I am a public service vehicle driver living in Eldoret. I earn Sh1,500 per day, which is about Sh39,000 per month. I get paid daily. I have a wife and three children.

Two of my children are in public primary school (Grade Five and Three) while the last born started kindergarten this year. My wife owns a kiosk at the matatu stage.

I am not sure how much she earns per day but I am happy that the business keeps her busy. My monthly budget is as follows: Rent Sh12,000, food and groceries Sh15,000, electricity and water Sh1,500, GoTv Sh2,000, mother Sh2,000, wife Sh4,000.

Despite working hard, I have not been able to realise any of my dreams which include buying land and building a permanent house for my family and owning a matatu.

I would also like to add money services such as M-Pesa and a mobile banking agency at my wife’s kiosk, but I don’t know how to raise capital from my salary.

I have also considered hire purchase for my matatu, but I still can’t afford a deposit. I am 40 years old, and I am afraid that my dreams are slipping away. Please advise.

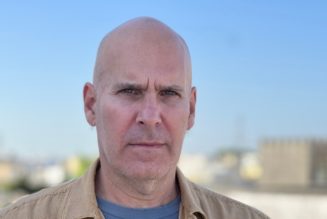

Alex Kibebe is the founder of Rubiani Wealth Management Ltd and an investment advisor and business development coach.

To achieve your financial goals, you need to adjust your monthly budget and reduce your spending. Start by reducing your food and grocery budget by Sh2,000 to bring it down to Sh13,000.

Consider cost-cutting options such as shopping on market days, buying wholesale or in bulk, and cutting back on certain luxuries.

Next, look at your family allowances. You can reduce your wife’s allowance to Sh2,000 and your mother’s to Sh1,000. Have a frank discussion with them about your financial goals and the need to start saving.

By making these adjustments, your total monthly expenses will come down to Sh31,500, leaving you with savings of Sh7,500, which is equivalent to Sh290 per day.

I recommend that you prioritise the goal of owning a matatu as it can significantly increase your income, making it easier to achieve your other goals. It is also an investment in a service that you are already familiar with.

Use your experience and networks to research and identify the ideal PSV (Public Service Vehicle) to purchase. For planning purposes, let’s say you settle for a well-maintained, second-hand 14-seater at a cost of Sh1 million.

Most financial institutions that provide loans for PSVs require a 20 percent deposit. For a Sh1 million matatu, you’ll need to come up with Sh200,000. Saving with a Sacco is a good strategy as it gives you credibility to access finance.

Look for a Sacco that offers PSV vehicle financing or one where you can find guarantors to support your loan application.

If you discipline yourself to save Sh290 a day in your Sacco and reinvest the dividends you earn, you should reach your Sh200,000 target in about two years.

You may want to save a little longer to cover licensing and other start-up costs, and to raise funds to support your wife’s business. Once you’ve saved enough, you can take out a loan to buy the matatu and set up the M-Pesa and mobile banking agency at your wife’s kiosk.

Assuming your Sacco offers a loan at 15 percent interest with a repayment period of 36 months, your monthly repayment would be Sh34,700, or Sh1,350 per day. If you earn an average of Sh4,500 daily from the matatu, your net daily income will be around Sh3,150.

I suggest you save Sh1,000 daily for vehicle maintenance and emergencies. Set aside Sh1,500 per day (equivalent to Sh42,900 per month) for your household expenses and invest the remaining Sh650 towards your other financial goals.

You could invest the Sh1,000 emergency/business buffer fund and the Sh650 ‘goals’ savings in a Money Market Fund (MMF) account.

An MMF account is a convenient way to save money on a daily basis while earning compound interest on your savings. You can research the various MMF providers available and find the ideal one to save with.

If you stick to this plan, you will have accumulated about Sh220,000 in your ‘goals’ fund within a year and about Sh750,000 by the end of three years.

You can use these savings to buy a piece of land on which to build your home. By this time, your matatu loan should be fully repaid and you can take out another loan from your Sacco.

At this point, you should consider taking out a development loan to finance the construction of your house. By following this plan, you should achieve your goals, or come close to them, by the time you reach the age of 45.

If you have money problems, email us at [email protected] and leave your contact number. Money questions will be answered in this column.