The essence of luxury is scarcity.

Luxurybrands face the complex task of amplifying their global

presence and ensuring their collections reach their loyal

clientele, all while carefully balancing the need to avoid

overproduction and preserve the exclusivity that underpins their

brand’s allure.

Excess inventory, typically associated

with fast fashion’s cyclical waste, is a growing concern for

luxury brands. Regulations around the destruction of unsold goods

have changed the calculus for the old model of overstocking to meet

demand, but shedding excess inventory through discounting puts

brand value at risk. Luxury brands face a unique challenge: They

must meticulously balance production with demand and navigate

evolving ethical and regulatory complexities. The Fashion

Transparency Index 2023 found that88% of major fashion brands don’t disclose

their production volumes, but we are seeing companies like

Hermès and LVMH get creative about waste reduction. AI

tools, enhanced network planning, gamification of forecasting, and

small-batch production each have a role in the solution, alongside

other key approaches.

Luxury brands must, therefore, introspect

and innovate to sustainably address surplus inventory without

compromising brand positioning.

Excess inventory wasn’t

always a problem

In luxury fashion, it has historically

been more profitable to produce in excess rather than face a

shortage, as missing out on full-priced sales can have a

substantial negative impact. High product margins cushion this

approach, which is also reinforced by the economics of luxury

branding and marketing investments—costs associated with

upholding brand prestige and market position exceeding the profits

companies could make from liquidating excess stock in the long

run.

With tightening regulations, especially

the European Union’sfirmstance against destroying unsold goods,

and evolving consumer awareness signaling a pressing need for

change, luxury brands are increasingly compelled to reconsider

their strategies, pairing the industry’s storied exclusivity

with sustainable, economically sound practices.

Eliminating inventory

destruction is a crucial step forward and alternatives are already

within reach.

