Brace for the desert heat, because a new location is being added to the Fashion Week calendar.

From October 20 to 23, Saudi Arabia is hosting its first Fashion Week in its capital city, Riyadh. The event is expected to spotlight the kingdom’s most promising designers from Saudi 100 Brands, a program run by the state’s Saudi Fashion Commission, which promotes local talent at home and abroad.

“For the first time ever, we now invite the fashion community to our home during this historic event,” said Saudi Fashion Commission CEO Burak Çakmak in a release. “Saudi is on its way to becoming the next international fashion destination.”

The Kingdom of Saudi Arabia (KSA) may not be the first place that comes to mind when thinking of fashion, but it’s on track to become a serious player — in terms of both creation and consumption. According to a recent report by the Saudi Fashion Commission titled “State of Fashion in the Kingdom of Saudi Arabia 2023,” retail fashion sales in the country are expected to expand at an average annual growth rate of 13 percent to $32 billion from 2021 to 2025.

Below is a closer look at the KSA’s evolution into a fashion hub and the opportunities for global brands.

Country of rising millionaires

Saudi Arabia is one of the wealthiest nations in the world with a per capita GDP of $27,941 (SAR 104,778) in 2023, according to the commission’s report. It was also the fastest-growing G20 economy in 2022, leading to its first budget surplus in almost a decade, although growth has decelerated this year due to lower oil prices.

In 2022, Saudi Arabia counted over 117,000 millionaires (net wealth between $1 million and $5 million) and 12,500 high-net-worth individuals (net wealth between $5 million and $50 million), according to Euromonitor International.

Via Riyadh, a luxury shopping mall in Saudi Arabia, offers brands like Sergio Rossi, Dolce & Gabbana and Tom Ford. Photo: Via Riyadh

The nation’s economic expansion and growing affluent population will help drive spending across its fashion industry. In particular, the kingdom’s personal luxury market is expected to double in size from roughly $3 billion in 2023 to $6 billion by 2030, fueled by younger generations, Boston Consulting Group and Altagamma said in a recent study.

Saudi consumers with a taste for luxury tend to have differentiated preferences when it comes to categories like fashion, accessories, and jewelry, says Aleksandar Josipović, founder of Dark Ink Consultancy and Coaching in the Middle East.

“When comparing the consumption patterns of luxury consumers with those from China and around the world, we find similarities and differences. While all appreciate luxury as a symbol of status and self-expression, Saudi consumers tend to gravitate towards designs rooted in tradition and heritage that resonate with their identity,” Josipović says. “On the other hand, Chinese and global luxury consumers often lean towards contemporary and innovative offerings.”

“Saudi consumers tend to gravitate towards designs rooted in tradition and heritage that resonate with their identity. On the other hand, Chinese and global luxury consumers often lean towards contemporary and innovative offerings.”

Appetite for China-made apparel

But high-end goods aren’t the only things Saudi consumers are purchasing. Thanks to the Ministry of Sports’ promotion of physical activity in recent years, especially among women, the sportswear category generated $1.3 billion (SAR 4.9 billion) in sales in 2022 and is forecast to grow to $1.5 billion by 2027, says the commission’s report.

Adidas, Nike and Puma accounted for more than half of total sportswear sales in Saudi Arabia last year. Adidas is the current market leader – it’s the sole supplier of all training and match wear for the Arabian Football Federation until 2026.

Adidas launched the new Saudi Arabia Football Federation Kit 2023-24 with its “Weaved as One” campaign, which pays homage to Saudi culture. Photo: Adidas

There’s also a strong appetite for China-made apparel. Saudi Arabia imported $2.6 billion (SAR 9.75 billion) of fashion goods from China in 2021, making China Saudi’s most important import market for finished fashion products, states the commission’s report.

