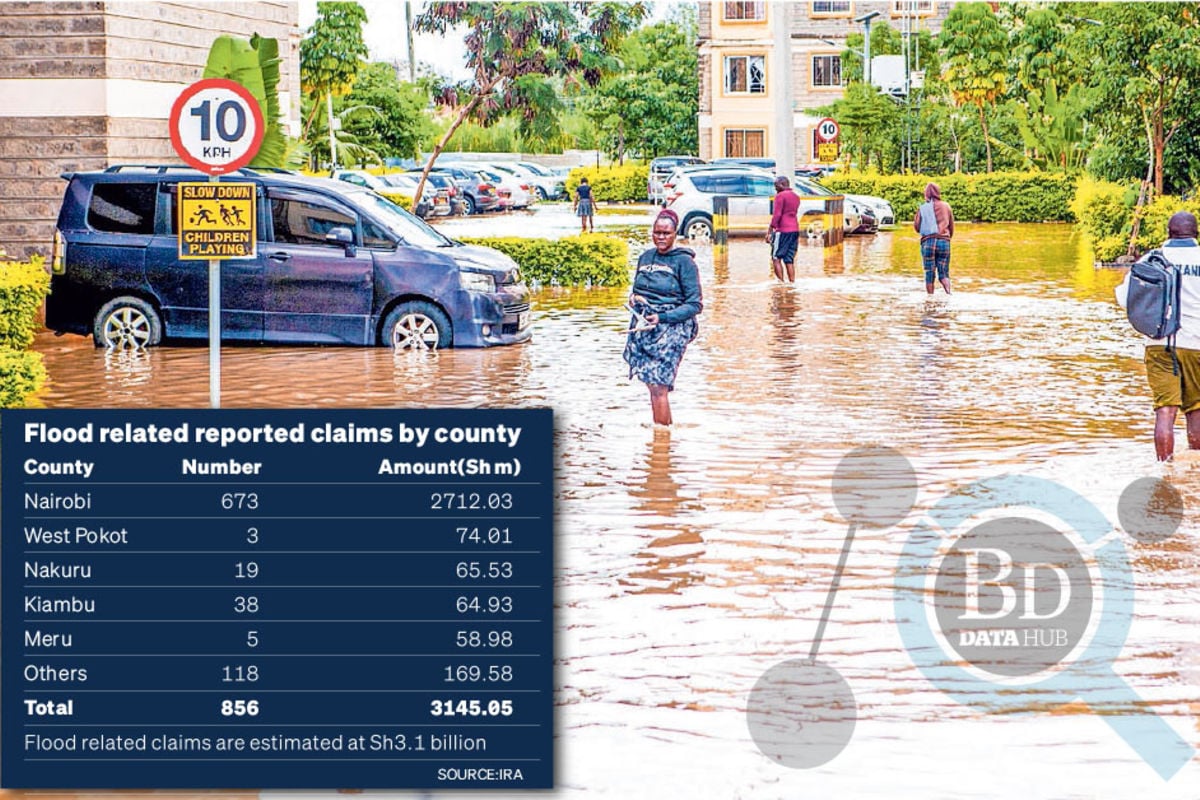

The widespread flooding that hit Kenya in March and April has seen insurance firms struggle to meet claims of Sh3.1 billion as effects of climate change emerge a top risk for insurers.

Latest data from the Insurance Regulatory Authority (IRA) indicate that insurers had settled Sh147.3 million or less than 5.0 percent of the claims for damaged farms, houses, industries and office blocks.

Heavy rains and flooding that started in March killed at least 330 people and displaced hundreds of thousands, according to government statistics.

The rains also destroyed farms, houses, roads and bridges across the country, triggering concerns it affected second-quarter economic performance.

“In 2024, Kenya faced substantial flooding due to heavy rainfalls, leading to significant damage and loss of lives. Consequently, insurers experienced a surge in claims for damages and losses caused by the flooding,” the IRA notes.

