Dunn, who graduated from Bucknell University with a master’s in economics and has a law degree from American University, started his career as an economist with the U.S. government and then became a mergers-and-acquisitions lawyer before going into banking — and forging relationships with music business players like Jackson estate executor John Branca and former Sony/ATV chairman/CEO Martin Bandier, or Big Deal’s founder and president Kenny MacPherson and Pulse’s co-CEO Scott Cutler, whose firms he helped sell to Hipgnosis and (a stake in) to Concord, respectively.

Before he began his investment banking career, while still working as an economist while going to law school at night, he once made money on the side as a bartender, including at one of Bill Clinton’s 1993 inaugural balls. “I got to serve Johnny Cash a Coke,” he says, and then recounts his favorite musical experience. “After the party was over and we staff were cleaning up, bass player Rob Wasserman, Lou Reed and Paul Simon took the stage and started jamming and it went on for hours.”

After a decade and a half in music, “the things that stand out are the relationships,” says Dunn. “I enjoyed watching and working with John Branca, [Jackson estate co-executor] John McClain, [Jackson estate executive] Karen Langford and with Marty Bandier. You can learn a lot working with executives like them. It provided me with a phenomenal opportunity — that helps you take some shortcuts on the learning curve.”

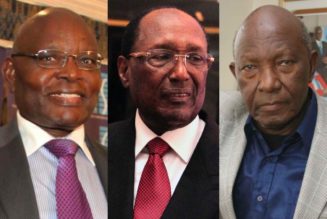

After your first music industry deal with Crosstown Songs, you became involved with Michael Jackson. How did that happen?

It was through Raymone Bain, a Washington, D.C., publicist, who worked with Michael. I flew out to Las Vegas to meet with him and was hired in 2007 to restructure all the debt, which had been acquired by Fortress from Bank of America. We did a bond deal that was secured by his interest in Sony/ATV, with Sony offering a guarantee that Barclays bought. We also did two loans against Mijac, his publishing catalog. We closed the three by the end of the year and then the world started melting down. I spent a fair amount of time with Michael then. When he passed, I began working again with John Branca, John McClain and Karen Langford to once again restructure and refinance the debt.

Jared Soares

Deal plaques and mementos for music asset sales, a tradition in the investment banking industry. The Grammy-looking award in the center celebrates the Michael Jackson estate’s sale of half of Sony/ATV to Sony, with plaques commemorating Hipgnosis, Pulse and Imagem deals around it.

What steps do you take when someone brings you a catalog they want you to sell?

First we do a preliminary valuation to make sure it’s aligned with the seller’s expectations, or it’s a nightmare. If everyone is aligned, then you do full due diligence, which means being prepared to tell potential suitors upfront about any issues, rather than waiting for a later stage to show all the warts. Then we identify potential buyers, make presentations and look for the buyer that has the ability to get a deal done. Rarely does the buyer you think will be the lead buyer end up there when the deal closes.

What do you assess to come up with a valuation?

We tend to look at what’s driving revenue, and then we look at the decay rates. So far we don’t have that many years of data from streaming in order to fully understand. Also, decay rates may still be offset from streaming adoption. If streaming adoption plateaus, then we can get a better handle on decay rates.

Five years ago, did you ever think multiples [of annual revenue, by which catalogs are valued] would ever get this high? And could they go higher still?

Multiples are directly related to what a buyer thinks about future growth. To the extent that there has been a music industry recovery driven by streaming, it’s no surprise multiples have gone up. There’s a correlation between multiples and where streaming goes, so if streaming matures we could see multiples slow. Still, if you look at Wall Street’s expectations for streaming, they expect growth over the next five years to be consistent with the past five years.

Jared Soares

Dunn’s vinyl collection: “I love mellow music, soft rock,” he says. “I never heard of the band Bread until I met Michael Jackson, who really liked them and turned me on to them.”

How do different genres of music affect multiples?

It makes a huge difference. If you’re looking at a catalog with iconic songs, I would say 18 times NPS [net publisher’s share] is an average fair value for a larger diversified catalog, with all rights owned, consisting of higher-quality rock and pop songs. Genres like country, Christian and electronic dance trade at lower multiples because there’s a perception that they have a narrower market and less duration to long-term cash flow. Country is dependent on radio, and when radio stops playing a country song, its royalty streams decay rapidly. Also, country doesn’t synch as well as rock and pop. It just doesn’t have the broad reach of rock and pop on a worldwide basis. Same for Christian and dance.

What types of multiples do you see for those genres?

A country catalog might carry a 10- to 12-times multiple. Christian, I would place the multiple in a range of single digit to low double digits, while electronic dance probably gets a single digit. Rap and hip-hop tend to trade in the same range as country. Hip-hop gets a lot of streams, but there isn’t much room for synch. I’m generalizing: Within each genre certain songs command higher multiples. Someone like Willie Nelson or Dolly Parton’s music would have multiples in the high teens or the low 20s.

“For What It’s Worth” Panel | Billboard Pro Spotlight

What about the age of songs?

Sure, that has an impact. Newer songs trade at lower multiples because they’re still decaying from their initial release. You generally have to wait until they’re past the decay curve so you can see what a song will settle at.

What kinds of investors are looking at publishing assets now as opposed to, say, five years ago?

The folks buying music five or 10 years ago were largely strategic players or investors backing industry players like Spirit or Crosstown, which were building out platforms to exploit the copyrights they acquired. Today, investors like Tempo or Shamrock Capital are perfectly happy to acquire copyrights and outsource administration for publishing assets or distribution for master recordings.

Jared Soares

A miniature boat Dunn bought to fix up as one of his hobbies.

And how would you compare the catalogs coming up for sale now?

There are more catalogs up for sale and more deals being done — but smaller ones. Maybe that’s driven by songwriters who can’t tour due to COVID-19, or maybe there’s a perception that the high multiples won’t last. Also, thanks to Hipgnosis and Round Hill going public with the London Stock Exchange, you might see others trying to do an income trust or become public. So while there are a lot more assets for sale, there are a lot more paths to liquidity.

Your firm is also involved in artist estate planning. What issues come into play there?

The issues depend on the estate. We have helped establish values to deal with taxes, we have negotiated rights agreements for record deals and publishing administration and helped analyze the economics of film licensing. We have helped, where necessary, to figure out liquidity when an estate is in debt. The issues that come up are interesting: Think about things like name and likeness, which an artist may never have exploited. But the IRS comes along and says it has huge value, which means big tax implications. At the end of the day, the math you have to do to figure out the worth of these assets isn’t that dissimilar to the math you have to do when thinking about selling an asset.

What aspects of the music industry have you come to appreciate?

I know I am supposed to be a boring finance guy, a cashflow guy, but its great working in such a creative industry where the product is just so awesome. The people you meet are incredibly passionate. You come to respect the A&R people and the producers and the immense amount of talent in the industry.

Jared Soares

“When I need to take a break from working on deals, I go downstairs and work on a car,” he says. “And if I get a call or need to have a video chat, I have a computer down there so I can walk over and do that.”