Bitcoin (BTC) could nail the now-popular $98,000 price target — but it could end up being the cycle top, new research argues.

In its “October 2021 Market Recap & Outlook,” major United States exchange Kraken said that Bitcoin should reach around $96,000 if this quarter copies the last bull run.

Copycat Bitcoin may top out below $100,000

With BTC price predictions reaching $300,000, the new analysis from Kraken suggests that if BTC/USD were to copy its 2017 performance, this cycle’s top could end up still being under $100,000.

While facing calls for a “worst-case scenario” November closing price of $98,000, it could be that Bitcoin ends up peaking at around that level instead.

“At the current pace, 4Q is trending most similarly to 4Q2017 with a correlation of 0.88. It should be noted that 4Q2017 went on to become Bitcoin’s third best 4Q on record with a return of +220%,” Kraken wrote.

“Assuming BTC continues to follow in the footsteps of 4Q2017, we could expect BTC to rally even higher into month end. For some context, a +220% in 4Q2021 would imply a price of $96,355 for BTC.”

The report also noted that November historically tends to be more volatile, as well as deliver the largest monthly returns.

A separate prediction involved Bollinger Bands and Bitcoin’s relative strength index (RSI).

“Historically, BTC’s cycle tops have coincided with BTC hitting both its upper Bollinger band AND the 1-month relative strength index (RSI) hitting a reading of 96,” it added.

Currently at 71.7, the RSI thus has room to grow in line with spot price action. As Cointelegraph reported, the metric is responsible for some of the loftier BTC price predictions for this cycle.

The upper Bollinger Band, meanwhile, currently gives a reading of around $112,000.

$1-trillion asset class is here to stay

Should Bitcoin’s current run stall at significant resistance near $70,000, a dip may not cost bulls more than around 20%.

Related: ‘Resistance is futile’ — 5 things to watch in Bitcoin this week

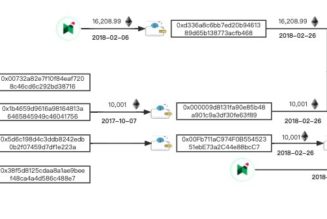

Looking at the cost at which every Bitcoin changed hands, analyst Willy Woo concluded that the $50,000–$60,000 zone is more than solid enough as support.

“Bitcoin as a $1T asset class IMO is now cemented; hard to see it dropping below this zone,” part of his comments on Monday read, alongside data from on-chain analytics firm Glassnode.

Contour map of every bitcoin at the price they last changed hands between investors. Huge price validation between $50k-$60k.#Bitcoin as a $1T asset class IMO is now cemented; hard to see it dropping below this zone.

This data is @glassnode‘s URPD visualised. pic.twitter.com/pHBlXrk1hs

— Willy Woo (@woonomic) November 8, 2021