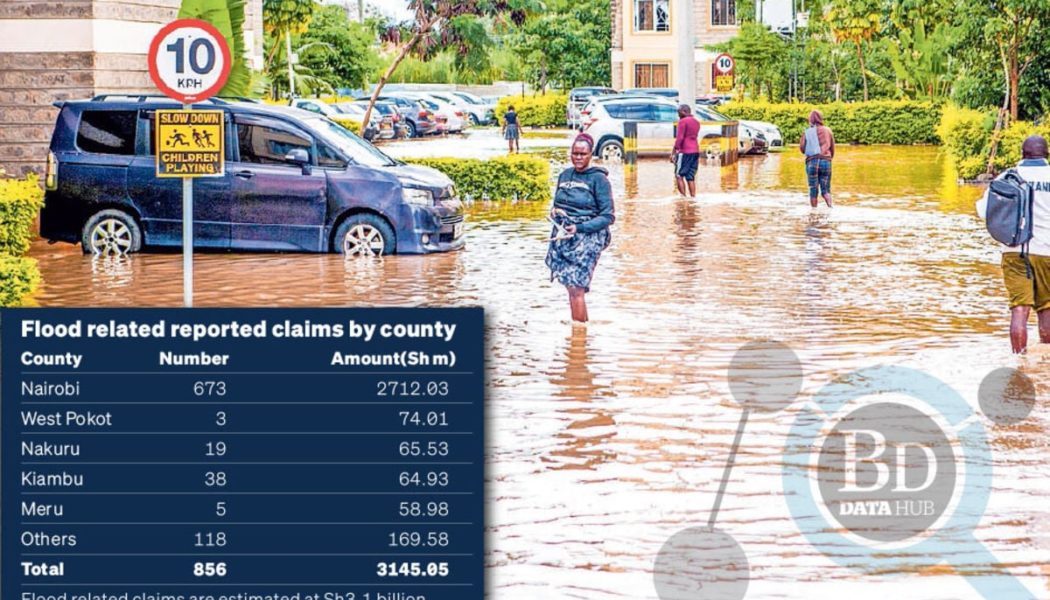

The Authority notes that by end of April, insurance companies had received upwards of 850 claims valued at Sh3.145 billion following the raging floods that affected different parts of the country.

More than three-quarters (86 percent) of the claims were reported in Nairobi, which was one of the hardest hit counties by the floods witnessed in March and April, notably affecting settlements in riparian land, and industries in Nairobi’s Industrial Area and Athi River.

The IRA’s records show that a total of 673 claims valued at Sh2.7 billion were reported by insurers in Nairobi, followed by Kiambu with 38 claims valued at Sh64.9 million and Nakuru with 19 claims valued at Sh65.5 million.

Insurance companies reported receiving five claims valued Sh58.9 million in Meru and three claims valued Sh74 million in West Pokot. Claims from all the other counties totaled 118 and were valued Sh169.6 million.

“Out of 47 counties, 19 counties (40.4 percent) reported flood-related claims to general insurance companies. The top five counties which reported the largest amount of flood-related claims are Nairobi, West Pokot, Nakuru, Kiambu and Meru,” the IRA stated.

Industry executives have voiced their concerns about the battle to keep up with the effects of climate change, which is fuelling natural catastrophes such as floods.

The surge in extreme weather events has created a property insurance crisis in some parts of the world.

The IRA data illustrates the extent of damage caused by the floods witnessed in the country for several weeks around March and April, where loss of lives and damage on properties valued billions of shillings were reported.

“We share these concerns and worry that growth will slow in Q2:24 (second quarter 2024) because of the widespread devastation and disruptions caused by the heavy rain,” Christopher Legilisho, an economist at Stanbic Bank, said earlier.

While the claims flowed heavily to insurance firms, the IRA data shows that settlement of the claims remained low by end of April, with just Sh147.3 million of claims paid.

GA Insurance received the highest number of 145 claims valued at Sh988.1 million, but had only settled one claim valued at Sh327,280.

Tausi Assurance Company had also received 87 claims valued Sh374.4 million, but had only settled one valued at Sh20 million by end of April.

Closing the list of top five insurers who received highest flood-related claims was Intra Africa Assurance Company, which received 44 claims valued at Sh209 million, First Assurance Company Limited with 21 claims valued at Sh60 million, and ICEA Lion General Insurance which received 57 claims valued at Sh80.2 million.

First Assurance and Intra Africa Assurance, however, did not settle any claim by end of April, while ICEA Lion paid six valued at Sh2 million.

The law requires that insurance claims be settled within 90 days after a policy holder submits all documents related to a claim to the insurer.

The IRA notes that most claims emanated from the Fire Industrial business class where 285 claims valued at Sh1.8 billion, followed by Fire Domestic class which had 210 claims valued at Sh169.2 million and private motor vehicle covers which reported 178 claims valued Sh83.2 million.

The flood-related insurance claims are set to worsen the business for insurers in the country, which continue to record losses in their core business —selling policies.

IRA data shows that since 2019, the companies have not made an underwriting profit — that is, profit from insuring businesses which is the core business of their existence — but have instead relied on other investments to make money.