Chopping Block

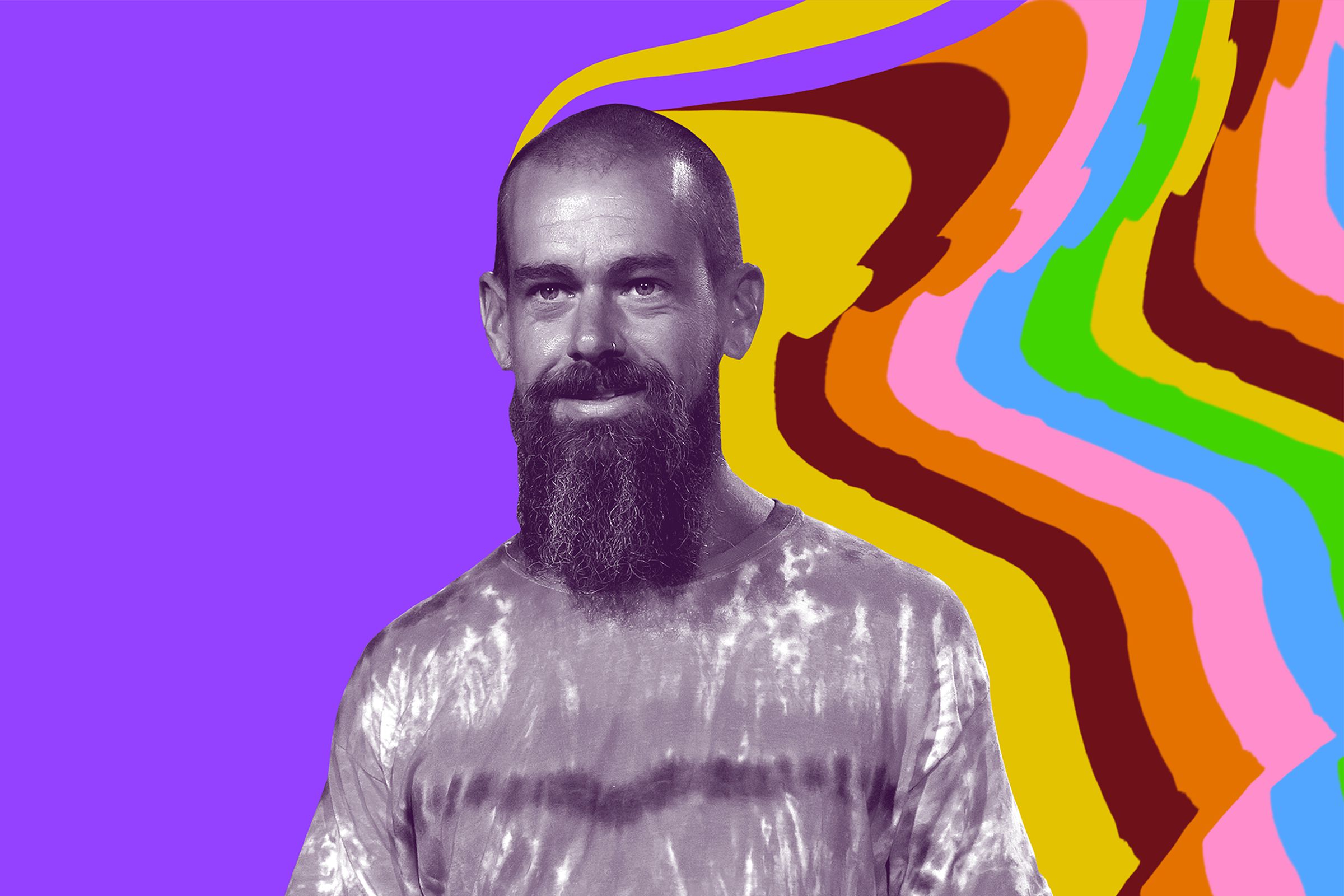

How’s our favorite Bitcoin maxi Jack Dorsey doing? Well, the short sellers at Hindenburg Research published an absolute barn-burner of a report alleging widespread fraud at his company, Block. Besides that, Hindenburg says Block misled its investors and is engaging in predatory lending practices.

Oh, okay! Block is threatening to sue. Its shares closed down almost 15 percent on March 23rd, the day the report was released, from the day before.

If you aren’t familiar with Hindenburg Research, they are bad motherfuckers! Like, they wrote a whole report alleging that the electric vehicle company Nikola was “intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career.” Milton was later convicted of fraud. They also went after Lordstown Motors, saying its executives had made misleading claims about truck preorders. Those allegations appeared to be substantiated by a law firm’s investigation into the preorders — statements about preorders were “in certain respects, inaccurate” was the phrasing. The CEO was forced out, and the Department of Justice decided they wanted to investigate.

This is also how Hindenburg makes money. They’re short sellers — which means they make money by betting a stock will decline in value. After they make their bets, they release their report, which, yes, often makes the stock decline in value! It’s cool that anyone does this much research and reporting on companies; I know very few journalists who can spend two years on a single story like this.