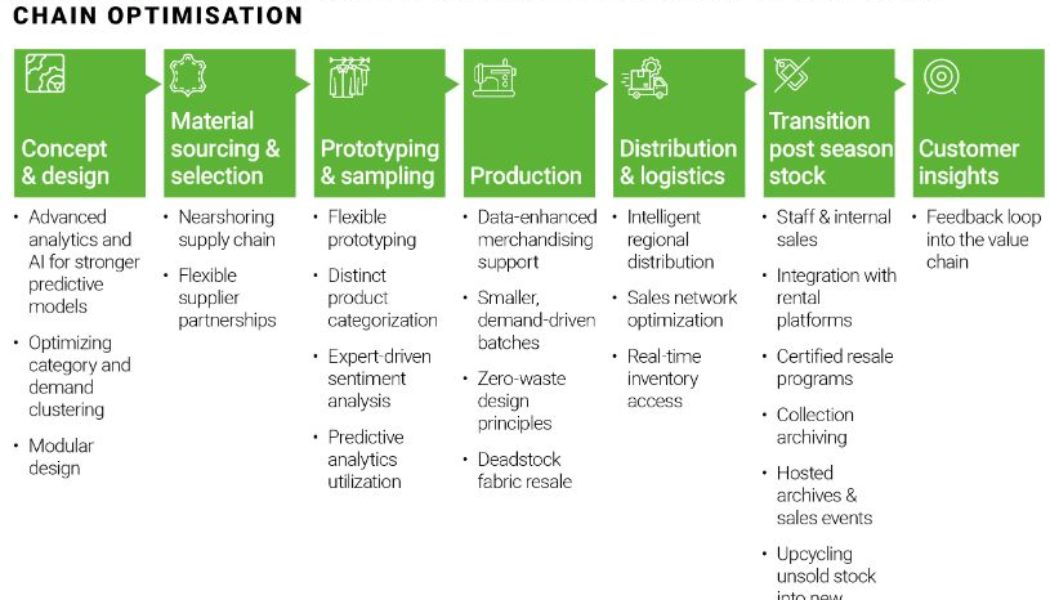

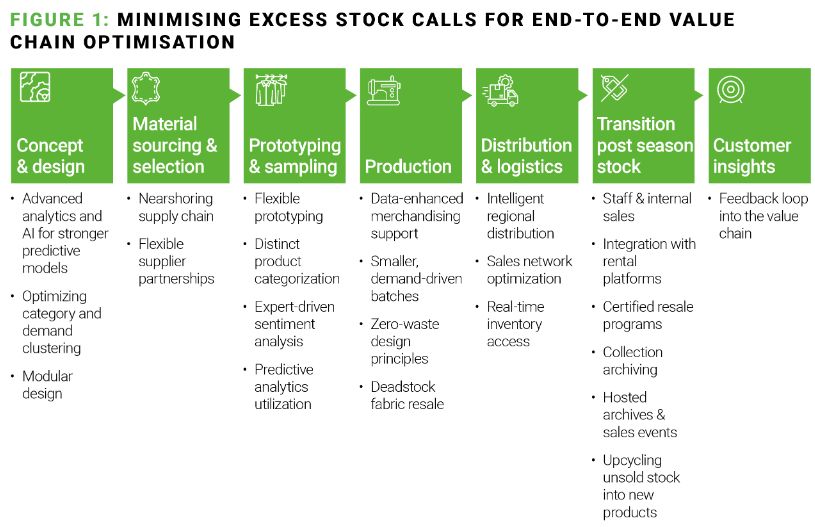

Efficient production in luxury fashion

hinges on strategically optimizing the end-to-end product value

chain—crafting key strategies to optimize production volumes

through the three phases: pre-production, production, and

post-production.

Pre-production

These strategies begin with precise

category and assortment planning, distinguishing between seasonal

and seasonless items to accurately demand forecast and mitigate

stock excesses.

Tailoring assortment

planning: Brands must adopt a tailored assortment

approach, shifting from a one-size-fits-all model to finely

segmenting their product categories.The risk of obsolescence varies

significantly within a product portfolio, especially for seasonal

items and variations of classic pieces. These items are highly

time-sensitive and prone to rapid shifts from shortage to excess in

the fast-paced fashion cycle. A sophisticated assortment

architecture strategy is crucial for production forecasting,

ensuring production forecasts capture product risks within

categories.

Leveraging precision

AI:Luxury fashion is in an AI revolution to enhance trend

prediction and inventory management. One clear use case leverages

enhanced data analytics for more qualitative insights such as

sentiment analysis, emerging fashion trends, consumer behaviors,

social-media dynamics, and rapid sales data-processing.

This data can then be used to enable

precise demand predictions, guiding brands to make informed

decisions on production volumes down to the most granular

level.

Amplifying salesforce and client

advisor insights:Luxury brands have a goldmine in their

client advisors. Their direct engagement with clientele offers

real-time insights into preferences and trends. These frontline

insights can also be used to refine production plans and align

forecasts with predicted consumer demand.

Companies can capitalize on this

knowledge by integrating gamification into the forecasting process.

With an intuitive digital platform, luxury brands can empower their

staff to input sales predictions, market insights, and inventory

recommendations. The platform could reward accuracy with points or

perks, fostering a competitive yet collaborative environment that

motivates front-line staff to share precise and actionable data,

transforming their observations into a strategic tool for enhancing

inventory precision.

During-production

After the essential groundwork paves the

way for a tailored production, critical inputs can match

up-to-the-minute market demand.

Adopting smaller batches and

on-demand production: By adopting smaller batch production

and on-demand manufacturing, luxury brands can more precisely meet

real-time consumer demand, minimizing overproduction and surplus

stock. Integrating virtual sampling is crucial, facilitating

digital prototypes that expedite the design phase, trim time to

market, and curtail waste. Such shifts demand a flexible supply

chain, supported by strong predictive analytics and nimble

suppliers, to quickly adapt to changing demands.

AI tools can also integrate real-time

data analytics to adjust production schedules, optimize supply

chains, and even tailor marketing campaigns to anticipated consumer

trends, ensuring optimal product availability.

