Everyone wants to work with the site that is growing artists into brands — and informing how the merch industry can grow, too

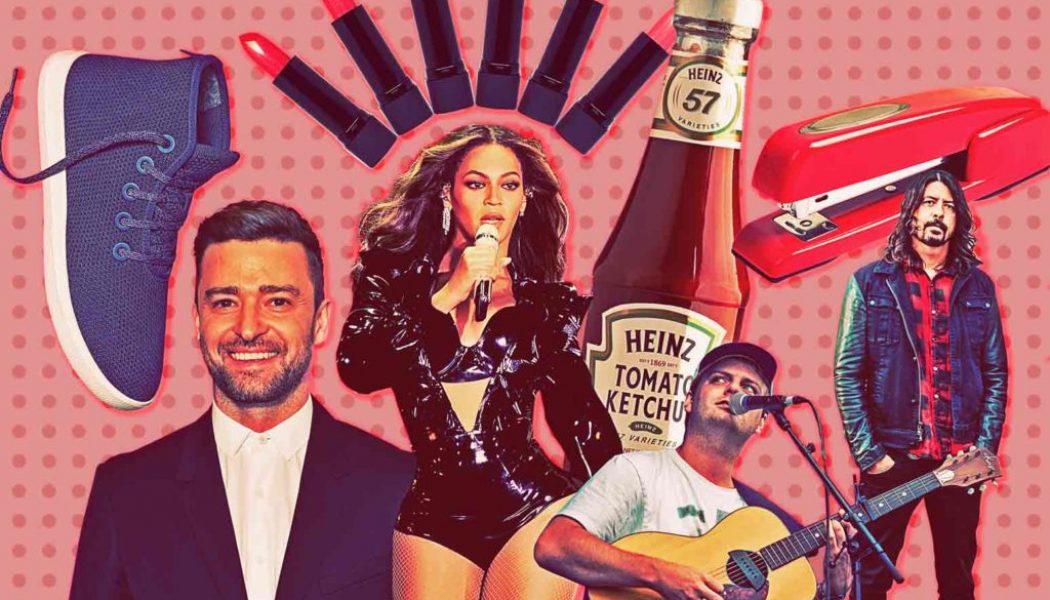

What do fans of Beyoncé, the Foo Fighters, Lauv and Mac DeMarco secretly have in common? Though they’d never know it, they all order their merchandise through the same Canadian e-commerce company, Shopify. The 14-year-old Ontario-based business has grown into a global giant over the last six years since it launched Shopify Plus, the enterprise version of its software. Smooth setup — and robust data — make it a favorite of not just the music industry, but retailers like Staples, Heinz, Allbirds and more. It’s a Wall Street favorite as well. In 2019, Shopify hit $1.6 billion in total revenue, a 47% year-over-year increase, and during the pandemic, its stock price has risen nearly 46%, from $489 a share on March 2 to $1,067 as of Aug. 31.

But unlike Amazon, Shopify remains a behind-the-scenes player, welcoming to startups and multinationals — and direct competitors. Shopify has built partnerships with many of the music industry’s biggest merch names, including Universal Music Group’s agency, Fame House, which hosts over 600 artist stores; Live Nation; OneLive, whose client list includes AEG Presents; Top Drawer Merch, a full-service merch company; Printful, an on-demand print and fulfillment business; and Firebrand Live, an independent global merchandising company. “They’re like Switzerland — for everybody,” says Alex Stultz, CEO of Red Star, which handles merch for the Dave Matthews Band, Chris Stapleton, Brandi Carlile and others.

Think of Shopify as a white-label e-commerce solution, providing the framework, software and tools to merchants selling everything from ketchup, coffee, cosmetics and shoes to concert tees and vinyl. Indie bands or living room entrepreneurs can set up a web store for $29 a month to process online transactions, while Shopify Plus, which the company bills as “the only cost-effective enterprise platform,” can provide access to its programs to help with customer retention and brand strategy. (Monthly pricing for the enterprise software begins at $2,000, with a variable fee for higher volume.) “We’re looking at everything an entrepreneur has to do, from taking your first payment to shipping your first order to setting up a mobile store,” says Shopify Plus GM Loren Padelford. “We’re trying to make that so easy that anybody can do it, and therefore we reduce the barrier of entry.”

