond that matured last month. This was a major boost that gave Prof Ndung’u some breathing space.

The Treasury had in February this year admitted to having jitters about Kenya’s ability to settle the Eurobond due to the wobbling shilling and dollar shortages.

In March, Prof Ndung’u acknowledged the tough balancing act that he faced in trying to raise revenue while without squeezing the payslips of Kenyan workers.

“The second point is that we need economic recovery for us to generate even higher taxes because the current, vibrancy, the current economic structure and the vibrancy of the economy are so low to support the added tax,” he said at the 12th African Fiscal Forum of the International Monetary Fund.

For workers and businesses, Prof Ndung’u was the face of punitive taxation that threatened the livelihoods of millions of Kenyans.

The ugly part of his tax push reared its menancing face mid last month when Kenyans, led by the youth, took to the streets in protests that culminated in the withdrawal of the Finance Bill, 2024.

One of Prof Ndung’u’s first tasks when he took over at Treasury was to address the dollar shortage that had threatened a host of sectors and businesses.

He was part of the team that crafted the government-to-government importation deal with Saudi Aramco, Abu Dhabi National Oil Company and Emirates National Oil Company in March 2023, which allowed Kenya to import of fuel on a 180-day credit period.

The fuel deal, despite a myriad of unanswered questions, has been key in reducing the monthly demand for the greenback and strengthening the shilling to below 130 units to the dollar from a record low of 160 units earlier this year.

Under Prof Ndung’u’s watch, Kenya breached the Sh10 trillion debt ceiling in May last year. This was after loans hit Sh10.027 trillion as a borrowing spree left the Treasury chief with more questions than answers.

Lawmakers would a month later threaten to impeach him over his continued failure to honour parliamentary summons and delay in disbursing the equitable share to the 47 county governments.

Prof Ndung’u’s 22-month tenure at the National Treasury from September 2023 to his exit two weeks ago was a fire-fighting exercise.

Like any other public servant, he had hoped to replicate his largely successful stint at the Central Bank of Kenya (CBK) at the helm of the National Treasury.

Prof Ndung’u’s tenure as CBK governor from February 2007 to May 2015 was described by many as a success, with market watchers hailing his legacy in financial services regulation, monetary policy and overseeing stability in the wake of the 2007-08 post-election violence.

As fate would have it, however, a combination of factors, including economic woes and pressure on Dr Ruto to act and restore hope to Kenyans, claimed his position at the helm of the country’s economic policy office.

As his successor, John Mbadi, prepares to take over, Prof Ndung’u could be enjoying a good night’s sleep far from the headaches of trying to stabilise an economy whose signs of recovery look set to be derailed by the ongoing youth-led protests.

And as was the case even during his tenure at the National Treasury, Prof Ndung’u has been keen to avoid the media since his sacking.