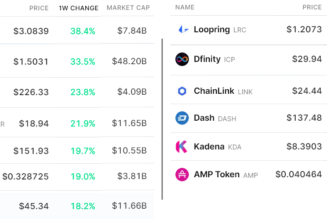

The cryptocurrency market experienced rapid growth this month, with the total market cap reaching the $2.8 trillion mark for the first time.

Bitcoin reaches a new all-time high at $67,200

The crypto market performed excellently this month, with the prices of most coins increasing in value by double-digit percentages. Bitcoin was one of the biggest winners this month, reaching a new all-time high above the $67,000 a few days ago. This is the first time the leading cryptocurrency is setting a new all-time high since April 2021.

The cryptocurrency’s price could soar higher in the coming weeks and months if the market momentum can be sustained. Ether, the second-largest cryptocurrency, also reached a new all-time high this month. ETH touched the $4,416 level a few hours ago thanks to the Altair upgrade on its blockchain. Other leading cryptocurrencies to have reached new all-time highs this month include Solana and Shiba Inu.

First Bitcoin futures ETFs hit the market

The United States Securities and Exchange Commission (SEC) has been reluctant to approve crypto-related exchange-traded funds (ETFs). However, it approved two Bitcoin futures ETFs earlier this month. The ProShares Bitcoin futures exchange-traded fund and the Valkyrie Bitcoin futures ETF were approved by the SEC earlier this month and are now trading on the New York Stock Exchange (NYSE) Arca and the NASDAQ stock exchanges, respectively.

The retail and institutional demands for the Bitcoin futures ETFs have been huge despite launching barely two weeks ago. The US SEC is expected to approve more crypto-related ETFs over the coming months and possibly a Bitcoin spot ETF.

Putin says crypto can be used for payments

Russian President Vladimir Putin became the latest world leader to admit that cryptocurrencies can be used as a means of payment. The president made this comment at the Russian Energy Week event earlier this month, admitting that it is perfectly okay to use cryptocurrencies to pay for goods and services. However, Putin thinks it is still early for Bitcoin to replace the US dollar for global transactions.

He also highlighted Bitcoin’s huge energy consumption in terms of mining, adding that it could be a major barrier for the cryptocurrency and might affect its massive adoption prospect. The Russian government has come out to state that they don’t intend to ban cryptocurrency services and transactions.

The United States regulators also said they don’t intend to follow in China’s footsteps regarding cryptocurrencies but will regulate the crypto space instead.

The NFT competition keeps increasing

One of the biggest fields in the cryptocurrency space at the moment is the non-fungible token (NFT) sector. In Q3, NFT transaction volume topped the $10 billion mark for the first time in history. As such, the competition in the sector has been growing.

Earlier this month, FTX.US, the United States arm of the FTX exchange, fully launched its NFT marketplace. The marketplace will allow users to buy and sell the various Solana-based NFTs. FTX already has an NFT marketplace, but it only supported NFT minting at the time.

Another leading exchange, Coinbase, also announced that it would launch an NFT marketplace. The platform will make it easier for its users to trade NFTs. Within the first few days of announcing this latest development, more than 1.4 million people signed up for the waiting list to gain access to Coinbase’s NFT feature.

The DeFi market’s total value surpasses $200 billion

In addition to NFT, another sector of the crypto market that has been recording massive growth in recent months is decentralised finance (DeFi). Earlier this month, the DeFi ecosystem’s total value surpassed $200 billion for the first time.

The growth represents a 100% increase in value since June 2021. The total value locked (TVL) in DeFi protocol topped the $200 billion mark for the first time in history. Ethereum remains the number one blockchain for most DeFi protocols. It is currently home to more than 60% of the TVL in DeFi.

Binance Smart Chain and Solana take the second and third places respectively as they begin to eat away at Ethereum’s dominance in the DeFi space.

China’s ban causes an exodus of crypto companies

The People’s Bank of China (PBoC) banned crypto services and transactions in September. This has led to numerous companies shutting down their operations and moving out of China. Some of the leading crypto exchanges, including Huobi, Binance, BitMart and Biki, all announced that Chinese users would no longer be allowed to register on their platforms, and the existing accounts would be closed.

Bitmain, the world’s largest crypto mining hardware manufacturer, said it has stopped shipping its products to mainland China. The company also halted its operations in Southern China and is moving to other parts of the world in the coming weeks and months.

Sparkpool, the second-largest Ethereum mining pool in the world, revealed earlier this month that its Chinese operation would be shutting down. The company will also shut down its operations in other parts of the world in a move to protect its users’ assets due to the regulatory crackdown in China.

Alibaba, one of the top e-commerce platforms in the world, said it would stop the sales of crypto mining hardware on its platform. So far, more than 18 companies have announced their exit from China in recent weeks.

The Chinese government blocked access to some crypto data sites includes CoinGecko, TradingView and Coinmarketcap. The government is also looking to prosecute any person or establishment caught dealing with cryptocurrencies in China.