Based on reported traffic, the biggest music stores on Shopify Plus include those for Beyoncé, Lady Gaga and Justin Timberlake. Padelford says Shopify’s “true partnership approach” is one reason there’s little mention of the company itself on the online stores of the more than 1 million high-profile artists and brands it works with (beyond the terms and conditions agreements). “Eventually you realize that all roads point to Shopify,” says Padelford. “We don’t have to tell you, our customers tell you.”

Padelford says one Shopify goal has been to dispel the misconception that it takes technical knowledge or an IT team to build an e-commerce store. CEOs at Music Today, Red Star and Perryscope Productions all use the word “easy” when describing Shopify. Says Tom Bennett, CEO of MerchTraffic (which works with Metallica and Paul McCartney, among others): “I wish I owned it. It’s an open system anybody can use. They’ve done a fantastic job proving themselves.”

Crucially, Shopify allows merch sales to follow listeners wherever they are, with plugins for Facebook, Instagram, Spotify and other social media platforms and digital service providers. All of which, says Padelford, “are huge drivers of experience and behavior.” He continues: “We’re at the nexus of, and we’re watching in real time, these brands becoming much bigger than merch stores. We see people using all kinds of sites, whether it’s Bandcamp or Big Cartel or Dizzyjam — the list is endless.”

Red Star’s Stultz praises Shopify’s “great back-end reporting system,” which provides data at no extra charge. For Padelford, having such a system was always a must. “If you go out and create an amazing brand and amazing products and you get all these customers to come to your store and buy stuff, that’s your customer, not ours,” he says. “To support [entrepreneurs] you have to give them the tools to be successful, and one [way we do that] is by giving them data and insights.” He says platforms that charge for access to such data have created a “cannibalistic environment that we’ve never been supportive of.”

Joe Perez, Kanye West’s longtime creative director, has two stores of his own that use Shopify, including Club Fantasy, a collection that draws inspiration from 1980s and ’90s rave culture. He calls Shopify’s analytics “beefy,” allowing him to see what customers are buying and where they are located. His data also helps him figure out how and why he might lose a customer. Perez says these analytics play a role in the merch drops that have become powerful drivers in hip-hop, helping determine a customer’s “needs and wants depending on what they’ve bought in the past — and then attacking those numbers.”

Similarly, Jen Florez, who handles artist relations at Sandbag (whose clients include Radiohead, blink-182 and Incubus), taps Shopify data when planning upcoming tour merch. “It goes down to, are more females or males buying in this region of the country? What items are they buying? Are they buying multiple items at the same time? All that data helps us identify what works and what doesn’t work,” she says. “And it’s really interesting — for example, here [in the United States] zip-up hoodies are super popular, but in Europe a pullover sweatshirt is what sells.” Knowing that, artists can load up on crew-necks instead of zip-ups for European tours.

While the augmented reality feature that Shopify introduced in 2018 may have to wait until a post-pandemic world to deliver on its promise, Shopify Plus’ Launchpad allows for automated flash sales, discounts and inventory restocks, making online merch drops easy to manage. Bruce Flohr, chief strategy officer/executive vp at Red Light Management, says, “As a manager, I love these concepts, especially as our artists are becoming more and more savvy with their overall business,” adding that even indie artists have been able to reap the benefits of a 24-hour merch drop. They “can sell 200 T-shirts and have it be worthwhile, whereas before if there wasn’t volume involved, there was no point in doing it.”

Padelford believes the last decade has seen a shift from artists saying “I just want to sell merch” to “I want to create and own brands.” Now — with livestreams replacing touring and online sales replacing merch tables — more than ever, he says, Shopify is seeing artists experiment with where they can take those brands next. “And as their partner, we say to them, ‘What would you like to do that everyone said was impossible?’ Because we can make it happen.”