Designing for zero

waste: From the initial design to the atelier’s floor,

embracing zero-waste principles ensures maximum material

utilization, marrying artisanal craftsmanship with sustainability

to reduce pre-consumer textile waste. Innovations like AI-powered

design software can revolutionize material use, particularly in

zero-waste pattern cutting, embedding sustainability into the

manufacturing process.

Instilling creative repurposing,

aka “scrap couture”: Integrating scrap fabrics

into luxury collections, the innovative concept of scrap couture

offers an avant-garde blend of sustainability and high fashion.

This approach challenges designers to creatively repurpose surplus

materials, transforming them into unique, luxurious pieces that

resonate with eco-conscious consumers.

Showcasing these upcycled masterpieces in

prestigious runway shows makes a powerful statement, elevating the

brand’s status while spotlighting its commitment to innovation

and sustainability. It also provides an opportunity to elevate

brand positioning and showcase design capabilities.

A prime example of this practice in

action isHermès’Petit h Studio. Celebrated as

a creative atelier within the esteemed luxury house, Petit h

breathes new life into scrap materials and leftovers, ingeniously

repurposing them into fashionable and home accessories.

Solving for sustainable raw material deadstock:

The resale of high-end deadstock fabrics is emerging as a

sustainable and economically viable avenue for managing excess raw

material. One notable enterprise leading this initiative is the

LVMH-backedNona Source, which capitalizes on repurposing

excess high-quality materials and providing creatives and emerging

designers with access to high-end circular materials from top

luxury houses and reports that it has upcycled up to 100 tons of

textile since creation.

Platforms such as these cater to diverse

needs, offering exclusive trims, leather offcuts, and specialized

fabrics. They broaden emerging designers’ resource pool and

present a sustainable solution to managing surplus raw

materials.

Post-production

This phase zeroes in on the crucial

elements of strategic supply chain planning and agile inventory

management to meet seasonal demand efficiently, ensuring products

reach customers before the fashion season transitions to a new

collection.

Honing assortment

allocation: Luxury brands must utilize in-depth market

insights to tailor product assortments to regional preferences,

strategically navigating the dynamics between trendsetting regions

and trend consumers. This strategy employs a reverse bullwhip

effect to streamline production and meet market demand

efficiently.

Timing and distribution agility are

particularly critical for seasonal wear, requiring swift product

delivery to stores to exploit fleeting market trends and seasonal

demand spikes. Customizing assortments according to regional tastes

is crucial. A strong understanding of diverse market preferences

will enable strategic product variation—in colors and

designs—to ensure alignment with local fashion

sensibilities.

Creating an omnisupply:

To mitigate discrepancies in product availability, efficient

synchronization between demand and supply across retail stores,

wholesale, and omnichannel is vital. Enhanced network planning,

mini depots, and flexible regional logistics strategies are

critical. Integrating a digitized, real-time inventory monitoring

system across channels also optimizes demand.

Charting a sustainable path

ahead

In the fashion and apparel sector, where

the pace of change outstrips nearly every other industry, deploying

state-of-the-art forecasting technologies still falls short of

achieving absolute precision in demand forecasting.

The dynamic nature of consumer

preferences and the rapid turnover of trends render stockouts and

surplus inventories a persistent challenge, notwithstanding the

adoption of pre-order models designed to mitigate these issues.

Thus, the imperative for fashion brands is not merely to minimize

excess stock but to pioneer and adopt sustainable strategies for

inventory management. These strategies must adeptly balance the

imperative of maintaining the brand’s value in the eyes of the

consumer with the necessity of adhering to increasingly stringent

regulatory standards.

Still stuck with excess

inventory? Consider the 3 Rs

Rent:Collaborating with

or establishing rental platforms extends the lifecycle of luxury

items, keeping them in circulation, reducing waste, and aligning

with sustainable consumption trends.

Resale: Developing

certified pre-owned programs or partnering with luxury resale

platforms can ensure the longevity and relevance of luxury items

and support a sustainable, waste-reducing ecosystem.

Re-release: Storing

select collections for future re-release taps into the power of

consumer nostalgia, offering luxury brands an opportunity to

repurpose past inventories while maintaining the allure of

exclusivity and timeless appeal.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.