Airlines expect record traveler numbers and revenues in 2024 but will continue to be constrained by the high cost of capital and limited capacity, the International Air Transport Association said Wednesday.

The industry group expects the sector’s net profits to reach $25.7 billion in 2024 on a 2.7% net profit margin, a slight improvement from this year’s upwardly revised projection of $23.3 billion net profit and 2.6% margin.

Total revenues in 2024 are set to grow 7.6% year on year to a record $964 billion, with around 4.7 billion people expected to travel in 2024, a figure exceeding the pre-pandemic level of 4.5 billion seen in 2019.

With demand for post-pandemic travel booming in North America, the Middle East and Europe, the airline sector has mostly recovered from the unprecedented hit suffered during the Covid-19 pandemic, when planes were grounded and travel banned for extended periods in most countries around the world.

In a statement, IATA Director General Willie Walsh said in the wake of the major losses suffered in recent years, the expected stabilization of profits in 2024 was a “tribute to aviation’s resilience.”

“The speed of the recovery has been extraordinary; yet it also appears that the pandemic has cost aviation about four years of growth. From 2024 the outlook indicates that we can expect more normal growth patterns for both passenger and cargo,” Walsh said in a statement.

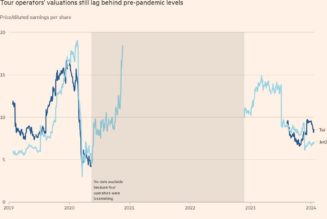

The recovery of post-pandemic consumer demand was evident in Wednesday’s full-year results from Anglo-German travel group Tui, which posted a 139% increase in underlying earnings before interest and taxes. The group also forecast a 25% year-on-year EBIT rise in 2024, sending its share price soaring.

Responding to Tui’s results, analysts at Jefferies said in a research note Wednesday that the market focus would be on the 2024 guidance, “which implies a positive outlook for international travel from Europe.”

Cost of capital

Airline industry operating profits are expected to reach $49.3 billion in 2024, up from $40.7 billion in 2023, according to IATA.

However, the body estimated that across both years, return on invested capital will lag the cost of capital by 4 percentage points as a result of a huge rise in interest rates, as central banks tightened monetary policy over the last two years to combat inflation.

Walsh said that the industry’s profit outlook must be put into “proper perspective,” and that despite the impressive recovery, a net profit margin of 2.7% remains “far below what investors in almost any other industry would accept.”

“Of course, many airlines are doing better than that average, and many are struggling. But there is something to be learned from the fact that, on average airlines will retain just $5.45 for every passenger carried,” he said.

“That’s about enough to buy a basic ‘grande latte’ at a London Starbucks. But it is far too little to build a future that is resilient to shocks for a critical global industry on which 3.5% of GDP depends and from which 3.05 million people directly earn their livelihoods.”

Walsh added that while airlines will always compete “ferociously” for customers, they remain “far too burdened by onerous regulation, fragmentation, high infrastructure costs and a supply chain populated with oligopolies.”