Huawei has announced that the Discovery Bank app is now available on its AppGallery platform, ensuring that the bank’s users now have access to this app across multiple platforms and can use it from anywhere in South Africa.

“We are happy to welcome Discovery Bank to our Huawei AppGallery family of apps,” says Zhao Likun Zhao, VP at Huawei Consumer Business Group for Southern Africa.

“AppGallery has over 400 million active monthly users worldwide and has secured its position as one of the Top 3 app marketplaces globally, even though we only launched it to a wider market in 2018. Locally, Huawei has partnered with a number of companies who create apps that are key to the daily life of South Africans, which includes banking apps, so people can manage their financial present and future.”

Commenting on the migration of the Discovery Bank app to the AppGallery platform, Akash Dowra, Head of Client Insights at Discovery Bank, notes that the “process was slick, with superb turn-around time. Direct support from Huawei SA and dealing directly with the assigned technical staff was a real plus.”

Dowra continues, “With Discovery Bank, South Africans are being offered a bank that’s built, from its core, to improve financial behaviours and reward financial resilience with attractive rewards including dynamic interest rates which allow clients to earn up to 3.75% on their cheque accounts.”

Huawei says that it is continuously working on increasing the selection of top apps that have become a staple of its users’ digital lifestyle, including both popular global applications and quality localised applications.

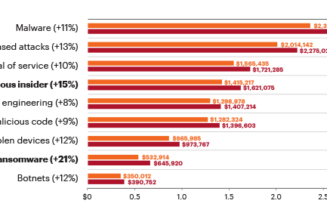

The platform reportedly also uses advanced security features to protect users’ data and privacy. This is achieved using a four-layer detection mechanism, as well as a post-release app inspection and a mechanism for user feedback. The four-layer detection includes security vulnerability scanning; privacy check; malicious behaviour detection; and a manual, real-name security check to ensure the apps users’ download are secure during the entire process.

Edited by Jenna Delport

Follow Jenna Delport on Twitter

Follow IT News Africa on Twitter