London Fashion Week kicks off this Friday and runs until Tuesday 19 September, but which top brands are best placed for keeping your investment portfolio looking chic?

Analysis from trading platform eToro shows luxury fashion stocks have generated more than quadruple the returns of their high street counterparts during the last five years.

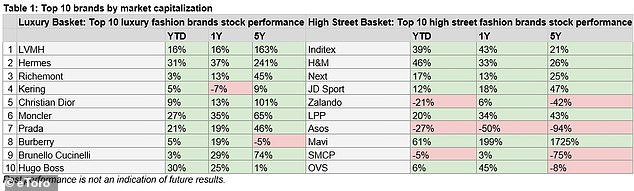

The top 10 luxury fashion stocks, including LVMH and Hermès, have recorded a growth rate of 90 per cent in the last five years, against 23 per cent among their high street counterparts, according to the data.

The figures cover the ten biggest British and European luxury and high street fashion retailers by market capitalisation, and demonstrate a degree of resilience in elements of the luxury market during the cost of living crisis.

Growth: LVMH shares have fared well in the last five years, data from eToro suggests

According to eToro, luxury brands outpaced Europe’s Stoxx600 by a four-to-one ratio over five years.

However, some high street brands have regained ground in the last year amid easing inflation and higher wages, the findings suggest.

Both luxury and high street retailers in the UK and Europe have outperformed the broader European stock market since 2018.

LVMH has seen its market value increase by 163 per cent in the last five years, while Hermès enjoyed a growth rate of 241 per cent during the period.

Since the start of 2023, Hugo Boss and Prada have seen growth of 30 per cent and 21 per cent respectively, while many well-known high street brands have registered more modest growth.

Spain’s Inditex, the parent company of Zara, is up 21 per cent over the past five years, behind Sweden’s H&M, which saw a 26 per cent increase.

UK-based Next shares have risen 25 per cent in the the last five years and JD Sports shares has enjoyed growth of around 47 per cent over the period.

Asos was, eToro says, the worst performer, experiencing a significant downturn with a 94 per cent decrease in its stock market value.

Asos reported revenue totalling £858.9million in the third quarter of its fiscal year, down 14 per cent on a year ago. In the year to date, Asos shares have dropped by around 25 per cent, according to eToro’s figures.

Brands: Top 10 brands by market capitalisation, according to eToro

Uphill struggle: Asos shares have struggled in the last few years

Data: Performance of luxury and High Street against Stoxx 600

Ben Laidler, global markets strategist at eToro, said: ‘The high street brands deserve credit for navigating this difficult economic environment well, with their collective share prices besting the European stocks average.’

He added: ‘However, the share price plunge of Asos for example, is a stark reminder of how unforgiving and competitive the industry can be.

‘This underscores the importance of adaptability and innovation in the ever-changing fashion industry.

‘As the sector continues to evolve, we can expect to see further shifts in the fortunes of these mainstream brands.’

Be mindful that when selecting stocks, while it’s crucial to look past as past returns, these won’t guarantee any future growth.