AGCreativeLab

Investment thesis

Our current investment thesis is:

- Kering (OTCPK:PPRUF) owns a range of high-value brands such as Gucci and YSL, allowing the business to enjoy a large share of market growth through sticky demand.

- The company’s margins have improved in the last 10 years, as brand strength has allowed the business to price aggressively and avoid discounting.

- The Balenciaga scandal and disruption at other brands represent a near-term headwind but could be offset by improving demand in China.

- Kering is trading at a discount to its historical average and peers, despite its financial and commercial superiority.

Company description

Kering is a global luxury group based in France, renowned for its portfolio of iconic luxury fashion, leather goods, and accessories brands.

The company’s brands include Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, and Qeelin.

Brands (Kering)

Share price

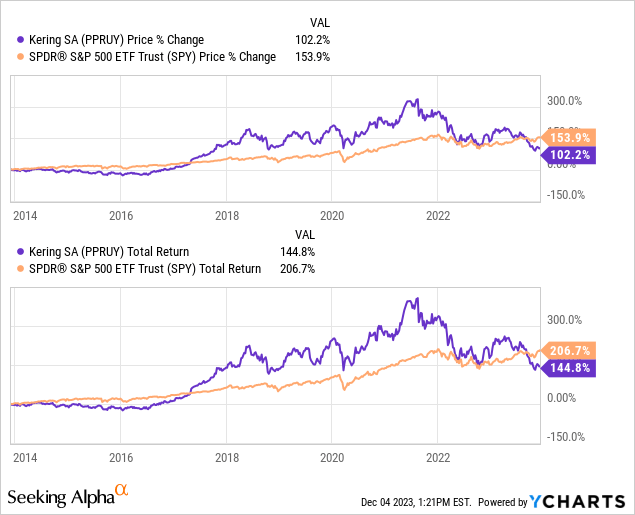

Kering’s share price has performed well in the last decade. This has been driven by a rapid improvement in financial performance, both on the top and bottom lines.

Financial analysis

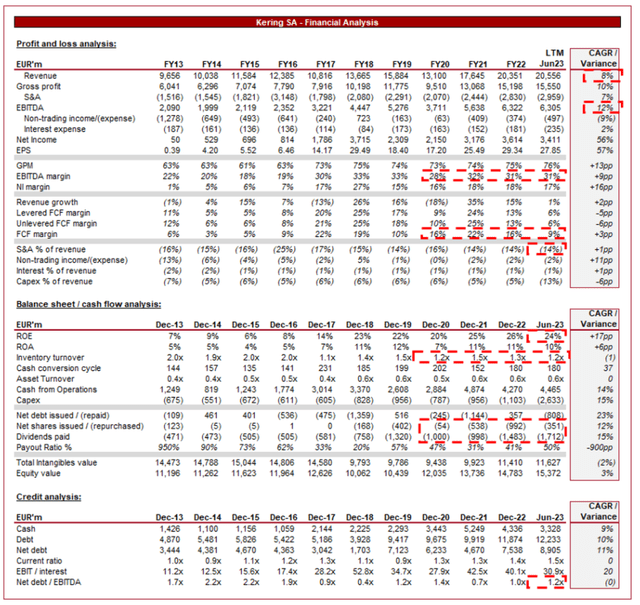

Kering financial analysis (Capital IQ)

Presented above is Kering’s financial performance for the last decade.

Revenue & Commercial Factors

Kering’s revenue has grown at a healthy CAGR of 8% in the last 10 years, with extremely consistent returns throughout the period. This is a reflection of a change in fortunes for several of its brands, allowing the business to outperform.

Business Model

Kering owns and manages a collection of luxury brands with distinct identities and target markets. The company nurtures these brands, providing creative autonomy while leveraging synergies in areas such as sourcing, distribution, and marketing. Kering’s operations are similar to other luxury conglomerates such as LVMH (OTCPK:LVMHF) and Richemont (OTCPK:CFRHF). With a range of brands, the company benefits from diversification, with no reliance on any single brand. This is critical in the fashion industry as trends can change quickly. This said, Gucci does comprise a large portion of the group, making up 51.1% of its FY22 revenue. This is a reflection of its rapid growth relative to the other departments.

