Kenya Airways has returned to profitability, largely helped by the restructuring of its debt after the Treasury took over a Sh82.7 billion ($641.4 million) loan burden from the national carrier.

This reduced the company’s debt finance costs, enabling it to post a net profit of Sh513 million in the half year to June to end an 11-year loss-making streak.

The profit reversed a net loss of Sh21.7 billion recorded in the same period a year earlier. The airline last recorded a profit of Sh384 million in the half year to June 2013.

In 2017, Kenya Airways took up the Sh82.7 billion loan (at current exchange rates) from US lenders Citi Bank and JP Morgan to finance the purchase of seven aircraft and an engine. The loan was later taken over by US export financier Private Export Funding Corporation (Pefco), with the Treasury and the US Exim Bank as co-guarantors.

The exchequer’s guarantee of the facility covered Sh67.7 billion ($525 million), a cost it would meet should the carrier default on payments.

KQ would subsequently fall behind payments on the loan following the vagaries of the Covid-19 pandemic, prompting a call-up of the guarantee, with taxpayers officially taking over the interest payments. Earlier this year, the guaranteed debt, which had already seen exchequer payments amounting to Sh29.7 billion between October 2022 and March 2024, was converted to external commercial public debt.

KQ subsequently saw the facility, which represents one of its biggest borrowings, restructured, with the Treasury framing up new terms for reimbursement by the carrier, including a new Kenya shilling-denominated loan with a longer repayment period.

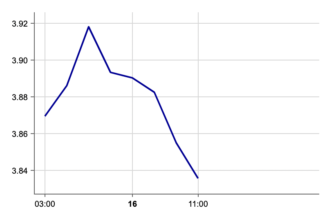

The debt restructure has served to reduce the carrier’s exposure to foreign exchange swings, even as KQ’s profited from a stronger local currency through the six months to June.

“The loan is now a Kenya shilling facility, which reduces the exposure from a currency fluctuation perspective. This was the biggest loan in our book and hence any movement in the exchange rate had a significant impact on KQ financials,” KQ Chief Finance Officer Hellen Mwaniri said on Monday. “To support KQ in its turnaround quest, the loan was extended to a longer period, supporting us from a cash flow perspective.”

The carrier’s non-operating costs, which include spending on key items such as interest and foreign exchange revaluations, fell by 97 percent to Sh687 million from Sh22.8 billion previously. At the same time, KQ posted an improved operating profit of Sh1.2 billion from Sh998 million in June 2023. The higher operating profit was supported by a faster growth in revenues, which hit Sh91.4 billion from Sh75 billion previously. This was as operating costs rose by 21.7 percent to Sh90.1 billion from Sh74 billion. The expansion in revenues for the carrier was widely supported by the continued resumption of air travel from the pandemic, which allowed the carrier to resume flights on some of its frozen routes, including Mogadishu and Maputo. KQ also commenced new freight routes on its recently acquired freighter carriers, including Mogadishu, Juba, Monrovia and Djibouti in addition to lifting fresh meat exports to the UAE. Despite the end of turbulence for KQ from a profitability standpoint, the airline remains in rough waters as it has yet to lock in a new strategic investor.

While operationally profitable, KQ remains technically insolvent with a negative equity position of Sh123.5 billion based on outstanding liabilities of Sh297.8 billion against assets of just Sh174.2 billion.

KQ’s chief executive Allan Kilavuka, however, remains hopeful of securing a new investor, citing the swing to profitability as a testament to the business financial viability.

“For the first time in over 10 years, we have been able to record a profit at both the operating and net profit level. We were intending to break even in 2024 in our journey to recovery. We had already recorded an operating profit (at the full year stage and we had targeted to make our first net profit this year,” he said.