This year, residents of 12 states can participate in a trial of the IRS’s new Direct File service, as long as their taxes are relatively simple.

Share this story

See our ethics statement.

The holidays are over, a new year is here, and along with all the various upheavals that we are facing, most of us have to deal with our annual income taxes. (The usual quote about death and taxes goes here.)

While we were able to wait until April 18th in 2023, this year tax day is back to the traditional April 15th, which is a Monday. That is, unless you live in Maine or Massachusetts — then you have until Wednesday, April 17th, because of the Patriots’ Day and Emancipation Day holidays.

Despite the stress that many of us feel at the thought of tackling our yearly taxes, try not to worry — we’re going to list some resources that are available so that you can prepare your taxes. As always, it might not be a bad idea to start working on those taxes as soon as possible to avoid any last-minute panic. And whether you’re a full-time worker dealing with a single W-2 or a freelancer / gig worker getting a series of 1099s, the fastest way to pay the piper these days is to do it online.

And this year, there’s a new way to file: through the IRS’s pilot of its own Direct File program. We’ll get to that in a moment.

To begin with, the IRS offers a series of directions on its website to help US citizens figure out their taxes, report those taxes, and send in payments (or ask for refunds) using its e-file online method. Here’s a rundown of what’s available and where you can find it, starting with how to fill out your tax forms.

As mentioned above, the IRS has developed Direct File, its own free filing software, and will be running a pilot program for a limited number of taxpayers. You have to live in one of 12 states:

- Arizona

- California

- Florida

- Massachusetts

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington state

- Wyoming

In addition, residents of four states (Arizona, California, Massachusetts, and New York) will be able to file their state taxes as well.

For now, the Direct File pilot program is limited to fairly simple tax scenarios. For example, you can’t use it if you’re self-employed or have any gig-economy income, itemize your deductions, or take the child and dependent care credit. As of this writing, Direct File was not yet open for business; we will let you know when you can apply.

