When Gavin Wood co-founded Ethereum, he stated that it would “allow people to interact in mutually beneficial ways without anyone needing to trust each other.” In theory, such a platform would pave the way for Web3, characterized by decentralized or distributed network architectures, that would lay the groundwork for a truly open internet where we would not have to blindly entrust our data to monopolistic corporations or get permission from them in order to participate.

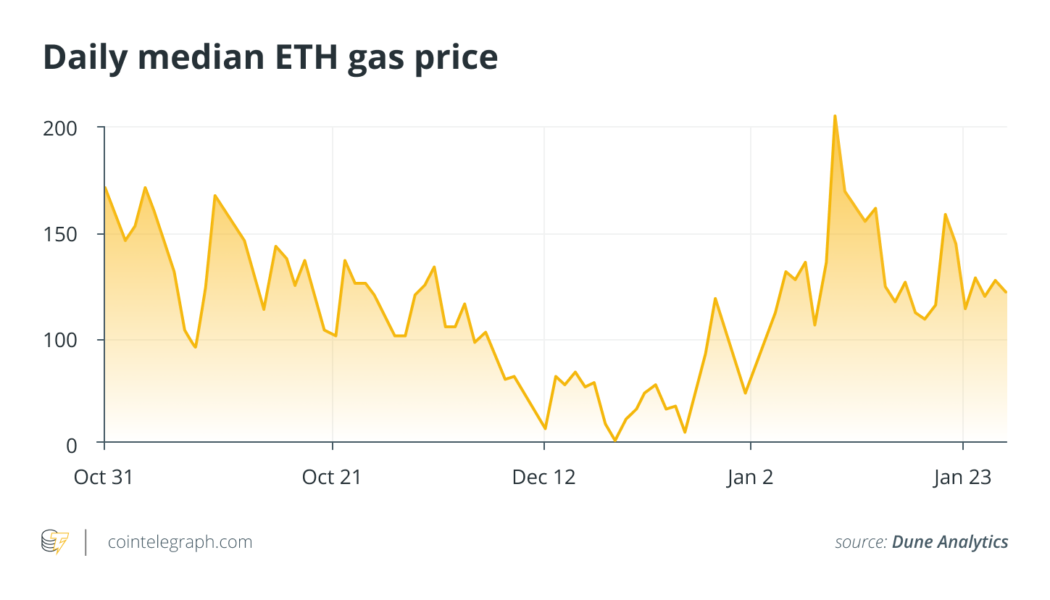

Since its inception in 2015, however, Ethereum has simply failed to adapt fast enough and keep up with the pace. Transactions costs for decentralized applications (DApps) have been too high while transaction speeds have been too slow. Wood left the Ethereum team in 2016 and founded the framework for a decentralized Web3: Polkadot.

With its series of parachain auctions beginning to turn heads, the blockchain of blockchains is rounding up a very exciting year, starting with the launch of Kusama, its canary network. Kusama’s motto is “expect chaos.” And, looking back, it’s clear that the network’s expected chaos during its parachain auctions laid the framework for a sturdy Polkadot foundation and an eventual decentralized Web3 in the coming years.

Related: What are parachains: A guide to Polkadot & Kusama parachains

Polkadot

The capacity to communicate is part of what sets Polkadot apart from Ethereum and other blockchains. Polkadot’s emphasis on parachains, formally a parallelizable chain, is a driver in propelling one of the core principles behind Web3 forward: The ability to communicate between different systems. Within the ecosystem, parachains run in parallel and any type of data may be sent between them due to Polkadot’s cross-chain composability, opening up possibilities for new use cases. Thanks to cross-network bridges, parachains can also be connected to external networks such as Bitcoin, Ethereum and others. By this token, parachains are unique, independent and designed for a blockchain’s specific needs unlike Ethereum’s shards, which are identical by design and less adaptable.

Related: Building multichain is a new necessity for DeFi products

Essentially, Polkadot is built around the Relay Chain — the central chain of Polkadot — which ensures interoperability between other blockchains in the network, allowing developers to safely build their own private blockchains. While the current relay chain processes transfers, applies governance protocols and offers staking services for the Polkadot network, an upcoming series of parachains is expected to provide advanced features including improved functionality and cross-chain compatibility.

If the Relay Chain represents the proverbial hub, parachains are essentially Polkadot’s spokes. Each parachain is a blockchain capable of running its own consensus algorithm, utilities, tokens and so on. Since the Relay Chain doesn’t support smart contracts or other specific features, those responsibilities are passed onto parachains.

It’s worth noting that parachains are not bound to any rules apart from the requirement that they are trustlessly validated. Polkadot limits the number of parachains to 100 — a hard limit creating competition among projects hoping to connect to Polkadot. To connect, potential parachains must win a parachain slot auction by outbidding other projects. Once a parachain wins a slot, it bonds Polkadot (DOT) tokens to pay for its slot lease (parachain slots are never sold, only leased). If these auctions sound complicated or perhaps obscure, it’s because parachain slots are scarce and Polkadot’s intention is to prioritize serious and high-quality projects.

Related: How liquid staking disrupts parachain auctions on Polkadot

Kusama

Officially speaking, Kusama is a network built as a risk-taking fast-moving “canary in the coal mine” for its cousin Polkadot. As Kusama puts it:

“It’s a living platform built for change agents to take back control, spark innovation and disrupt the status quo.”

The network billed itself as allowing for the most realistic testing environment possible for blockchain projects, and you’d be forgiven for assuming Kusama for some sort of doppelganger since it has an almost identical architecture and structure to Polkadot apart from its capacity for fast upgrades. The network hasn’t only been used for parachain candidates to innovate and test changes, but also as a proof of concept for Polkadot’s sharded model.

For Kusama, auctions have proved key to its scalable multichain architecture where parachains connect to the network by leasing a slot on the Relay Chain via a permissionless auction. When Polkadot initially reported on the launch of its parachain auctions, it noted how Kusama had successfully completed 11 parachain auctions since beginning in June. Since then, over 2.4 million Kusama tokens have been contributed by more than 49,000 unique addresses, signaling some rather significant community interest.

Further, the fact that there were no technical issues throughout the parachain auctions proved to galvanize Polkadot’s preparation for its own auctions. It’s becoming clear that a gradual rollout is central to Polkadot’s success, with the total number of parachains onboard to Polkadot not exceeding 75 percent of those running on Kusama in a bid for quality over quantity. The success of Kusama undeniably spells a bright future for Polkadot.

Related: How much intrigue is behind Kusama’s parachain auctions?

The path toward a decentralized internet starts with parachain auctions, beginning with those that are starting on Kusama. Web3 is focused on returning the control of the internet to users and that is exactly what is happening with the parachain auctions where everyone is free to participate. Polkadot’s ongoing parachain auctions are bound to be successful thanks to rigorous testing on Kusama and will ensure a decentralized Web3 by connecting different blockchains together. The future is likely to see Kusama bridged to Polkadot for cross-network interoperability — the ultimate realization of Web3.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

James Wo is an experienced entrepreneur and investor in the digital assets space who founded Digital Finance Group in 2015, where he oversees over $1 billion assets under management. He is an early investor in companies like LedgerX, Coinlist, Circle, 3iQ. James is also an early investor and supporter of Polkadot and Kusama Network. He contributes substantially to the ecosystem through capital allocation, donations and actively supporting the Parachain Auctions. Additionally, James serves as the board and committee member of the Chamber of Digital Commerce and acts as chairman at UAE Licensed Matrix Exchange.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news