Capital Markets

Kwale titanium exports fall 63pc in Sept quarter

Friday November 10 2023

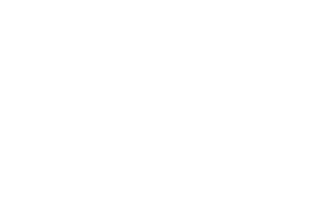

Base Titanium factory in Kwale County where the minerals are processed. FILE PHOTO | KEVIN ODIT | NMG

Exports of titanium minerals fell 62.9 percent in the three months to September amid reduced production and shipment from the Kwale-based operation owned by Base Titanium.

The value of the minerals — ilmenite, rutile and zircon — sold in the period stood at $23.1 million (Sh3.5 billion) compared to $62.4 million (Sh9.4 billion) a year earlier using current exchange rates.

The performance comes as the company plans to cease production at the end of next year, citing dwindling titanium deposits.

The sharp drop in sales, which will also lower the royalties paid to the government, was due to a 74.2 percent decline in export volumes to 22,500 tonnes from 87,500.

Read: Kenyan suppliers earn Sh9.6bn from Base Titanium

The government is paid royalties at Five percent of the export value.

The company’s shipment of products often differs from production numbers, sometimes due to strategic stockpiling and sales in response to international prices of the titanium minerals. Production fell 53.7 percent to 54,200 tonnes from 117,200.

“Despite lower production levels for the remainder of Kwale Operations’ mine life, the company plans to continue bulk shipments of ilmenite (up to 54,000 tonne lots) and rutile (between 5-10,000 tonne lots), which will result in greater volatility in quarterly sales volumes, as illustrated by the sales volumes for this quarter,” Base Titanium’s parent firm Base Resources said.

Average prices per tonne of titanium minerals were higher in the review period at $1,029 compared to $714 the year before, helping to mitigate the decline in exports value.

Economic uncertainty

“Market conditions became increasingly challenging through the September quarter due to growing economic uncertainty and softening property sectors across all key markets,” Base Resources said.

“However, firm demand continued for Base Resources’ products through the quarter and sales were in line with expectations. Prices held up well for ilmenite and rutile, but zircon prices moderated due to the sluggish conditions that emerged during the latter part of the June quarter.”

The Kwale operation is scheduled to cease at the end of 2024, resulting in loss of an estimated 870 Kenyan jobs besides billions of shillings per annum that the government has been earning in the form of taxes and royalties.

Prohibitive costs

Base Titanium says there are not enough titanium resources to sustain the operations beyond the set exit date.

Read: Kwale titanium miner exit risks 870 jobs

The parent firm says it will turn its focus to Madagascar where it is working to start mining titanium minerals while maintaining exploration activities in Kenya and Tanzania.

The firm noted it could not expand the mining activities in Kwale due to several factors including prohibitive costs, weaker prices of titanium in the international markets as well as substantial land acquisition and community resettlement programme.