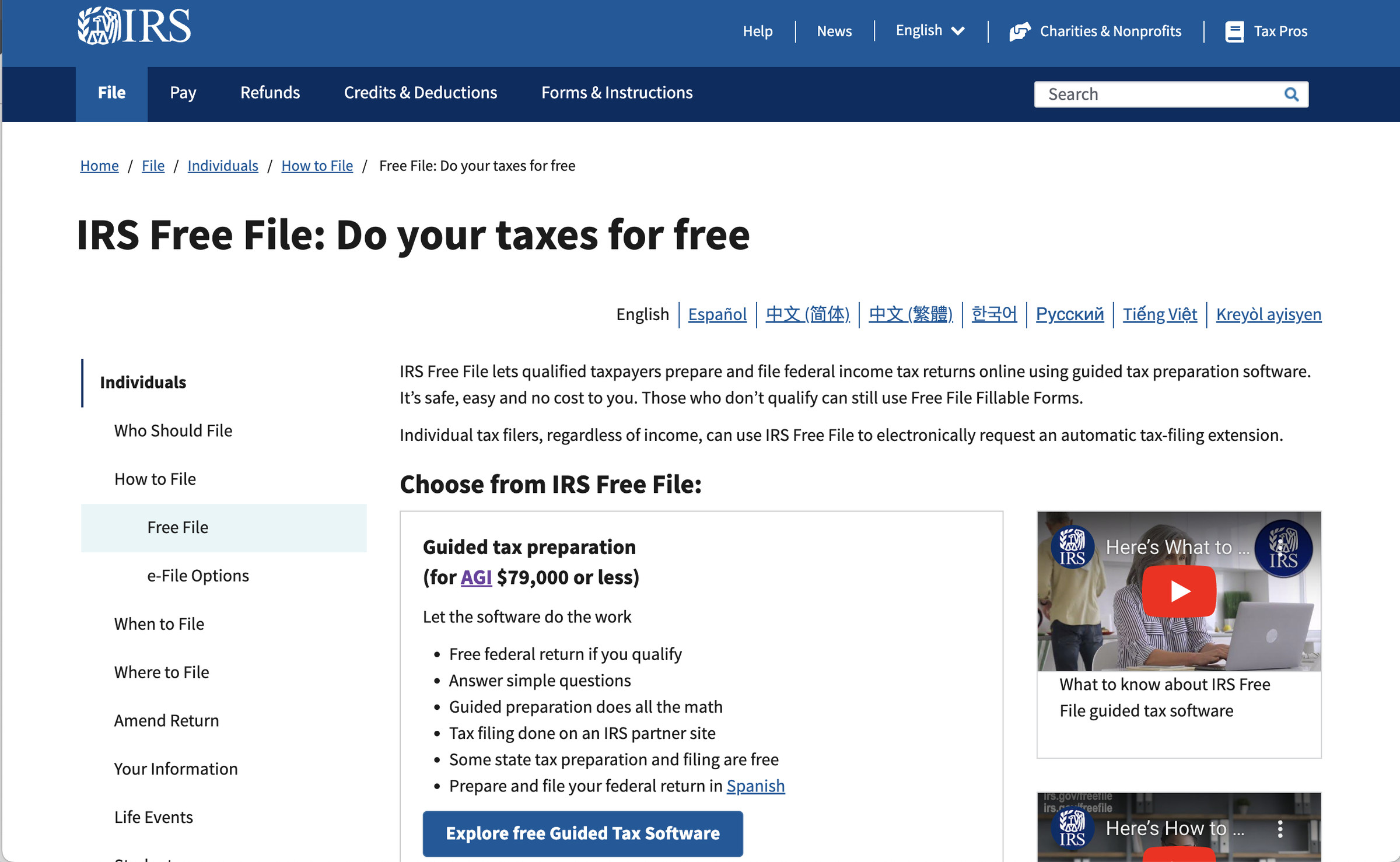

If your adjusted gross income for 2023 was $79,000 or under, you can use the IRS Free File option. There are several of what the IRS calls Trusted Partners to choose from. When you go to IRS Free File, you are given a series of questions to see if you qualify; if you do, you are then referred to an appropriate partner.

You may notice the absence of two prominent tax software companies: Intuit, the maker of TurboTax, and H&R Block. For some time, there had been some tension between the IRS and those companies. For example, in March 2022, the FTC sued Intuit because of what it said were deceptive claims of free tax filing, and in May of that year, Intuit agreed to distribute a refund of $141 million to consumers who were tricked into paying for its free service.

Finally, when the IRS announced its intention to develop Direct File, Intuit and H&R Block pulled out of the Free File program in protest.

If your income is above $79,000, you can still use fillable forms provided by IRS Free File, but you don’t get the support of the free software, and you can’t do your state taxes through this method. (If you’re really into doing your own taxes, you may want to check out the IRS page on tax tips.)

If you’re not a pro at filling out taxes, you’re going to either have to use e-file with one of the available software solutions or find a tax preparer who can do it for you. For those whose income is $60,000 or less, who have disabilities, or whose English is limited, the IRS has a program called the Volunteer Income Tax Assistance (VITA) to help with tax preparation. There is also Tax Counseling for the Elderly (TCE) for people who are 60 or older. Go to the page describing these programs for more information. You can also use a locator tool to find providers of these programs near you. You can also take a look at the AARP Foundation Tax-Aide program. According to its website, it “provides tax assistance to anyone, free of charge, with a special focus on taxpayers who are over 50 or have low to moderate income.”

If you use a tax preparer, the person or company who does your taxes needs to be authorized to use e-file; if you don’t already have a tax professional, you can find one at the IRS site.

If you’ve got to actually pay taxes, it’s a lot easier to do it online. The IRS lists a variety of ways.

First, you can use Direct Pay to pay your annual taxes (using 1040 forms), quarterly estimated taxes, or a number of other types of taxes; they are listed here. Direct Pay is for paying personal taxes. If you are paying business taxes, you can do that through the Electronic Federal Tax Payment System (EFTPS). Be aware that, according to the IRS, it can take up to five business days to process a new EFTPS enrollment.

You can also pay via a credit or debit card or a digital wallet such as PayPal or Click to Pay; however, there is a fee involved (since the IRS isn’t going to absorb what your credit card company is charging for the service). If you’re paying by debit card, it can cost from $2.14 to $2.50, depending on the service you use. If you use a credit card, it could cost you up to another 1.98 percent of your payment amount — so if you can, Direct Pay is definitely the way to go.

If you owe taxes but simply don’t have the available funds to pay them, you can arrange for a payment plan. If you owe less than $100,000 and can manage to pay the full amount within 180 days, you can establish a short-term payment plan in which there is no setup fee (although you will have to pay penalties and interest on the owed amount). Otherwise, you could qualify for a monthly payment plan for which you apply either online, by phone, or by mail. It will cost an additional $31 setup fee besides penalties and interest if you apply online (or $107 if you apply by phone, mail, or in person), although it’s possible to get a waiver of that fee if you qualify.

One of the ways the IRS tries to convince you to file online is to assure you that you will get your refund faster — in less than 21 days, in most cases, although there are exceptions. (If you file via paper, it could take six months or more to process.) Once you’ve filed, you can check the status of your refund online 24 hours after you’ve filed. You can also download the official IRS2Go mobile app, which allows you to check the status of your refund, pay your taxes, and get other information.

If you can’t do your taxes by the due date because of a family emergency, job pressures, or because you simply put it off for too long, you can file for an extension. We’ve got a separate article telling you how to do that right here.