Now, there are a lot of people out there who hate short sellers on principle — Elon Musk in particular — but personally, I view them as more like the apex predators in the financial ecosystem, picking off the weak companies. Sure, it’s rude to bet on someone’s failure and profit off it, but rude isn’t the same as immoral.

But let’s get to Hindenburg’s new report on Block. There are a bunch of concerning things in this extremely lengthy report (which is worth reading!), but I just want to focus on this, possibly the funniest part of the entire report:

Examples of obvious distortions abound: “Jack Dorsey” has multiple fake accounts, including some that appear aimed at scamming Cash App users. “Elon Musk” and “Donald Trump” have dozens.

To test this, we turned our accounts into “Donald Trump” and “Elon Musk” and were easily able to send and receive money. We ordered a Cash Card under our obviously fake Donald Trump account, checking to see if Cash App’s compliance would take issue—the card promptly arrived in the mail.

If this is right, Block is so bad at policing its own users that Dorsey himself is collateral damage in scamming. But the real pièce de résistance is the Donald Trump credit card, which, of course, they tweeted:

These are not the most scandalous allegations in the Hindenburg report, which alleges that Block’s Cash App was facilitating fraud. Massachusetts had to claw back 69,000 (nice) unemployment requests from Sutton Bank, which is also behind the Cash App accounts. That far exceeded how many the state tried to reverse from other banks, such as JPMorgan Chase or Wells Fargo, despite the bigger banks having more customers.

It wasn’t just Massachusetts. In Washington State, Sutton Bank account holders had twice as many suspected fraudulent payments as those at Wells Fargo and Chase combined.

The report goes on: “Block turned a blind eye to obvious signs of fraud despite warnings from employees and the government.”

Hindenburg says this report took them two years to put together. During that time, our boy Jack was the CEO of not just Block but Twitter; his attention was split. While it isn’t Dorsey’s job to identify fraud himself, it is his job to hire and invest in a fraud department that, you know, functions. I do not find it difficult to believe that he might not have had his eye on the ball with respect to fraud at Block because he didn’t have his eye on the ball at Twitter, where he was characterized as a “disengaged CEO.”

Also, historically, a lot of payment companies are bad at verifying their users. At Paypal, Musk, the “singular solution” Dorsey trusted with Twitter’s future, had tremendous problems with “know your customer” rules — the thing that makes institutions actually verify people’s identities. This led to a lot of fraud.

That said, there was some stuff in the Hindenburg report I thought was weird, and it was about hip-hop and rap. “Dorsey has publicly touted how Cash App is mentioned in hundreds of hip hop songs as evidence of its mainstream appeal,” the report says. Those rappers are describing scamming, trafficking drugs, and paying for murder, Hindenburg says.

Personally, I think there’s a strong likelihood that the actual “scam” in “scam rap” is pretending to be a scammer for attention. Teejayx6, a rapper cited in the report, managed to star in an entire episode of an HBOMax show without conclusively proving he’d scammed anyone at all.

Still, Block paid to promote a song by 22Gz called “Cash App,” which described paying hitmen through the app. Though 22Gz was later arrested for attempted murder, he wasn’t charged with paying off a hitman. Embarrassing for sure, but not evidence of wrongdoing by Block.

Anyway, I’m not surprised that Block wants to come out swinging here because, you know, this report seems bad, man. Block’s statement calls the report “inaccurate” and threatens legal action, but I notice something missing here: any denials.

There are no refutations of any of the many specifics in Hindenburg’s 17,000-word report, and there are, like, a lot of specifics. Hindenburg has also been posting receipts — the credit card, the freedom of information act requests it made, screenshots from websites.

There’s one thing, though, I want to highlight specifically:

Core to the issue is that Block has embraced one traditionally very “underbanked” segment of the population: criminals. The company’s “Wild West” approach to compliance made it easy for bad actors to mass-create accounts for identity fraud and other scams, then extract stolen funds quickly

There is a group of people active in financial innovation who like the Wild West approach to compliance: cryptocurrency enthusiasts. And while Dorsey is a Bitcoin-only guy, the first serious use case for Bitcoin was, well, crime.

But it’s not just Bitcoin users. Coinbase, for instance, is now facing enforcement action from the Securities and Exchange Commission — though it’s unclear exactly how broad that action is. Also, the SEC has sued Justin Sun (and an assortment of celebrities) for selling unregistered securities. Oh, and Terra / Luna villain Do Kwon maybe just got arrested.

What I mean to say is, for a while, it seemed like US financial authorities were taking a laissez-faire approach to fintech. But then the good times stopped rolling. And right in the middle of the US regulators waking up, Hindenburg has dropped this bad boy on Block.

You might find short selling distasteful and the citation of rap lyrics silly. But the people at Hindenburg keep staking their reputation on their findings. Their money is where their mouth is: they make a profit by being right. So if Block does bring the lawsuit it’s threatening, discovery is likely to be fascinating. Block has to prove that Hindenburg is wrong by giving us all a peek inside the company, and there are good reasons to believe that might be trouble for Dorsey. I, for one, would love to know what he has said in his emails about fraud, Bitcoin, and, yeah, rap music.