Brand split (Kering)

Kering emphasizes creative excellence and innovation in its product development as a means of growth, relying heavily on the recruitment of talented designers to create unique and desirable luxury offerings. Thus far, this recruitment has been unrivaled among its peers and we believe it is the primary reason for the growth Kering has achieved.

Kering’s last 10 years are the equivalent of winning the lottery several times. Demna Gvasalia took Balenciaga from a niche Spanish brand to the most hyped in the world. Daniel Lee took an underwhelming Bottega Venetta into the mainstream, with consistently strong growth. Tom Ford had essentially saved Gucci several years prior, with the brand going on an incredible run following this. Finally, Francesca Bellettini drove unwavering growth at YSL while successfully creating a competitive Men’s offering.

This does pose the question of whether growth will now slow, following disruption, departures, and maturity at many of its brands. There is the potential for this but we are not overly concerned. These brands are now established at their heightened level, implying a larger base from which to develop. Although growth may slow, these brands are at a much larger scale.

Kering operates a network of directly operated stores and also distributes its products through authorized wholesalers and e-commerce platforms, ensuring a strong global presence. Similarly to other large conglomerates, Kering has been rapidly increasing the number of sales conducted by its owned distribution channel, with only 22% of sales from wholesale. This gives Kering greater control over the customer experience, as well as improving its financial economics from a sale.

Kering’s geographical revenue profile is highly diversified, with no region comprising more than 33%. The largest market is APAC, which is primarily comprised of China, the largest Luxury market. China has faced issues with Covid-19 as recently as several months ago. With these issues seemingly subsiding, we expect near-term tailwinds from the region, as well as tourism spending.

Geographical split (Kering)

Kering’s key value driver is its brands. Our view is that Kering is only rivaled by LVMH when considering the number of world-class brands that are owned. According to Luxe Digital, Gucci is the 2nd most popular luxury brand in the world, Balenciaga the 11th, and YSL the 13th. This allows Kering to enjoy a large share of the luxury market, which is expected to grow well in the coming years.

Luxury Industry

Luxury brands differentiate themselves through product design, quality, brand image, and marketing strategies. Between fashion seasons, we generally see brands toping others, however, this rarely materially impacts relative sales between brands. Brands are built on their heritage and demand is usually heavily based on this. The luxury market is not like the general apparel market. Demand is far more inelastic and consumer demand is less volatile. This is critical for a high-value investment as one of the biggest issues we have with apparel businesses is their exposure to rapidly changing trends.

Given the influence brands have in the purchasing decision of consumers, luxury brands are usually aggressive with marketing, so as to draw consumer interest. Balenciaga has been by far the best at this under Demna in our view, taking “ugly/rebellious fashion” to the mainstream. Balenciaga took this too far, however, when a recent campaign was unanimously lambasted by the public, contributing to several apologies and Demna stating that he would focus on clothing rather than the marketing approach taken previously.

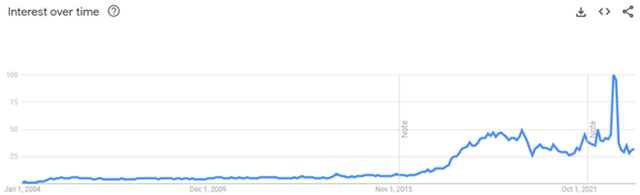

This campaign was unequivocally wrong, however, it was a human error, not a systemic one. We are concerned that Balenciaga (and potentially other brands if pressured by Kering) will lose its buzz by being comparatively boring with marketing. Further, we have yet to see the full impact of this campaign. As Google Trends illustrates, Balenciaga’s interest is declining following this scandal, a concerning trend. We are not overly concerned about this in the medium term, even if growth does slow in the coming quarters, as many brands have mistakenly caused controversy, only for this to subside. This said, significant uncertainty remains.

Balenciaga interest (Google)

M&A is a critical strategy in the luxury segment, as conglomerates seek to acquire highly regarded brands, combining them with their operational excellence to maximize financial performance. We believe this will be a key avenue for Kering, as the business supplements its organic development. Most recently, Kering acquired Creed, the high-end luxury fragrance house.

