Strong FY2023

The Burberry Group (BRBY.uk ) is a global luxury fashion brand established in Great Britain in 1856. It designs and sells clothes and accessories for men, women and kids around the world. Late-last year, it had set a strategy to increase its medium-term sales to £4 billion and to reach £5bn in revenue in the long-run.

Before the UK market opened today, it released strong financial results for Fiscal Year 2023 (52 weeks ended April 1), which showed good progress on that plan, with CEO Jonathan Akeroyd speaking of a “strong financial performance”.

Revenue increased 10% y/y, to more than £3 billion, Adjusted Operating profit jumped to £634 million, Margin widened by 200 basis points, to 20.5% and Free Cash Flow rose 16%.

The China Factor

China is a very important market for most high-end designers and its 2022 struggle with the pandemic and the strict zero-Covid policy were detrimental, since they suppressed demand, while also disrupting trade and factory activity. Burberry’s sales in mainland China dropped 11% in the reported fiscal year, due the pandemic disruptions.

Even though the world’s second largest economy shifted away from these stringent containment measures late-last year and its economy has been reopening, helping the performance of these brands, recent data have cast doubt over the recovery prospects.

Retail Sales have been growing over the past few months and jumped 18.4% y/y in April, according to this week’s release. One of the most disappointing indicators this year has been the Consumer Price Index (CPI), as inflation rose by just 0.1% y/y in April, in a sign of weak consumer demand.

Burberry’s overall Revenue increase was largely driven by the rebound in mainland China in the fourth quarter of FY2023, where sales jumped by 13% – a testament of the strength of the country’s reopening over the past few months.

The Asia-Pacific region as a whole, was once again the main revenue generator, with £1.297 billion, responsible for more than 40% of sales.

Competition

Burberry is an iconic and important luxury fashion designer, but it is dwarfed by high end behemoths such as LVMH Moët Hennessy Louis Vuitton (MC.fr). The French-based firm had Sales in excess of €79 billion last year, with the Fashion & Leather Goods business accounting for most of it. In terms of geographic breakdown, Asia (excluding Japan) was the biggest revenue generator, responsible for or 30% of it . In the first quarter of 2023, Revenues grew 17% y/y to around €21 billion and Asia (excluding Japan) accounting for 36% of total sales.

Another French rival is the Hermes Group (RMS.fr), which had Revenues of €11.602 billion in 2022, with the Asia-Pacific region accounting for nearly 60% . During the first quarter of the year, Revenues grew 23% y/y to €3.38 billion.

Last week, US-based Tapestry Inc (TPR.us), which includes coveted brands kike Coach, released its results for the nine months ended April 1. Total Sales were roughly unchanged at a little over $5 billion and Operating income narrowed to $898.8 million, while sales in China grew 20% in the third quarter.

Stock Reaction

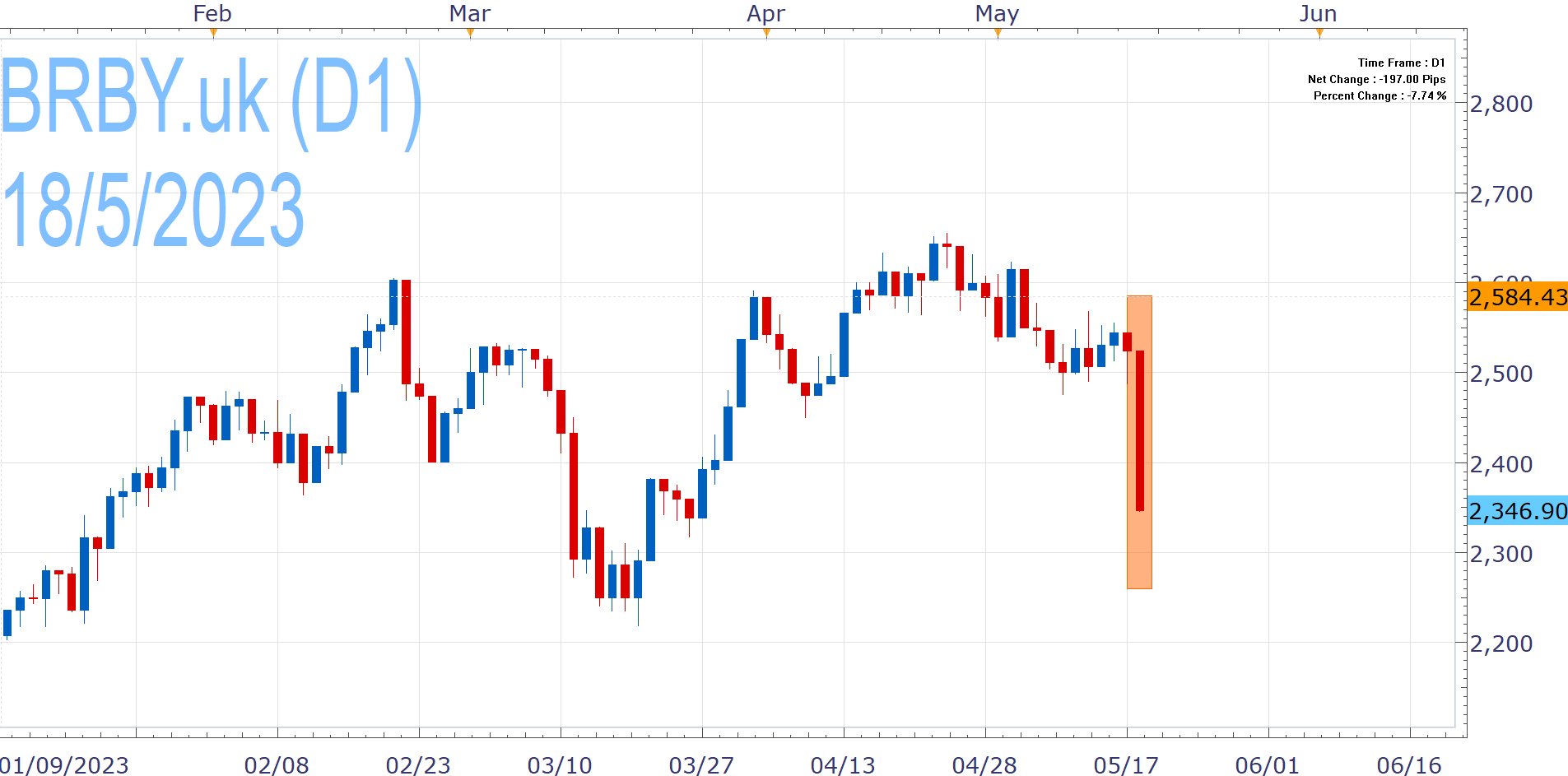

BRBY.uk is having a good year, with a very strong first quarter, but has been facing pressure during the current month. Despite today’s overall solid results and the strong Q4 performance in China, Burberry’s stock opened with steep losses today.

It looks like investors may be unconvinced by the China rebound and that they focused on the poor results in the Americas. Sales in that region fell 3% in FY2023 and 7% in the last quarter of the fiscal year.