/* custom css */

.tdi_4_3a1.td-a-rec-img{ text-align: left; }.tdi_4_3a1.td-a-rec-img img{ margin: 0 auto 0 0; }

While the world continues to deal with the challenges of the pandemic, it is emerging markets such as Sub-Saharan Africa that have faced the biggest challenges.

According to the World Bank, Sub-Saharan Africa has been hit the hardest by the economic impact of COVID-19, with an estimated 23 million people in the region projected to be pushed into poverty by the pandemic.

SMBs Need Support with Challenges Caused by COVD-19

/* custom css */

.tdi_3_0ed.td-a-rec-img{ text-align: left; }.tdi_3_0ed.td-a-rec-img img{ margin: 0 auto 0 0; }

While there are some sectors in the region that have accelerated their adoption of digital technology throughout the pandemic, such as South Africa’s financial and retail sectors, many other parts of the economy, especially micro and small-to-medium businesses (SMBs), have struggled to address the challenges of COVID-19.

With SMBs making up around 90% of all businesses in SSA, it is vitally important that SMBs are supported not just to weather the tough economic conditions of the pandemic, but that they are also supported in turning digital business and digital payments to their advantage, so that they are better prepared to grow in future.

Whilst it is mostly seen as a challenge, the acceleration of digital business and payments also represents a great opportunity.

Digital Payments on the Rise

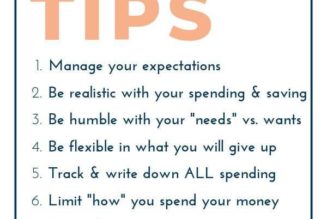

Consumers within the region have shown a marked preference for digital payments, for the sake of convenience, to avoid the physical contact of paying with cash or to avoid physical visits to crowded stores, as a result of the pandemic. This trend towards digital is set to continue, but for small businesses within the region, adapting to this new digital world is not always easy.

Small businesses in South Africa don’t necessarily have access to the IT expertise needed to set up digital solutions, training staff to use systems can be difficult, and cost can be a barrier to entry.

Despite these hurdles, giving SMBs access to digital solutions is vital to economic recovery and growth across emerging markets.

Ensuring that local businesses, that create local jobs and opportunities, are able to compete and participate in this digital transformation, is a key concern for governments and companies including Visa.

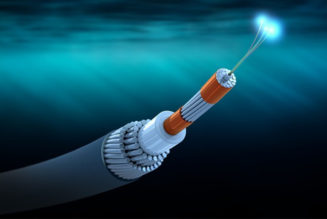

The potential of technology to reach communities in emerging markets, create economic inclusion and improve livelihoods, has already been well demonstrated in areas such as mobile money. Banking and payment solutions accessed through mobile phones have brought financial services to millions of underserved consumers in emerging markets, and their potential to bring positive change continues to grow.

Visa Partners with Mobile Payment Platform Paga

Visa understands the importance of supporting small businesses to join the digital economy, and the potential of mobile phones to realize this ambition.

This is why it has partnered with the mobile payment platform Paga, to pilot an app that will serve as a solution to help small business owners to digitize their business, including payments, point of sale and access to credit, via a mobile device.

To have maximum uptake and impact, Visa and Paga, knew that the product would need to be merchant-centric, and fit with the needs of the intended users.

For that reason, it was developed with input and consultation from merchants in emerging markets and is focused on being affordable, quick and intuitive to set up, and based on devices and applications that will be reliable and without latency or downtime.

As part of the offering, merchants will be able to purchase a smartphone on instalments, making it affordable to own a device configured with secure Visa payment acceptance and Paga’s merchant tools.

Through the app, merchants will be able to develop their credit history and receive microloans and ultimately work on their capital to grow their businesses.

The app will provide a range of services and products. For merchants looking to streamline their internal processes and operations, it will provide the opportunity to track their sales and their transaction history, receive and make payments, download digital receipts as well as card control and cash tracking.

Employees can be set up with their own accounts and permissions so that the owner and their staff can all utilize the tools for their roles. To accommodate consumer preference, payments can be accepted through multiple means, including card payment, NFC tap, QR codes and payment links.

The product has been designed to grow with the business, with a modular design that will enable new features to be added in future.

Mobile Payments Here to Stay

Business owners and consumers know that mobile payments are here to stay, and Visa and Paga are providing merchants with the means to offer the services their customers want and helping them to take their first steps on the journey to digitally-enabled their businesses for future growth and prosperity.

Over the next few years, Visa says that it is set to see even faster changes in the payments landscape, and its emerging markets are set to be at the forefront of this payment’s transformation.

By Tad Tilahun, Senior Vice-President, Head of Products & Solutions for Central Europe, the Middle East and Africa at Visa.

Edited by Luis Monzon

Follow Luis Monzon on Twitter

Follow IT News Africa on Twitter

/* custom css */

.tdi_5_ec3.td-a-rec-img{ text-align: left; }.tdi_5_ec3.td-a-rec-img img{ margin: 0 auto 0 0; }