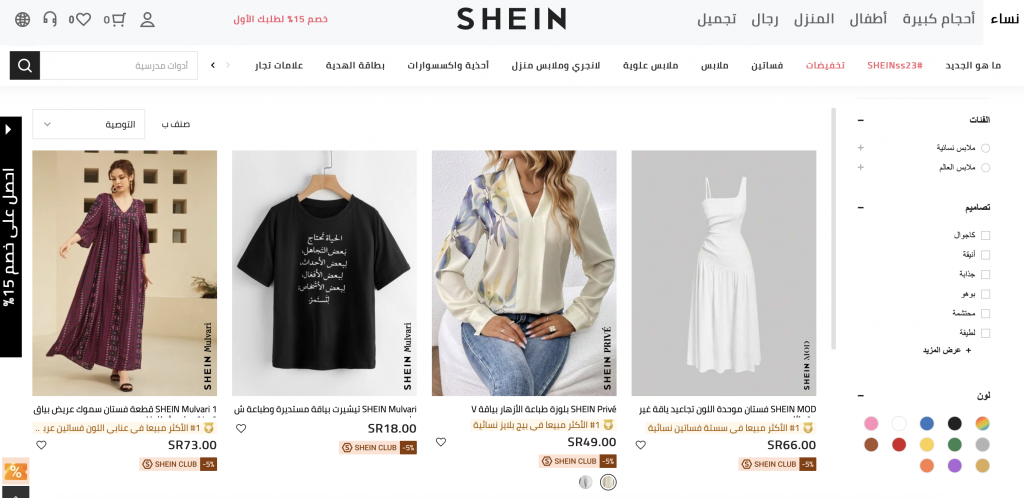

Chinese e-commerce site Jollychic has played a key role in helping Chinese-made products enter Saudi Arabia and other MENA (Middle East North Africa) markets since 2013 — reaching 35 million registered users by the end of 2017 — but quietly shuttered last year. Other Chinese retailers like Shein, AliExpress, Alibaba and Chicpoint have filled the gap, growing to become the kingdom’s top fashion apps.

“This preference can be attributed to a combination of factors, including affordability, diverse product options, and accessibility associated with products,” Josipović tells Jing Daily. “In addition to being cost-effective, clothing made in China caters to tastes by offering a range of styles and designs that align well with the preferences of Saudi consumers.”

Shein is one of the most popular shopping apps in Saudi Arabia. Photo: Screenshot

Beyond fast fashion, there’s also an appetite for Chinese designer brands thanks to the rise of Chinese pop culture, observes Reiting Lee, founder of The Oriental Hybrid, a consulting agency for Chinese and Arabic speaking audiences.

“The spread of Chinese language learning, C-drama, and Chinese celebrities such as Wang Yibo have evidently impacted Saudis and the Arab world in these few years, which can be observed in the age group of 19-25,” says Lee. “Many young Saudis also had the opportunities to study in China during their university years, and this has greatly affected their preference and interest in Chinese designers and Chinese fashion from a young age.”

Local designers on the rise

At the same time, Saudi Arabia is intent on becoming a fashion producer in its own right. In addition to offering design-related courses across 12 universities and funding students to study fashion abroad, the kingdom has also launched a designer incubation program through the Saudi Fashion Commission.

Established in 2021, the Saudi 100 Brands program provides year-long mentorships and masterclasses to 100 designers, covering topics such as branding, sales and marketing, and product development. Participants are also provided opportunities to display their work internationally; in July this year, participating designers including Adnan Akbar, Ashwaq Almarshad, Najla Almunajem, and Yousef Akbar staged a three-day showroom during Paris Haute Couture Fashion Week.

In July, Saudi 100 Brands held a special runway show during Paris Haute Couture Fashion Week. Photo: Saudi 100 Brands

Later this month, they will have the chance to showcase their Spring 2024 collections at White Milano, a leading womenswear trade show held during Milan Fashion Week.

Fashion hub future

All these efforts are part of the country’s ambitious Saudi Vision 2030 development strategy, which aims to create a more sustainable economy. The domestic fashion industry plays a direct role in achieving this by bolstering non-oil related GDP growth and reducing the KSA’s reliance on fashion imports.

While many changes have been made since Vision 2030 was launched in 2016, much work still needs to be done to achieve long-term success. In terms of fashion, the domestic sector still lacks a sufficiently large talent pipeline for technical specialists and struggles with low awareness of its emerging design capabilities, notes the commission’s report.

Lee adds: “Saudi’s fashion industry is indeed growing extremely fast thanks to Saudi Fashion Commission’s CEO Mr. Burak and their strategy. However, there have been very few Arab brands made visible to the Chinese audience, such as Elie Saab (Lebanese) and Okhtein (Egyptian), and almost no Saudi brands have been communicated and introduced to the Chinese market.”

Still, Saudi Arabia’s potential as a fashion market is evident. With a population of young, wealthy spenders and a growing pool of creatives who are showcasing their nation in a new light, the kingdom has become critical for luxury to keep tabs on.