Selfridges department store in London could be missing out on a spending boom by wealthy American and Middle Eastern tourists.

Photo: Vuk Valcic/Zuma Press

U.S. tourists can get a much better deal on a new Louis Vuitton handbag in Paris than in London. It is becoming a problem for the British capital and its home-grown luxury brands.

The U.K. government scrapped tax-free shopping for overseas visitors at the end of 2020, arguing that the country could no longer afford to offer a perk its Treasury estimated cost the public purse £2 billion a year, worth $2.4 billion at current exchange rates. London is now the only major European shopping destination where tourists can’t get back the 20% value-added tax they pay on luxury purchases.

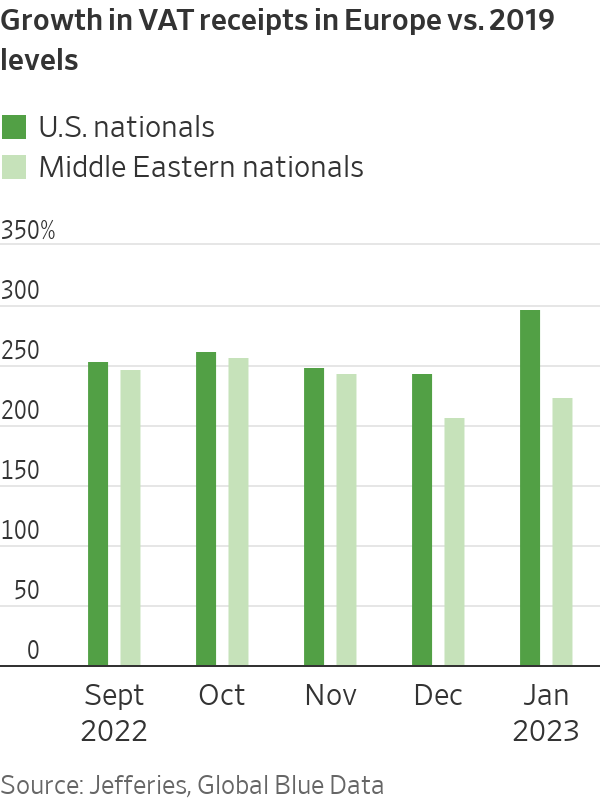

That means London is missing out on a spending boom by wealthy American and Middle Eastern tourists that began last summer and has benefited big cities on the European continent, mainly Paris and Milan. In January, VAT receipts from Middle Eastern visitors to continental Europe, a good proxy for luxury spending, were up 224% compared with the same month of 2019, based on data from tax refund company Global Blue.

American spending was even heavier, with receipts up 297% over the period. The strong dollar means the discount available on luxury goods in Europe has been historically wide recently and U.S. tourists outspent all other nationalities in every month of 2022. Data from Planet Intelligence also shows that Britons are spending heavily on tax-free goods in the European Union.

London’s luxury retailers are lobbying the U.K. government to reinstate VAT-free shopping for visitors. Big department stores like Harrods, owned by Qatar’s sovereign wealth fund, and Selfridges, which was sold for £4 billion in 2021 to Thai and Australian investors, relied heavily on tourist spending before the pandemic. The issue is more urgent since China reopened its borders last month. Chinese tourists, historically the luxury industry’s biggest spenders, are expected to be on the move again soon.

The U.K. tax rules aren’t an issue for major brands like Louis Vuitton or Gucci, which can recoup lost London sales in their European flagship stores. Even Burberry is global enough that it can make up the revenues elsewhere. But it has noticed a change in buying patterns. Burberry’s finance chief recently said sales to Middle Eastern travelers in its latest quarter were up 122% in its European stores compared with the same period in 2019, but only 14% in the U.K.

London-listed Mulberry is more exposed as it still generates around half its revenues in the U.K. The handbag brand’s store on Bond Street used to make around 50% of its sales to overseas tourists before the tax rules changed, but the share has slumped to less than 5%.

If overseas visitors continue to shop in Europe instead of Britain, landlords on the U.K. capital’s poshest streets could suffer. In 2022, London’s New Bond Street slipped out of the top-three ranking of the world’s most expensive retail streets, according to real estate firm Cushman & Wakefield. It was overtaken by Via Montenapoleone in Milan, where rents are now 9% above 2019 levels.

Well-heeled visitors will probably still come to London for the sights, but unless the U.K. government changes tack they will increasingly do their shopping elsewhere.

Write to Carol Ryan at carol.ryan@wsj.com