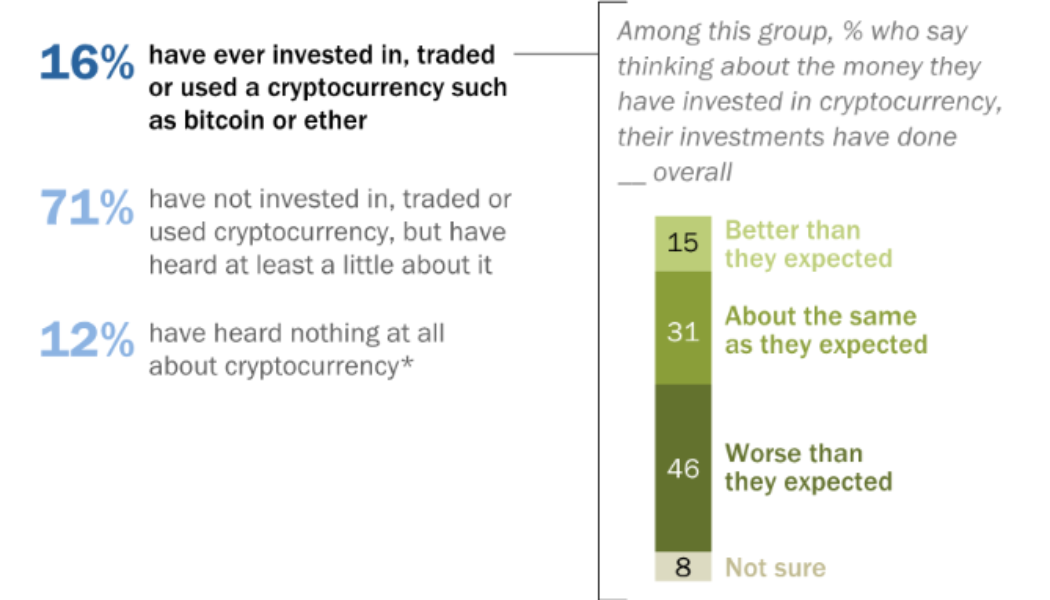

Amid the ongoing crypto winter, new data from a Pew Research Centre survey has shown that 46% of adult crypto users in the United States are seeing lower than expected returns on their crypto investments.

The survey gathered responses from over 6,000 randomly-selected adults across the United States, with panelists participating in self-administered web surveys.

Conducted from July 5 to 22 of this year, the majority of respondents who said they had invested in crypto said they saw lower than expected returns than expected while only 15% of people surveyed said their crypto investments had done better than expected. Meanwhile, around 31% said it was “about the same as they expected.”

It’s unfortunate, given the vast majority of crypto user respondents said they became interested in cryptocurrency because they were looking for a “different way to invest,” and thought it was a “good way to make money.”

Women made up over half of the respondents and people over 50 years old represented the largest sample size. Overall, only 16% of total respondents said they had invested, traded, or used a cryptocurrency at some point in their lives.

U.S. investors piled into crypto in its heyday

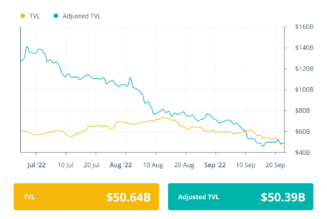

The high proportion of disappointed crypto investors could be attributed to a sharp rise of crypto adopters in the country in 2021 when the market was at its all-time high.

Cointelegraph previously reported that roughly 70% of crypto hodlers in the U.S. started investing in cryptocurrencies such as Bitcoin (BTC) in 2021, the year that saw BTC reach an all-time high (ATH) of roughly $67,582 on November 8, 2021.

Massive institutional adoption, growth in altcoins, easier access to cryptocurrency trading, and celebrity endorsements were all cited as possible reasons for the huge spike.

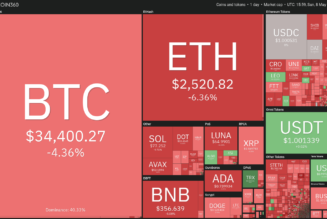

However, most people who jumped into the crypto market during the 2021 boom are likely to be feeling the pain now, with Bitcoin plummeting over 69% from its ATH to $21,403, and Ethereum (ETH) falling 66% from its ATH to $1,640.

Boomers and Gen X

A separate poll by financial service provider deVere Group found nearly half of their more than 700 Baby Boomer (born between 1946 and 1964) and Generation X (born between 1965 to 1985) clients from all over the world already own cryptocurrency or are planning to buy it before the end of 2022.

Nigel Green, deVere Group CEO and founder believes most people born between 1965 and 1980 are investing as “part of a wider retirement planning strategy.”

Related: 3.6M Americans to use crypto to make a purchase in 2022, research firm predicts

However, he also cautioned anyone from investing in crypto without first seeking professional advice, “As this year has proven again, the crypto market remains known for its volatility.”

“Therefore, retirees or those on the cusp of retirement need to bear this in mind and not over-commit, as this could put the wider retirement strategy in jeopardy.”

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, crypto investments, Crypto news, crypto users, Pew Research Centre