This acquisition represents more than just growth, as it reflects Kering’s entry into the beauty industry following the creation of Kering Beauté. Kering has hired former Estee Lauder (EL) executive Raffaella Cornaggia as head of this segment. The beauty industry is highly lucrative due to the consistency of growth (1 year of negative growth in 20 years), as well as its high margins, with market leader L’Oreal having an EBITDA-M of 22%. The issue for Kering is that this industry is highly competitive and structured similarly to the luxury segment, with large conglomerates such as L’Oreal and Estee Lauder. We believe M&A is the only realistic option for Kering to gain scale in the market and so the ability to identify targets is key.

Economic conditions

Although the current economic conditions are characterized by high inflation and elevated interest rates, we have seen the luxury segment perform extremely well, with back-to-back years of growth in excess of 10% by the leading houses. Kering has managed to keep pace, with positive pricing not sufficient to deter sales.

As we mentioned previously, however, Kering is experiencing disruption at its houses. This appears to be impacting growth, with revenue down (13)% in Q3, following a H1 growth rate of +2.1%. LVMH, Richemont, Burberry, and Hermes all continue to post positive growth, implying this is an issue with Kering.

We expect the company to bounce back relatively quickly, although this could take more than 2 quarters to achieve. The heightened levels of FY20/FY21 are slightly working against the company on a comparable basis.

Margins

Kering’s margin development has been a key reason for the company’s strong improvement during the decade. Its EBITDA-M has increased 10ppts to 31%, and its NIM 7ppts to 17%. Although we have discussed its brand strength from a commercial perspective, this reflects it from a financial perspective.

The increase in margins is a reflection of a reduction in discounting activities, as well as the ability to increase prices without materially impacting volume (as growth has remained healthy). There has been some volatility in margins in the last 4 years, partially due to the impact of Covid-19 and inflationary pressures, however, normalizing at the current levels looks reasonable based on the ability to achieve 15% revenue growth.

Balance sheet & Cash Flows

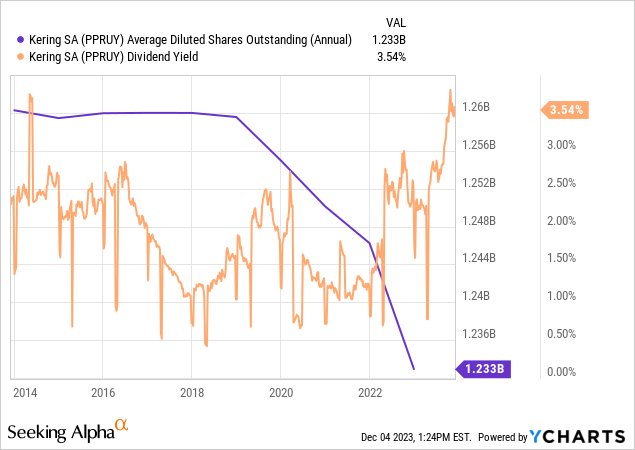

Kering is conservatively financed, with a ND/EBITDA ratio of 1.2x. This gives the business sufficient flexibility to conduct further M&A if required, especially as cash has accumulated in recent years.

Kering has consistently distributed through both dividends and buybacks, with a current yield of 3%. Based on the current cash conversion of the business and its accumulated funds, this should be sustainable.

Outlook

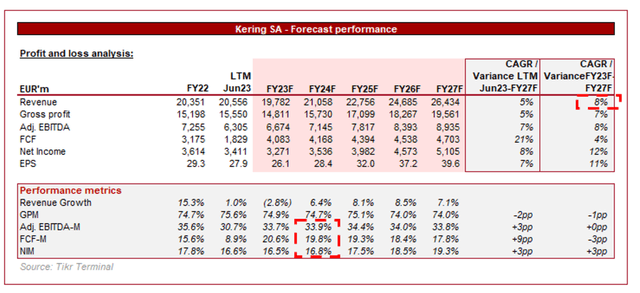

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Kering is forecast to grow at a CAGR of 5%, in line with its 10Y historical average from FY23F. Given the strength of its brands, this is a reasonable estimate in our view, as we expect the company to quickly turn fortunes around. This reflects the power of a large luxury brand and the luxury market dynamics, dictating trends and being less susceptible to changing trends. Despite the various impressive growth stories across the Kering group in the last 2 decades, a “boring” half-decade is very much desired.

