In 2010, if someone had told you that Internet memes, digital artwork and Twitter avatars would sell for hundreds of thousands of dollars, would you have believed them?

Well, these are nonfungible tokens, or NFTs, in a nutshell. NFTs are driving blockchains toward uncharted territory on the backs of cute kitties and pixelated punks. What may appear to be a shroud of speculation over pointless collectibles is actually the clouded horizon of fintech innovation. NFTs represent a turning point. Blockchain technology is now being used to represent assets beyond the chain.

In order to understand the thriving and intriguing world of NFTs, the Cointelegraph Research team delves deep into this new space, presenting the findings in the latest report “Nonfungible Tokens: A New Frontier.”

This report covers the history and development of NFTs, how NFTs are stored, traded and exchanged, how to mint an NFT and what platform to choose, how the NFT market works and how the prices are formed, how to find exciting new NFT projects, how NFTs are regulated in various jurisdictions, how much energy is used when creating and trading NFTs and what future awaits this emerging market.

Download the full report here, complete with charts and infographics.

How it all started

Bitcoin pioneer Hal Finney first mentioned an early version of NFTs in 1993. He called them “Crypto Trading Cards.” In a forum discussion, Finney touched on definable scarcity, exclusive ownership and provenance. These concepts are now at the core of every NFT.

The idea of NFTs wouldn’t see much development until 2012 when Yoni Assia wrote about “colored bitcoins,” which eventually became “colored coins.” Built on top of the Bitcoin blockchain, Colored Coins created semifungible tokens that were supposed to represent real-world assets such as real estate, commodities and bonds.

One of the earliest NFT iterations “Quantum” was created in 2014 by Kevin McCoy and Anil Dash and presented at the New Museum in New York City. In 2015, the first Ethereum-based NFT called Etheria was launched at Devcon 1. This is largely considered to be the first truly nonfungible token.

The term “NFT” emerged in 2017. Although little known at the time, two very significant NFT projects, CryptoPunks and CryptoKitties, were launched in 2017. This same year, the first NFT house was sold through Propy. This marked the first wave of NFT popularity which synchronized with the crypto market cycle.

Market growth

NFTs have become a booming market that expands year after year. For example, sales have grown from just $41 million in 2018 to an astonishing $2.5 billion in the first half of 2021, representing a 60-fold growth in three and a half years.

Even compared to 2020, the growth is staggering. Total sales in 2020 reached $340 million and in 2021 so far the sales have already surpassed $9 billion which is more than 25-fold growth according to data from NonFungible.com on NFTs on Ethereum.

The rich, famous and influential began collecting or issuing NFTs in 2021. By May, monthly sales volume reached $360 million. Shortly thereafter, a deep downturn in the crypto markets briefly ended the NFT euphoria, causing daily volumes to drop significantly — a reduction of up to 90% from their highest levels. By July, NFTs rebounded and once again reached record-breaking highs, astonishingly attaining $2.6 billion in total volume in August on Ethereum alone based on data from NonFungible.com.

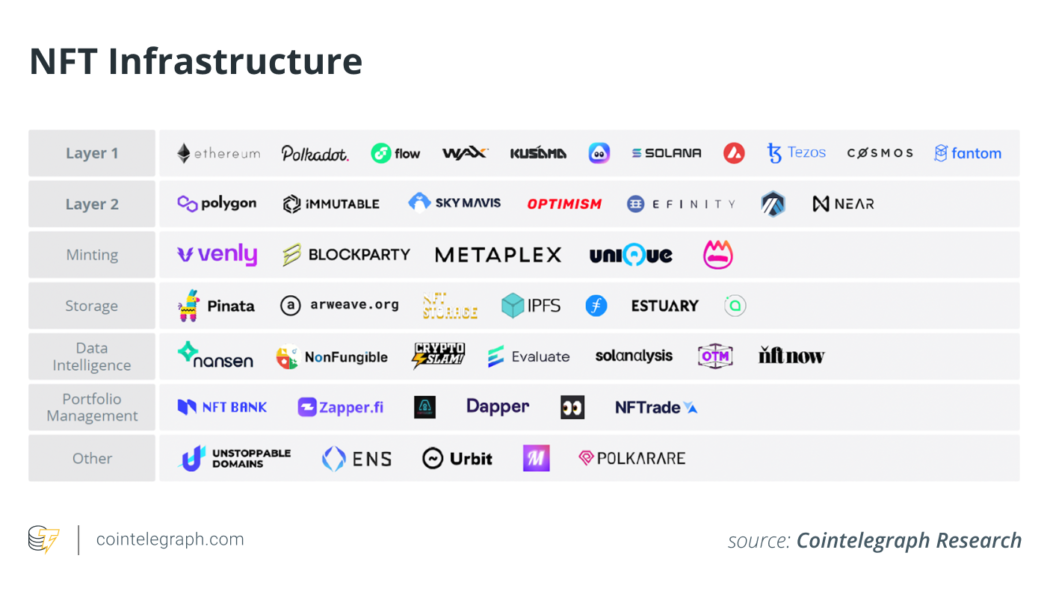

While Ethereum continues to dominate NFT market activity, there is interest growing in alternative layer-one blockchains due to their cheaper transaction fees and faster block times.

Ethereum holds approximately 80% of NFT sales volumes in 2021, but only 37% of total NFT traders. This is a reflection of the higher average NFT valuations on Ethereum and larger transaction fees. Flow and Wax both hold a large share of total traders, 32% and 25%, respectively, but with significantly less volume. Their cheaper transaction fees enable lower-priced NFT transactions and use cases for high-volume applications such as games.

What categories are among the most popular?

A breakdown of transactions by popular NFT categories, discussed in section 1.3 of the report, reveals that early sales were dominated by collectibles such as CryptoKitties and CryptoPunks. In late 2019, the gaming NFT category surged in transaction count, as player bases expanded on games such as F1 Delta Time, Gods Unchained and Decentraland.

In mid-2020, the number of transactions that included sports and metaverse NFT projects began climbing as these platforms increased in popularity. Around the same time, art NFTs also drew increased attention, peaking in January 2021 with Beeple’s record-breaking sale.

Although the overall share of transactions for collectibles has decreased, they still dominate total sales volume and lead projects by a significant margin. The art category follows behind collectibles in sales volumes, reflecting the similarly high valuations in the art and collectibles categories.

Will NFTs survive the next crypto crash?

This year, there are over $9 billion in NFT sales on Ethereum so far. Total NFT sales are expected to achieve at least $17.7 billion by the end of the year, as new traders look to boost secondary market activity.

Historically, the NFT’s dependence on cryptocurrency has been quite high. NFTs waned in popularity during the 2018 bear market in cryptocurrency and again in June and July of 2021 when the cryptocurrency market pulled back. Elevated interest in NFTs has coincided with the overall uptrend in the digital asset market, which may indicate that NFT prices will drop if cryptocurrency prices drop.

This article is for information purposes only and represents neither investment advice nor an investment analysis or an invitation to buy or sell financial instruments. Specifically, the document does not serve as a substitute for individual investment or other advice.