At the midyear mark of 2023, there’s one over-arching theme: so far, it’s the year of Morgan Wallen. The artist’s One Thing At a Time is the most-consumed album of the year so far by far, racking up 3.312 million equivalent album units in the U.S. since its March release, while its single “Last Night” gobbled up the most U.S. on-demand audio streams of the year so far, with 588.7 million.

That helps explain a huge leap in country music market share so far this year, with the genre growing to 8.36% of the U.S. market, from 7.83% at the halfway point last year. Overall, in terms of current consumption units — those derived from albums released within the past 18 months — country music increased by 4.5 million equivalent album units over the same period in 2022, the highest among all 15 genres tracked by Luminate in 2023 so far.

But that’s just one of the big takeaways derived from combing through the data six months into this year. Here are four other observations from the first half of 2023.

Why is Rock so big? Catalog.

Overall, rock has grown most of any genre year over year in consumption units, with 11.2 million more units in 2023 over 2022. That growth, however, is almost entirely from catalog — 10.3 million of it, compared to 900,000 units of growth from current releases. It’s the second-largest growth metric among genres in terms of catalog, just behind R&B/hip-hop in raw numbers (11.2 million), though because R&B/hip-hop actually declined in current releases (more on that later), rock saw the biggest overall growth in unit terms.

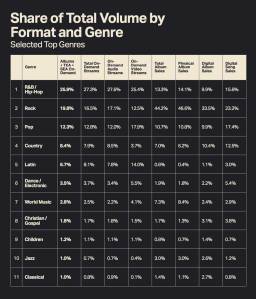

It’s a testament to the enduring value that exists in classic rock recordings — and a reason those catalogs continue to be valued, bought and sold at such high figures — and helps explain why it still represents such a large part of the market, despite rock not generally being represented in the highest echelons of the charts. Rock’s catalog share of 23.31% is behind R&B/hip-hop’s 27.15% in the rankings, but is much higher than that of pop (12.91%) and country (7.69%), the next two genres in share.

Consider the rankings in terms of current share: rock (10.32%) slides to third place, behind pop (10.69%) and barely ahead of country (10.16%), with Latin coming in fifth at 7.84%. And its current unit growth year over year of 900,000 is significantly behind country (4.5 million), world music (3.3 million) and Latin (2.5 million), although at least it’s still growing, while R&B/hip-hop and pop are not.

R&B/Hip-Hop: The Elephant In the Room

The drumbeat has been growing louder over the past year when it comes to what, exactly, is going on with R&B/hip-hop from a market share perspective. But despite concern that the genres’ grip on the public consciousness is getting diluted, a few things have remained consistent: it remained the largest genre in consumption units, it was still growing the most in raw numbers (if not percentage-wise), and R&B and hip-hop artists were continuously topping the charts dictating the culture.

Some of that dominance, however, has begun to slip. There is the biggest one — in the first half of the year, no hip-hop album had yet topped the Billboard 200, a distinction that finally ended in the first week of the third quarter with Lil Uzi Vert’s Pink Tape this week. And in terms of year over year unit growth, R&B/hip-hop slipped to second at 13.01% of the market’s growth, behind rock (17.71%) and just ahead of country (12.35%). And as consumption overall grew by 13.4%, R&B/hip-hop remained stagnant at 6.3% — the same mark it had at the midway point of last year. Still, it’s been a weird year; R&B/hip-hop actually accumulated more growth in raw units in the first half of 2023 (8.3 million) than in the first half of 2022 (7.8 million).

Yet there are signs for concern — and not necessarily just because of gains in other genres. R&B/hip-hop’s overall market share has slipped from 27.64% halfway through 2022 to 25.92% halfway through 2023, more than a point and a half. Its share of on-demand streaming has dropped from 29.39% to 27.31% — more than two percentage points. Overall album sales growth — huge for rock (45.85%) and pop (30.99%) — was just 2.53%, though growth at all in that metric is still positive. Even more concerning are its current numbers, which we’ll get to in a second. So, with R&B/hip-hop’s market share at its lowest point since 2018, is it just a cyclical, first-half blip due to domination by the likes of Morgan Wallen and Taylor Swift so far this year? Or something deeper?

Current Share Tells the Story of the First Half

The three genres that experienced the biggest growth over the first half of 2023 also tell the story of the first six months of the year, and they’re undeniable on several metrics. In terms of overall percentage growth year over year, World Music — which encompasses ex-U.S. genres like K-Pop and Afrobeats — was up 42.5%; Latin was up 21.9%; and Country was up 21.1%. Each managed to grow their overall share of the market significantly over the same period last year: Country, the fourth-biggest genre, rose from 7.83% to 8.36%; Latin, in fifth, grew from 6.25% to 6.72%; World, in seventh, grew from 2.20% to 2.76%. In comparison, the top three genres — R&B/Hip-Hop, Rock and Pop, in that order — all ceded share of the market at least somewhat year over year.

Looking at the current share illustrates where those gains came from. The country genre came in 4.5 million units higher than at the same point in 2022, boosting its current share from 7.98% to 10.16%. World Music added 3.3 million units, vaulting over dance/electronic into sixth with a 5.22% share of the current market, up from 3.29% at this time last year. And Latin added 2.5 million units over last year’s total, increasing from 6.86% to 7.84% this year.

The flip side of that is the current percentage drops from the other leading genres. Current R&B/hip-hop share fell from 27.50% halfway through 2022 to 22.62% this year, an almost 5% decline, and dropped 8.0% in consumption units year over year. Pop slid from 12.87% to 10.69% in share, dropping 7.1% in consumption units year over year. Rock’s slip in share was more modest (10.83% to 10.32%), but also still fell, though its unit count actually grew (the slide in share is due to larger gains elsewhere). It’s a reflection of how the first half of the year has gone in terms of impactful releases in the market.

World Music’s Growth Isn’t Slowing Down

World music now accounts for 2.76% of the overall market in the U.S., up from 2.20% at the midway point last year. It’s not huge, but by percentage, it’s far and away the fastest-growing genre (up 42.5% year over year) in the industry; by raw consumption unit growth, it’s sixth-highest, having increased by 4.4 million units over its midyear 2022 mark. And it’s up by huge percentages in just about every metric: Overall album sales (71.3%), physical album sales (76.4%) and on-demand streaming (38.2%) growth all far outstrip the industry overall.

Some of this is just a function of how percentages work: a smaller number that’s growing quickly will naturally have a higher percentage growth than a larger number that, while growing at a larger volume, is growing at a slower rate. But these percentages continue getting higher, not smaller: in 2020, it grew 8.0% over 2019; in 2021, the metric was 18.9%; in 2022, it was 26.4%. From the first half of 2019 through the first half of 2023, world music is up 131.3%.

So far this year over midway through 2022, K-pop consumption is up 154.9%, and Afrobeats consumption is up 143.8%. They’re still small in terms of actual consumption numbers — K-pop’s numbers compare most directly to those of children’s music for the first half of the year, for example — but they no longer exist in the realm of the potential. The industry has spent the past few years pouring money and resources into these areas and hoping to boost these artists in the States. The metrics are no longer about what the future may look like: it’s here now.