Industry analysis

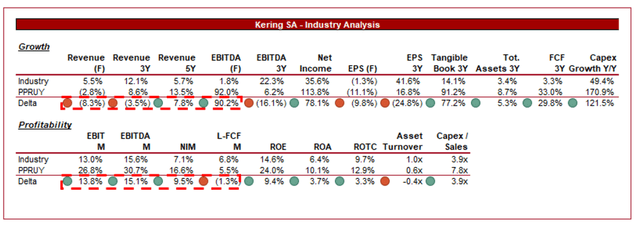

Apparel, Accessories and Luxury Goods Stocks (Seeking Alpha)

Presented above is a comparison of Kering’s growth and profitability to the average of its industry, as defined by Seeking Alpha (33 companies).

Kering is a clear market leader based on its financial metrics (aligning to its commercial superiority), with significantly higher margins. This is a reflection of the company’s scale, allowing the business to share competencies and supply chain capabilities, in conjunction with its brands’ pricing power. Unlike many of its peers, the company has not relied on discounting or 3rd party retailers to drive growth, allowing for a win-win scenario.

Growth is closer to the industry average but at a significantly larger scale. The FY23F forecast is disappointing, but its 5Y forecast broadly aligns to the 5Y industry growth rate achieved (again, at a significantly larger scale).

Valuation

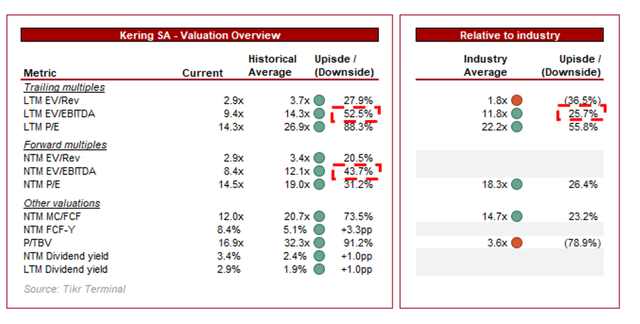

Valuation (Capital IQ)

Kering is currently trading at 9x LTM EBITDA and 8x NTM EBITDA. This is a discount to its historical average.

This valuation looks completely misaligned to the company’s financial and commercial development in the last decade. Almost every brand has positively developed (even if they are facing near-term issues), some significantly, as well as the potential for growth through Kering Beauty. Investors have turned slightly bearish on luxury, with an extreme view on Kering given its relative underperformance. Although double-digit growth is likely off the table, a NTM FCF yield of ~8% is still fantastic.

Further, Kering is trading at a ~25-26% discount to the industry average (LTM EBITDA / NTM P/E), a sizeable level that appears completely unjustified based on financial performance. Even when outliers are removed from both the financial and valuation metrics, Kering looks undervalued.

Based on its historical trading range and industry valuation, we believe Kering is significantly undervalued. Analysts’ consensus upside is ~23%, aligning with our assessment.

Key risks with our thesis

The risks to our current thesis are:

- Balenciaga. The scandal poses two key risks to Kering. Firstly, we could see a complete derailment of the brand’s growth trajectory, as consumers remain stubborn in their unhappiness. Secondly, the change in marketing approach could slow its growth trajectory. of the two, we believe the second is far more likely.

- Beauty. Expansion into Beauty through its existing brands looks reasonable but the wider market could be far more difficult. There is a risk that Kering sinks cash into a poor acquisition while attempting to develop its presence in the market.

Final thoughts

Kering is a fantastic business. It owns several large luxury brands, all of whom have strong pricing power and sticky demand. The significant improvement throughout the decade is a reflection of quality recruitment and a clear focus on brand development. We believe this will drive a continuation of the current trajectory, with China representing the potential near-term outperforming.

Despite significantly outperforming its peers, Kering is trading at a discount to its peers and historical average. We believe investor sentiment has contributed to the stock being oversold.

Based on this, we believe Kering is undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.