Economy

Inside the multi-billion dollar deals at Nairobi climate summit

Thursday September 07 2023

GRAPHIC | CHRISPUS BARGORETT | NMG

Kenya and other African countries struck climate-related financing deals worth $23 billion (Sh3.36 trillion) at the just-ended inaugural climate summit held in Nairobi, giving the continent’s green investments plans a shot in the arm.

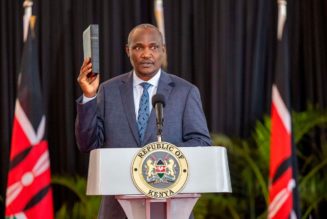

President William Ruto said the three-day Africa Climate Summit had lived up to its billing and offered a springboard for take-off for the continent’s climate action plans.

“During this action-focused summit, various stakeholders, including governments, the private sector, multilateral banks, and philanthropists have made substantial commitments totalling a remarkable $23 billion for green growth, mitigation, and adaptation efforts across Africa,” said the President.

Read: Clashing agendas at the Nairobi climate summit

“I am satisfied that we have done well in our first Africa Climate Summit. I am delighted that much progress has taken place here.”

The deals, some directly targeted at Kenya such as the Sh1.9 billion (€12 million) in grants from the European Union (EU) for investment in the country’s green hydrogen industry, are expected to accelerate Africa’s green agenda.

Africa needs between $160 billion (Sh23.4 trillion) and $340 billion (Sh49.7 trillion) by 2030 for adaptation, but current annual flows are around $16 billion (Sh2.3 trillion), according to Pan-African Climate Justice Alliance, which likens this to “a fraction of a budget for a blue-chip company.”

One of the big deals from the Nairobi Summit was the $4.5 billion (Sh657.2 billion) finance initiative to unlock Africa’s clean energy. This was announced by COP 28 president-designate Sultan Al Jaber.

Britain also announced £49 million (Sh8.99 billion) for UK-backed projects, adding to the deals basket that, if honoured, will help the continent in achieving its growth agenda in renewable sectors.

The UK deal includes £34 million (Sh6.2 billion) for new projects across 15 African countries to help women, at-risk communities, and more than 400,000 farmers build resilience against the effects of climate change, according to the UK foreign, commonwealth and development office.

Dr Ruto said there was a notable increase in adaptation financing, aligning with the ambitious Nairobi Declaration that seeks to give the continent a common vice and direction in climate change issues.

“The signing of Kenya’s green hydrogen strategy with the EU is expected to drive and accelerate green manufacturing and create thousands of new, high-value jobs in addition to attracting large private investment,” said Dr Ruto of the Sh1.9 billion deal.

The African Development Bank (AfDB) and Global Center on Adaptation launched a $1 billion (Sh145.5 billion) initiative to finance youth-led businesses and startups across Africa.

AfDB also committed to providing $25 million (Sh3.65 billion) towards climate finance by 2025, adding to the Summit’s deals book.

The US Climate envoy John Kerry announced Tuesday that the US intends to provide $30 million (Sh4.38 billion) in food security and climate resilience efforts across the continent.

Africa had scored early wins on the first day of the Summit with the United Arab Emirates investors committing to buy $450 million (Sh65.7 billion) of carbon credits generated in Africa by 2030.

AfDB president Akinwumi Adesina said it was time for African nations to revalue their wealth by accounting for the “proper valuation” of its natural resources, an example being the Congo Forest which is a carbon sink.

“Africa’s GDP must be re-valued based on their carbon sequestration. Africa must develop its own carbon markets, properly price its carbon, and turn its vast carbon sinks into a new source of enormous wealth. Africa cannot be nature-rich and cash-poor,” he said.

Climate Asset Management— a joint venture of HSBC Asset Management and Pollination, a specialist climate change investment and advisory firm—also announced a $200 million (Sh29.2 billion) investment in green projects.

Germany had on the second day of the Summit announced a €60 million (Sh9.4 billion) debt swap with Kenya to free up money for green projects.

The Bezos Earth Fund announced a $22.8 million (Sh3.3 billion) to accelerate the restoration of 600,000 hectares in the Greater Rift Valley in Kenya and the Lake Kivu and Rusizi River Basin in DRC Congo, Rwanda, and Burundi.

The two landscapes are critical for carbon sequestration, and their restoration will create carbon sinks.

Climate and impact fund manager Camco, with a presence in Kenya, announced commitments worth $25 million in equity and debt funding for Spark Energy Services— its innovative financing platform—to deepen solar initiatives in Sub-Saharan Africa.

Read: Kenya’s climate catastrophe as Nairobi hosts Africa summit

Africa hopes to complement these commitments with money from the loss and damage initiative that was agreed at COP 27 but whose implementation has been lagging.

UN Secretary-General António Guterres said in his address on the second day of the summit, that large emitters like the G-20 countries that are responsible for 80 percent of emissions must “assume your responsibilities.”

Research reports said that despite suffering from some of the worst impacts of climate change, Africa only receives about 12 percent of the nearly $300 billion(Sh43.81 trillion) in annual financing it needs to cope.